Domestic premiums firm, but how long will it last? Analyst Insight

Thursday, 27 August 2020

Market Commentary

- UK feed wheat futures lost ground yesterday, falling by £0.75/t, to close at £166.75/t. The market did briefly move up to £168.00/t before falling away at the close of the day.

- Global grain markets are still reacting to uncertainty in maize markets. Adverse conditions in both the US and Ukraine has seen Chicago maize futures rally to levels seen in early July, the Dec-20 contract is up $5.71/t Wed-Wed at $139.46/t.

- A gap opened in the Dec-20 contract earlier in the week and we may yet see this close without further bullish news. Weakness in the dollar against sterling has also supported maize values.

Domestic premiums firm, but how long will it last?

It’ll be no surprise to anyone that we are currently experiencing unprecedented circumstances in terms of wheat production in the UK. It is highly anticipated, as I mentioned last week, that the UK wheat crop will be the smallest since 1982, and potentially lower than that.

As a result, the UK market is likely to remain pegged at import parity. In the past couple of weeks we have talked quite a bit about the likelihood that maize values will cap prices of domestic feed grains. Of late, storm damage has pushed maize values higher, giving physical grains in the UK some headroom and allowing prices to move higher.

However, there is another element that we need to consider which may also support domestic delivered premiums and offer some lifts in ex-farm values.

A slow start to the season

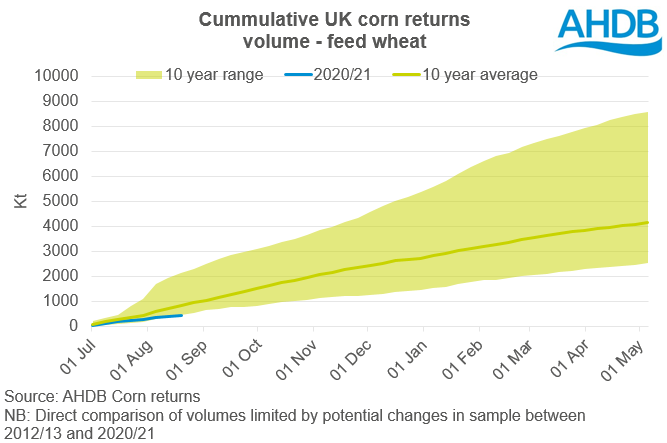

Unsurprisingly, given the potential size of the UK harvest, sales of wheat so far this season have been sluggish. Looking at the corn returns volumes data published by AHDB every Monday, we can see that ex-farm purchases of feed wheat in all positions are at the bottom end of the 10-year range. The total volume of purchases so far this season stands at 445.5Kt as 20 August 2020, 23.6Kt behind the same point in 2012/13.

What does this mean for pricing?

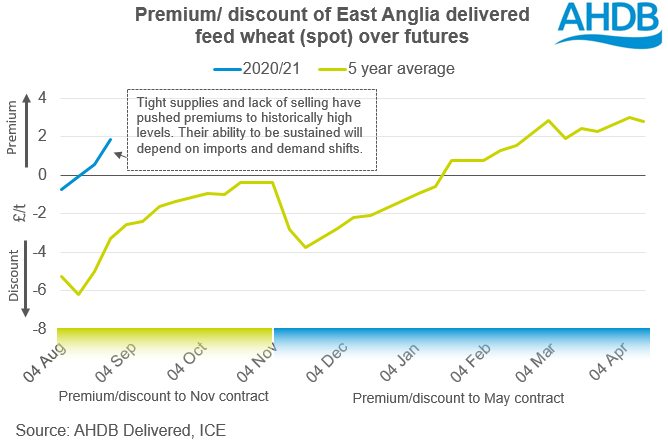

A lack of farmer selling, combined with small crops and a need for merchants to fulfil short positions, adds support to domestic physical prices. The corn returns data suggests that there could be an increased need for some merchants to short cover in order to fulfil contracts.

In the week ending 20 August, the premium that delivered feed wheat into North Humberside (spot) had over Nov-20 futures stretched to £9.35/t. The average North Humberside premium over feed wheat in the last five-years is £1.36/t, for mid-August.

This has in turn dragged the premiums of wheat in surplus regions higher. The latest delivered prices published last week (w/e 20 August), showed the premium of feed wheat delivered into East Anglia over Nov-20 futures had stretched to £1.85/t. Considering the 5 year average for similar weeks is £3.32/t under futures, the market appears to be signalling a need for wheat and is willing to pay for it.

So if I don’t sell, my price will rise?

In a world where we have no alternative to UK feed wheat this argument could be made, and premiums will be firm throughout the season due to the tightness in overall supply. This, however, is not the case. There are a number of factors we need to be aware of, that could make of the support for premiums a temporary market effect.

First, we could see shifts in demand. We have been through a period of very cheap maize, and we will have a large barley crop. If premiums firm too much, we could see a demand shift for feed ingredients.

Second, looking further down the line, imports will play a large role in domestic price formation, even with the prospect of tariffs on wheat beyond 31 December. We will likely see a significant front loading of wheat imports, particularly milling wheat, this in turn will pressure physical prices. Equally, we need to be aware of the impact of plantings for 2021 on futures.

Similarly, imports of maize are likely to be a key feature of feed demand throughout the season. I highlighted some of the key drivers for maize going forward recently. Since then, prices of maize have subsequently firmed from the US and Black sea region on crop concerns, but with a large global crop still expected, and Northern Hemisphere harvests imminent, we could see price pressure on domestic grains in the coming months.

So, while domestic supply remains tight, we must remember that we are essentially price takers in a global market. Global supply, and the interchangeability potential from other crops, will play a key part in domestic price direction going forwards.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.