Analyst Insight: Maize more important than ever to wheat prices in 2020/21

Thursday, 13 August 2020

Market Commentary

- UK feed wheat futures (Nov-20) closed yesterday at £161.70/t, a fall of £1.05/t. The market opened the morning up £1.80/t at £163.50/t, but have subsequently fallen back.

- Prices are currently well below both the 20-day and 50-day moving average of the November contract. Both of which broke below the 100-day moving average towards the end of last week, a bearish market signal.

- Yesterday, the USDA released their latest world supply and demand estimates (WASDE). The report raised forecasts for 2020/21 wheat production in Russia, Ukraine and the US, but trimmed EU production forecasts by some 4Mt. With global consumption and exports seen falling world wheat ending stocks are seen up by 1.95Mt.

Maize more important than ever to wheat prices in 2020/21

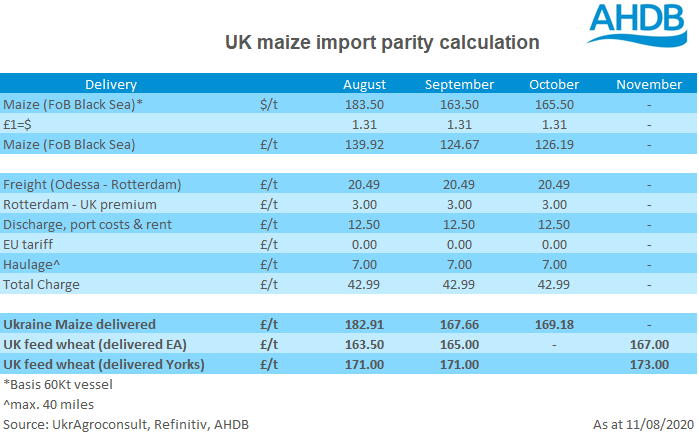

With England and Scotland wheat production likely to be sub-10.2Mt, and despite opening stocks around 3.4Mt, we are facing a pretty significant deficit. In theory, we could make up much of this shortfall with imported wheat or maize. This season, in the wake of coronavirus capping ethanol demand, maize is exceedingly cheap. As a result the hole in grain for animal feed, ethanol and distilling will more than likely be filled by imported maize. This increased demand for maize is exacerbated by the tariffs set to be applied to wheat imports from January, whilst maize can be imported tariff free.

Price talks

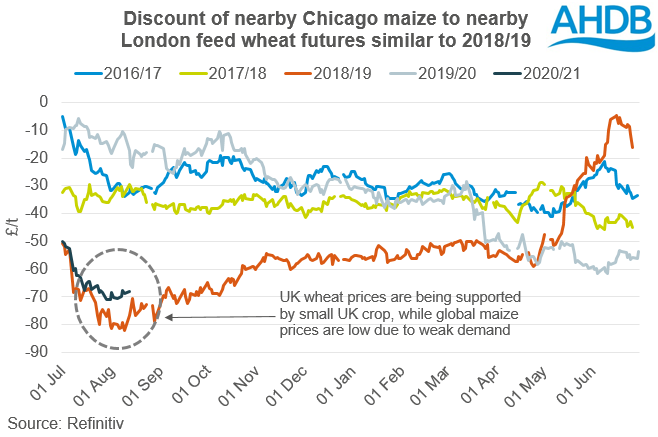

How much maize the UK will import and use depends heavily on the end-market. However, Chicago maize futures (nearby) are currently sitting at a £60-70/t discount to London feed wheat futures (nearby). The last time these levels were hit was during 2018/19.

2018/19 was another tight year for wheat production (barley production was also reduced). Then 2.82Mt of maize was imported, with 1.62Mt utilised in animal feed and a further 0.80Mt for human and industrial uses. Both imports and animal feed consumption set new record levels.

Looking ahead to this season, the wheat crop is again small. Barley production is higher, but maize is at such a strong price discount it is difficult to make an argument against high, potentially record, maize imports and consumption across the season.

Any lessons we can take from 2018/19?

The market dynamics are very different. However, the discount of maize in 2018/19 drove imports and a large increase in maize stocks, +27% year-on-year. This increased grain availability in turn pressured the wheat market through the latter half of 2018/19.

Whilst there is a larger requirement to consume maize this season owing to the wheat shortage, there is a large amount of barley that needs to find a home. If there remains a large volume of barley to be exported in the second half of the season and a tariff on trade into the EU, we could see some pressure across UK grain prices even in a tight year.

What is the outlook for maize?

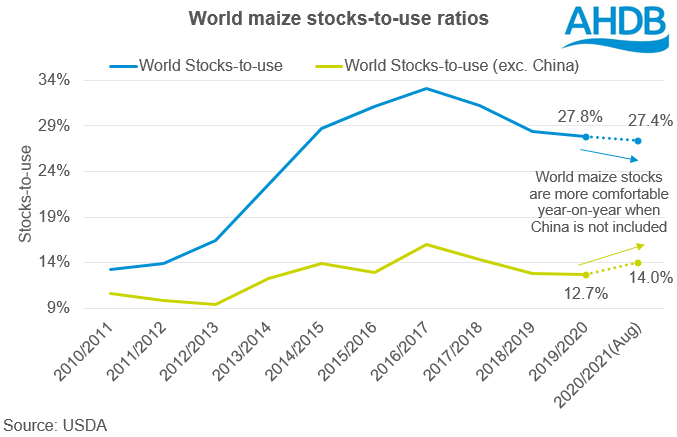

On the face of things the global outlook for maize is tighter year-on-year, with stocks-to-use down from 2019/20. In reality, the large accumulation of maize in China means that the stocks-to-use ratio excluding China is actually more comfortable year-on-year, pressuring maize markets.

Ethanol is also a key driver. While daily production of ethanol from maize remains below average due to the coronavirus pandemic, there is little support for prices.

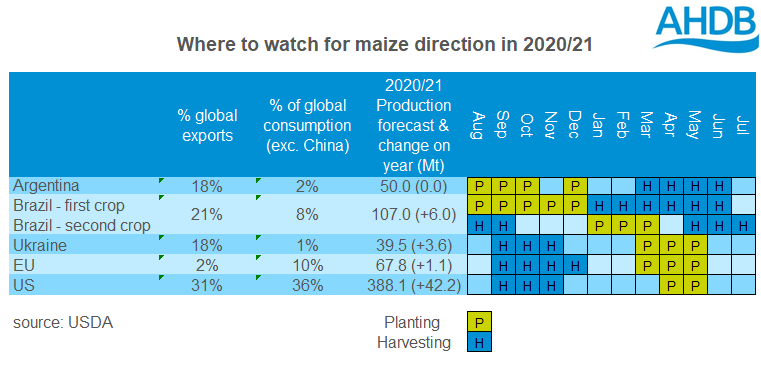

To consider what could change the direction of the maize market, we have to look at the crop calendar. We are about a month away from the kick-off for maize harvests in much of the northern hemisphere. As such yield reports, harvest progress and weather will be very important to the direction of maize and things to keep a close eye on.

The storm which hit Iowa, Wisconsin, Illinois and Nebraska this week caused significant damage to crops. In response, we have seen the spot maize futures gain approaching $2.66/t since 7 August, despite the increase in global production and stocks in last night’s USDA report. The storms would not have been accounted for in the report as the forecasting period closed before they hit.

That said, with larger crops expected across much of the Northern Hemisphere, harvest pressure in the next three months could offer a bearish sentiment.

Potentially working against that sentiment will be maize planting in Brazil and Argentina. Argentina is currently much drier than normal which may impact planting – due to start in a few weeks’ time. The first crops in Brazil are starting to be planted. Conditions in Brazil are more conducive to a good planting campaign at present, but again will require close attention during the next few months.

So what does this mean for you?

As David showed last week, domestic feed grain values will be capped at the import value of maize. As a result, we will be regularly tracking the competitiveness of maize into the UK market as can be seen below

With maize values setting the price of domestic grains, this market needs our close attention.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.