- Home

- News

- England and Wales store lamb price inflation lags behind finished markets: Lamb market update

England and Wales store lamb price inflation lags behind finished markets: Lamb market update

Friday, 29 August 2025

As the store sheep season ramps up, this article looks at the throughput of store lambs so far this year and their prices in relation to the liveweight and deadweight finished market.

Key points:

- 37,000 head of store lambs went through live markets last week (w/e 24 August 2025), a 22% decrease from the same week last year.

- The year to date total for new season stores sold is 173,000 head, down 3% on the year.

- Store lamb price have fallen below 2024 levels in the w/e 24 August following several weeks of fluctation.

- There is significant differences between the year-on-year price inflation of store lambs and finished lambs as the finished market continues to hold well above 2024 levels.

Throughputs

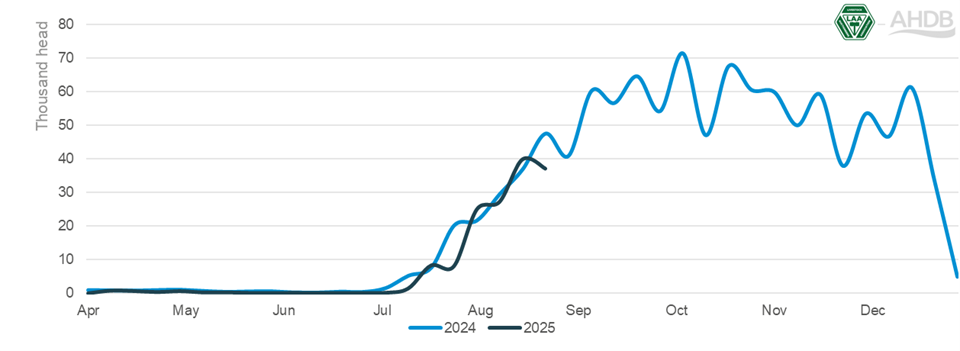

The number of store lambs sold in English and Welsh Livestock markets fell the past week (w/e 24 August) to 37,000 head, a 22% decrease from the same week last year.

So far in 2025, fewer new season store lambs have come through livestock markets in England and Wales than the same period last year. Indeed despite recent weekly increases, year to date totals for new season stores sold are 173,000 head, down 3% on the year.

England and Wales NSL store lamb throughputs in 2024 and 2025

Source: LAA

This fall in throughput can be attributed to multiple factors. The first of which is exceedingly dry and hot weather conditions that have impacted parts of the country, checking both grass and lamb growth rates, meaning that fewer lambs have been ready to sell as stores so far this season.

The second factor is the impact of the later lambing as discussed in our Sheep market outlook. This,combined with the adverse growing conditions, may have skewed the seasonality of the start of this year’s store market, pushing animals later into the season.

These factors are also occurring against a backdrop of a generally reduced UK flock size, which has reduced throughputs across the board.

Store sheep prices

Thus far, these lower throughputs have had a mixed effect on store lamb prices. Although supplies are tighter, in some areas the appetite for buying lambs to finish appears to be waning amidst the regional lack of forage.

Indeed, after a strong start to the season in July when most store sales begin, the price fell back in the last week to average £97.60/head, bring the price to stand 60p lower on the year.

How does this compare to the finished market?

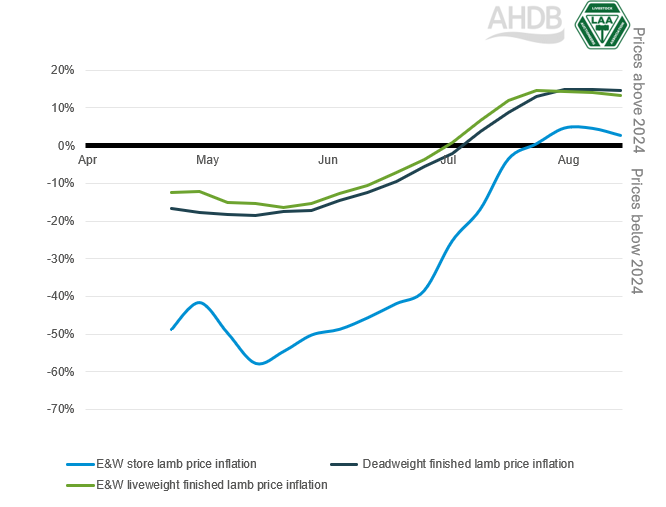

When comparing the year-on-year price inflation between store sheep, liveweight fat lambs, and deadweight fat lambs, we can see that although they have followed similar trajectories, store lambs have not experienced the same year on year price inflation as seen in the finished markets.

4 week rolling average lamb price inflation vs 2024

Source: LAA, AHDB calculations.

Indeed, in the 4-week ending period to the 24th of August, liveweight store price inflation was running at +1% on the year, whereas liveweight finished price inflation was up at 11% on the year and deadweight was at +13% on the year. This means that finished lamb prices have risen proportionally more compared store lamb prices.

These varied inflation rates could potentially point to higher margins for store lamb buyers and finishers, especially as grain prices remain favourable. However, forage availability could be a major limiting factor, alongside any price fluctuation throughout the remainder of the season.

© Livestock Auctioneers Association Limited 2025. All rights reserved.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.