EU wheat and barley imports start strong, though UK origin lags: Grain market daily

Thursday, 7 September 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £186.60/t yesterday, up £1.30/t from Tuesday’s close. The Nov-24 contract closed at £197.50/t, gaining £2.50/t over the same period.

- Domestic futures tracked European wheat futures, which climbed yesterday on the back of harvest downgrades in Australia, and reports about potential harvest disruptions in Russia due to fuel shortages (Refinitiv).

- Paris rapeseed futures (Nov-23) were up €4.00/t over yesterday’s session, closing at €459.75/t. The Nov-24 contract closed at €473.75/t, down €1.25/t from Tuesday’s close.

- This season’s rapeseed price climbed yesterday on the back of declining US soyabean crop conditions. On Tuesday, the USDA rated 53% of the US soyabean crop in good-to-excellent condition, down from 58% the previous week. Read more on this in yesterday's Grain market daily.

EU wheat and barley imports start strong, though UK origin lags

Last season (2022/23) the UK exported 1.48 Mt of total wheat and 1.10 Mt of barley to the EU, according to HMRC data. For wheat, this included the highest volume of wheat exported to the EU since 2015/16 and made up for 94% of total wheat exports. So, what can we expect this season? GB harvest is progressing despite rain causing a slow start – though quality and yields remain in focus. Larger carry in stocks year-on-year have boosted UK ‘s feed wheat supplies on starting this season. As such, it’s important to assess how export prospects to the EU are currently looking.

Wheat

As mentioned in previous analysis, weather across Europe over the growing season, and throughout harvest, has led to downward revisions to the EU’s wheat production figure. The EU Commission currently expects EU soft wheat production to sit at 127.1 Mt, though this remains up 338 Kt (0.3%) on the year and higher than the five-year average of 125.3 Mt. Quality has been in focus too.

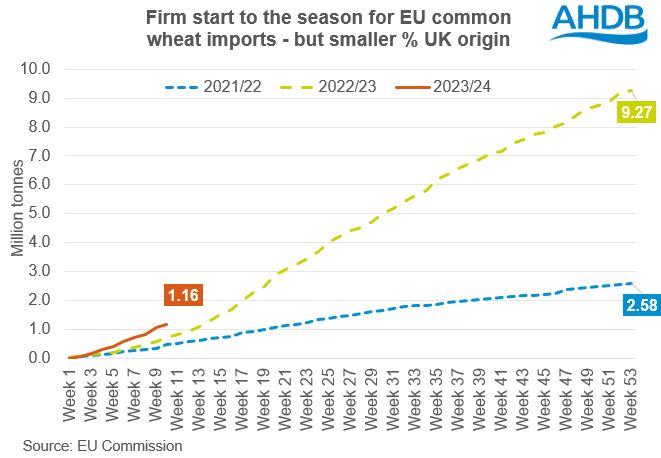

According to EU Commission import data for this season so far, import pace of common wheat has started off firm. However, Ukrainian origin wheat is currently dominating EU imports, whereas UK origin wheat lags on the previous year. This is perhaps not surprising given the delays at the beginning of UK harvest and relative pricing (more on this below).

While there isn’t any HMRC trade data available yet this season, according to EU Commission customs surveillance data, 6.9% (79.7 Kt) of common wheat that has been imported up to 4 September is of UK origin. At the same time last year, UK imports accounted for 22.8% (159.2 Kt). This season to date, Ukrainian wheat now makes up 59.7% of imports as they continue to supply competitively priced grain to the continent, compared to a 31.1% share this time last year.

The last available UK export price was as at 8 August, when feed wheat off the east coast for August was £196.00/t. While there isn’t a Ukraine FOB price available for the same day, EU Black Sea feed FOB price for wheat (Constanta, Varna, Burgas) was £186.33/t on the same day (UkrAgroConsult), giving some indication of price difference from that region.

Looking ahead, unless there are severe disruptions to Ukraine’s export routes, Black Sea wheat has the potential to remain competitively priced into the EU. Like the UK, areas of the EU have seen harvest delays. Though as the EU assesses their own availability, we could see EU import pace ease off. With a smaller wheat area for harvest '23 in the UK, and quality in focus, availability of UK wheat for export will also remain a watchpoint.

Barley

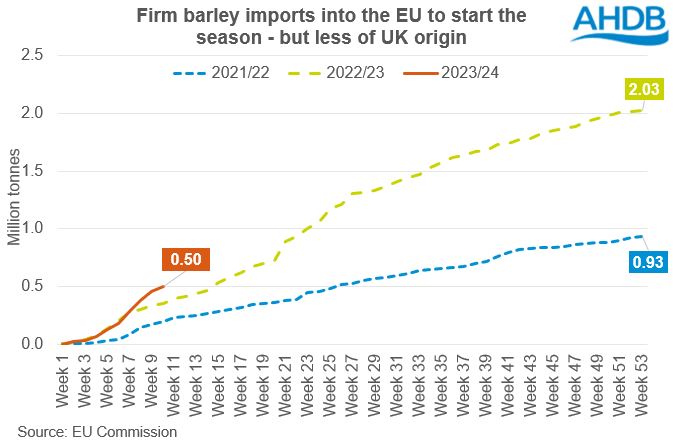

The EU Commission currently estimates 2023/24 EU barley production at 49.1 Mt, down 5.5% on the year, and the lowest production figure since 2011. Again, according to EU Commission customs surveillance data, imports of barley are currently ahead of where they were at the same point last season. Though like wheat, Ukraine is the top origin and UK origin imports are slower than last season.

UK origin barley as at 4 September made up for 35.4% of total barley imports this season, totalling 178.5 Kt. At the same point last season, UK origin barley accounted for 74.5% of barley imports, totalling 264.6 Kt. As could be expected, this season, Ukrainian barley makes up a larger proportion of imports (49.8%) compared to last season (18.9%).

In terms of price competitiveness, on 5 September, feed barley off the east coast for September was £173.00/t. On the same day, EU Black Sea feed barley FOB price (Constanta, Varna, Burgas) was £153.23/t.

Similarly to wheat, Ukrainian barley has potential to remain competitively priced against UK origin barley in at least the short-term. There was also a slow start to barley harvest in the EU and UK, and quality is in focus. However, with a tight EU barley balance and expectations of greater year-on-year UK production (due to an increase in area), could we see the potential for UK exports to pick up? This is something to watch as we gather more information from harvest and price competitiveness.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.