The Chinese pork market in four more charts

Wednesday, 10 November 2021

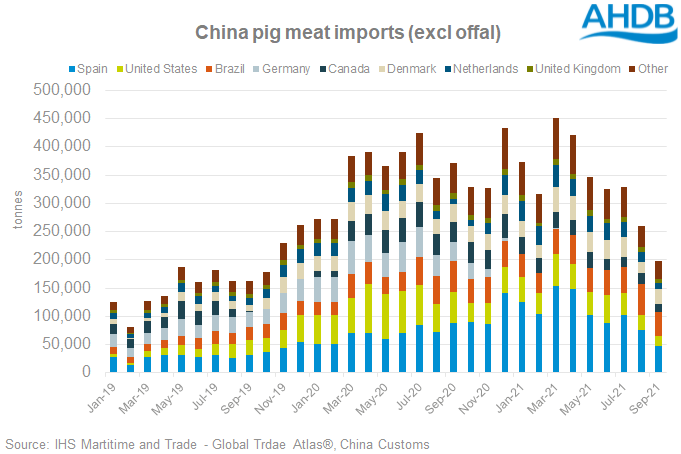

UK pig producers continue to face extremely challenging financial circumstances. Hope remains that the Chinese market will start to import more pork again, however, the signs are that it could be some time before that happens.

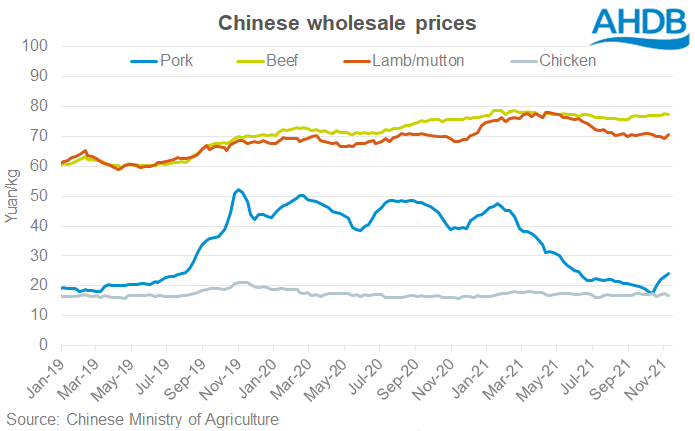

Chinese wholesale pork prices have been picking up in recent weeks. Nonetheless, reports suggest that there could be a significant amount of frozen pork in strategic storage. This could potentially be used to cap future price rises, perhaps even around New Year.

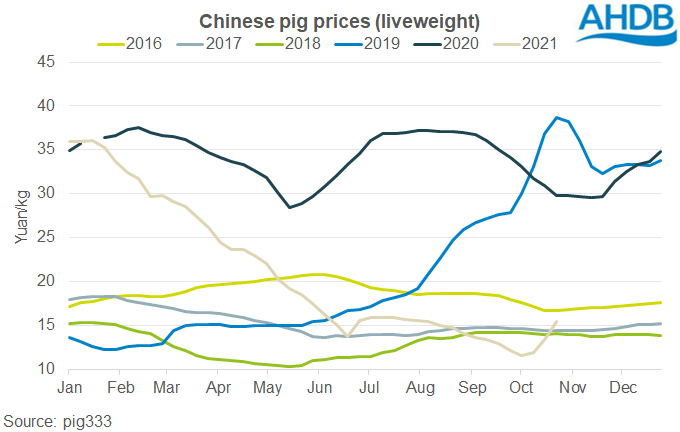

Live sow and piglet prices are also creeping up. However, they remain depressed in historic terms, and reports indicate that producer profitability in China is suffering.

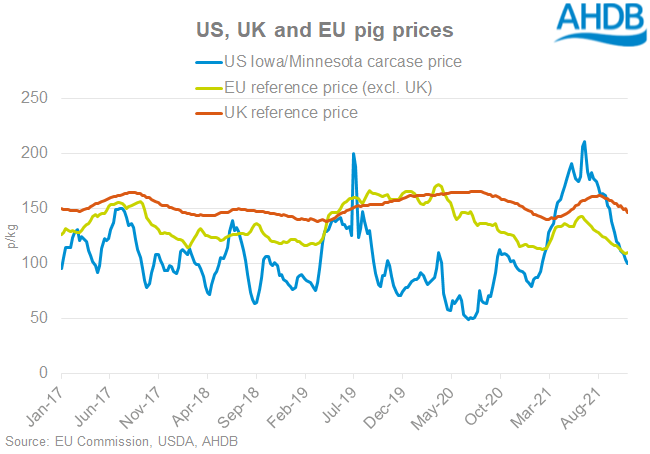

Another current feature of the global market is falling US pig prices. If they continue to drop, this will further increase the competitiveness of US pork against exports from the UK and EU. This would be detrimental, should import demand pick up from the Chinese market. EU prices are already weak. Prices in the UK are also responding to domestic and European market conditions, as well as the logistical situation where processors are unable to take all the slaughter-ready pigs available on farm.

According to the National Pig Association, UK producers are reducing the number of breeding sows by more than 25,000 head (out of a national population of around 400,000 sows). This would mean that the number of finished pigs available starts to decline, although any impact may not be seen until we are comfortably into 2022.

High feed costs and falling pig prices are set to challenge profitability here for some time. We hope to be able to publish GB cost of production estimates for Q3 2021 in the next couple of weeks.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.