EU pig meat trade H1 2023: volumes down, prices up

Wednesday, 23 August 2023

- EU export volumes are down 17% year-on-year (Jan–Jun) driven by a 9% production decline (Jan–May)

- Unit value of exports has increased 16% in 2023 so far on the back of higher pig prices and rising inflation

- Mixed movements in the market share of top destinations as consumers focus on affordability

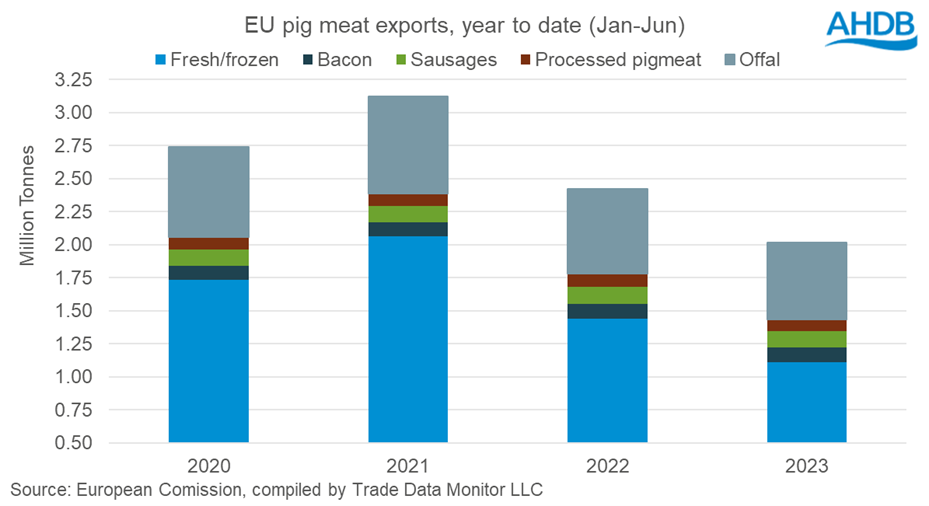

In the first six months of this year (Jan–Jun 23) the EU has exported just shy of 2.02 Mt of pig meat. This is the smallest volume for the period since 2015, when shipped volumes totalled less than 2 Mt.

Year-on-year, total pig meat exports for the region have fallen 17% with the fresh/frozen category seeing the largest declines, dropping 23% to 1.11 Mt. This is again the smallest volume since 2015, when shipped volumes of fresh/frozen pork were less than 1 Mt. All product categories have seen volumes decline; exports of both offal and processed pig meat are down 10%, while bacon and sausages recorded smaller declines of 4% and 3%.

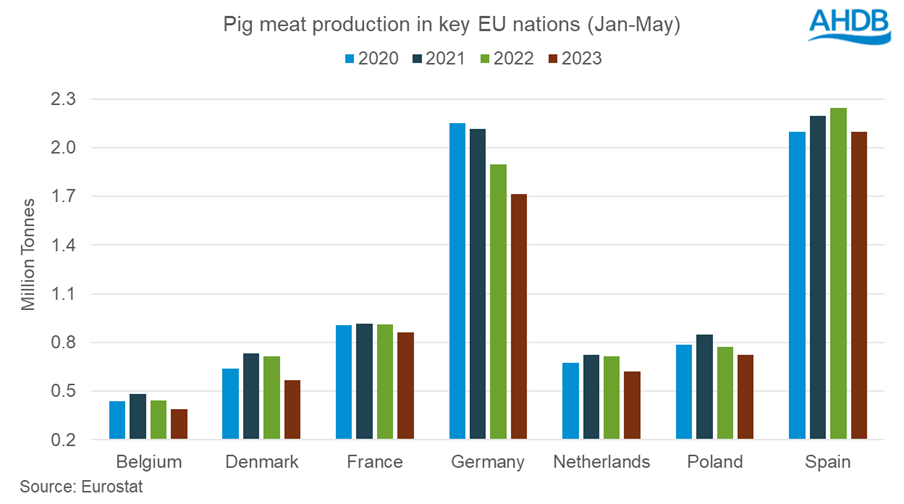

This decline in volume has been driven by reduced supplies, with lower pig meat production on the continent limiting export availability. In the first five months of the year (Jan–May) the EU has produced 8.68 Mt of pig meat, 9% less than it did during the same period in 2022; this is the first time since 2014 that production for the period has been less than 9 Mt. All EU nations have recorded declines, with the largest volume changes seen in the key producing countries of Germany, Denmark and Spain.

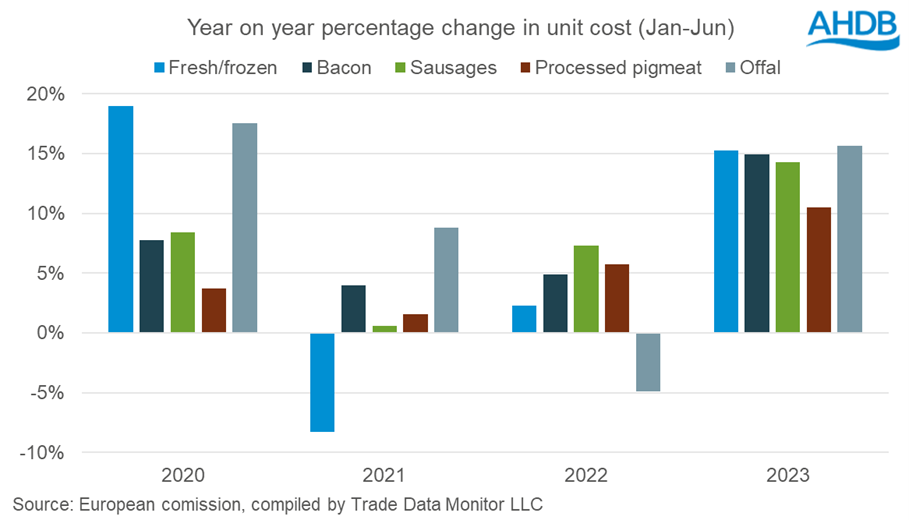

This loss of production has led to increased pig prices and, paired with rising inflation, this has driven up the value of exports. The total value of EU pig meat exports for the year to date (Jan–Jun) stands at €6.16bn. Although this is a slight decline year-on-year (-4%), this is due to the lower volumes, as the average unit price (value divided by volume) has grown 16% to €3,051/t. The unit price for bacon has seen the strongest growth, up nearly €750, with sausages a close second increasing by €660. Offal has seen the smallest growth (up €230), while the processed and fresh/frozen pork categories have gained €520 and €400 respectively.

Although volumes are lower and prices higher, the top five destinations for EU pork have remained the same. China holds the majority market share at 31% of EU export volume, an increase of 3 percentage points from last year. The UK’s market share has also grown, up 6 percentage points to hold a 20% share. However, the Philippines and South Korea have fallen by 3 and 1 percentage points to hold a 6% market share each. Meanwhile, Japan has held steady year-on-year, maintaining a 9% market share.

The European Commission forecasts EU pig meat production to end the year 5.5% below that of 2022. This indicates there will be little change from the current market place, with exports anticipated to end the year 12% behind volumes from last year. However, there remains some questions around the direction of travel for pig prices. Input costs have eased from the historic highs seen throughout 2022 and, although lower availability of product has driven prices up, demand is weakening. High prices have led EU product to be less competitive on the international market, with consumers at home and abroad looking for more affordable options.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.