EU cattle prices rise against background of reduced supply

Friday, 4 November 2022

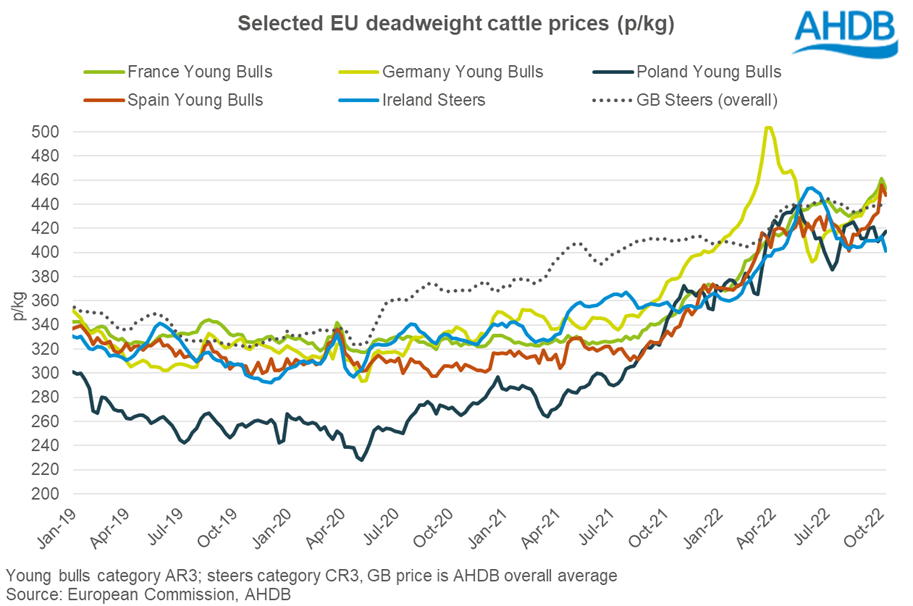

EU deadweight cattle prices have been trending upwards since late 2021. EU production has been lower year on year with Germany and France seeing the largest declines. The EU Commission is forecasting beef production to remain down vs 2021 for the rest of the year and then stabilise at this lower level through 2023. This is likely to offer some support to cattle prices for the foreseeable future if demand remains at current levels.

GB prices had been sitting at a premium to those on the continent through 2020 and 2021, with price support coming partly from cattle supply tightness and elevated retail demand due to the pandemic. Since the spring, prices have returned to tracking the upper end of EU prices, softening recently, partly due to movements in exchange rates.

UK beef exports have seen strong growth year on year. Although some of this growth will be down to the return of normal trading patterns following Brexit and the removal of covid restrictions, more competitive pricing will also be a driving factor on the market with the EU being our largest trading partner.

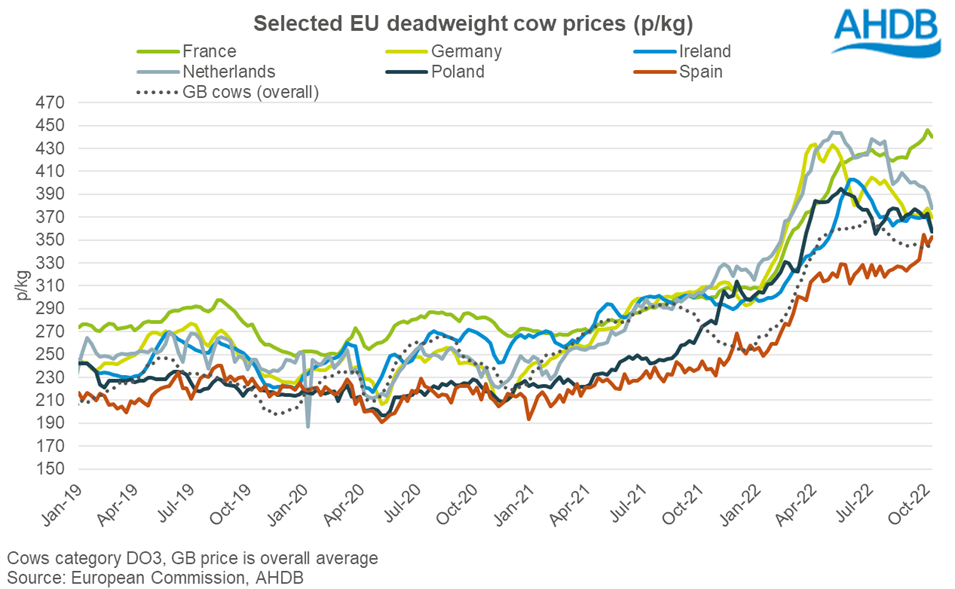

EU cull cow prices have been following the same upwards trend as prime cattle prices. The EU average deadweight O3 cow price stood at €4.30/kg (£3.76/kg) in the week ending 10 October, up 27% from the same period a year ago.

Again, these prices are being driven by the tighter supply of cattle and sustained demand for beef post-COVID, particularly manufacturing beef. Breeding cow populations have been shrinking in several EU member states, including France and the Netherlands, driven by pressures including profitability and environmental targets. Recent drought has also affected production across the region.

The EU Commission anticipates additional slaughtering of cattle towards the end of the year, due to shortages of forage and high feed prices.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.