Analyst Insight: Planted area data indicates tight milling crop

Thursday, 9 July 2020

Market Commentary

- UK feed wheat (Nov-20) futures have continued to accelerate up this week. New crop futures ended yesterday up £1.85/t, at £169.30/t.

- UK markets continue to follow trends in global markets, Chicago wheat futures (Dec-20) closed yesterday at $191.71/t, up $7.26/t. Paris milling wheat futures (Dec-20) ended yesterday at €187.75/t, up €2.25/t.

- Wheat markets are reacting to the tightening outlook for 2020/21 production, with further cuts to Russian forecasts this week.

- Tomorrow’s WASDE will likely see further cuts to global wheat production. That said, world wheat stocks-to-use is highly likely to remain up year-on-year.

Planted area data indicates tight milling crop

Yesterday saw the release of the latest AHDB planting and variety survey, detailing regional planting figures across the different crops. One of the key highlights of the survey is the 25% reduction year-on-year in the area planted to wheat.

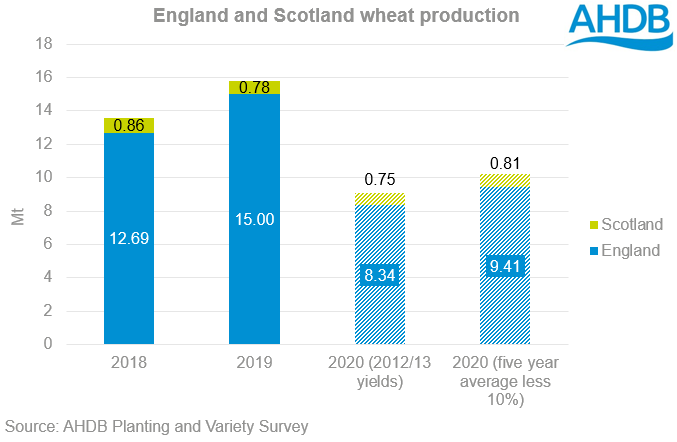

We can use these figures to provide possible scenarios for 2020/21 wheat production. Using two different regional yields, a five-year average less 10% and a 2012/13 yield, suggests wheat production of 9.1Mt to 10.2Mt for England and Scotland. This would give a 35-42% reduction in year-on-year production and a fall of 31%-39% against the five-year average level.

According to the UK wheat balance sheet average consumption of wheat between 2014/15 and 2018/19 was 15.2Mt, even accounting for 3.4Mt of opening stocks UK wheat would be in 1.5-2.7Mt deficit.

Part of this deficit is likely to be seen in milling wheat, with the area planted to Group 1 and 2 varieties down a combined 93Kha, at 555Kha. Using the same yield scenarios as above hard “milling” wheat production could reach just 3.6-4.0Mt, versus 5.7Mt last season.

We can take this a step further and looking at average pass rates for a reduced quality specification (Protein 12.5%, Hagberg 180s, Specific weight 74kg/hl) in the AHDB Cereal Quality Survey. The functional Group 1 and Group 2 hard wheat milling crop could be tiny, at 2.4-2.8Mt, against 4.1Mt last season and against a total milling wheat demand across all grades (hard and soft) of circa 5Mt in the UK.

With this in mind, the attention will very much be placed on the value of imported milling wheat this season, with UK premiums capped at the import ceiling

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.