EU pig prices: January blues, where next?

Friday, 9 February 2024

Key points:

- EU pig prices have continued to fall in January, with negative movements recorded in all key nations

- Belgium and Denmark are the only key nations where prices remain above those seen this time last year

- Tight supplies of pig meat could provide some support to prices if demand picks up, following seasonal trends

Current situation:

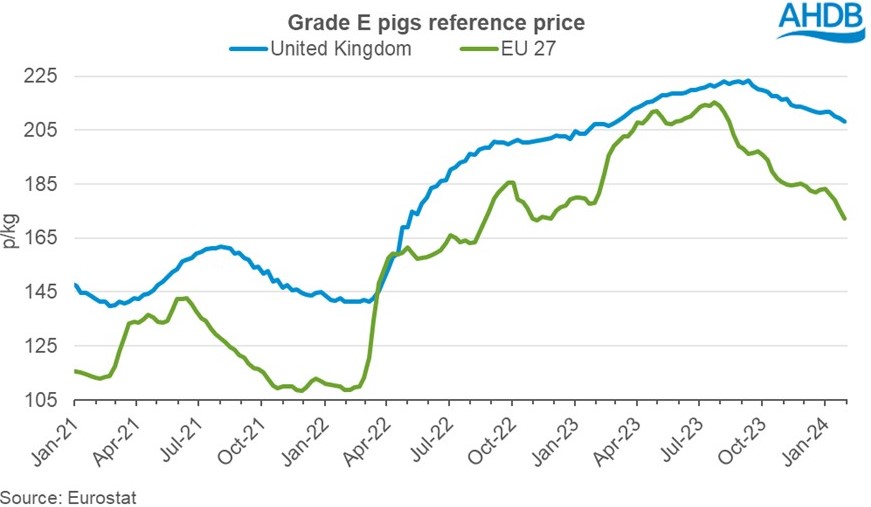

EU pig prices faced further pressure through January with the EU 27 average for Grade E reference prices falling 11p/kg in the four weeks ending 28 Jan. Pig supply has been reported as sufficient to satisfy seasonally weak demand. This movement has increased the differential between EU and UK reference price to over 36p/kg, the largest gap we have seen since late 2021.

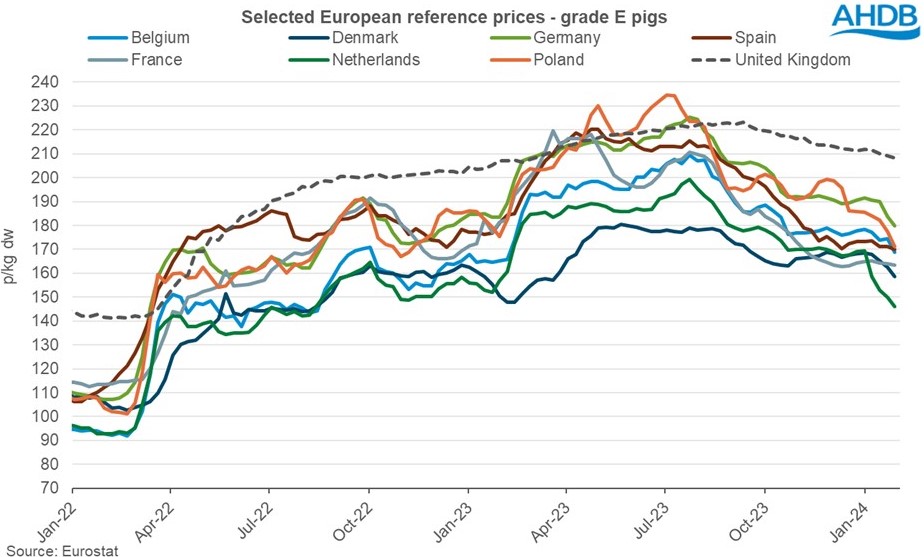

Prices have fallen across all key producing countries. The Netherlands saw the strongest decline in the four-week period, following some relative stability seen since October. Prices fell by 24p/kg in the four weeks ending 28 Jan and now sit 11p/kg behind levels from a year ago.

On the contrary, France and Spain saw prices ease by only 2p/kg and 3p/kg respectively during the four-week period. Price declines in these two nations appear to have been levelling off since mid-December, but sit lower year-on-year following a steep fall during the summer and autumn months.

Belgium and Denmark are the only key producing nations where prices remain above those seen this time last year.

Looking ahead:

Pig meat production volumes have been in decline throughout 2023. For the year-to-date 2023 (Jan–Nov) the EU 27 has produced 18.9 million tonnes of pig meat, a drop of 7% year-on-year. In the European Commission’s latest outlook, they forecast production to continue to decline by about 1% annually between now and 2035. These tightening supplies could support prices if consumer demand improves.

Although pork consumption has been easing long term on the continent, and this is a trend forecast to continue, this change in consumer behaviour has been gradual, largely driven by health and environmental concerns. The rising cost of living which has been impacting consumer spending in the latter half of 2022 and through 2023 has led to a significant drop in EU per capita consumption of 5%, according to the European Commission. Many consumers traded out of pork and into the poultry category due to the lower price point.

Pork consumption does have some seasonality, with volumes picking up during the warmer months and again ahead of the festive period. These trends may generate some short-term uplifts which may feed into prices. On top of this, as inflationary pressures ease and price rises slow, we may see an uptick in overall consumer demand as consumers return to the category.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.