More questions raised over Northern Hemisphere maize crops: Grain Market Daily

Tuesday, 25 August 2020

Market commentary

- Global wheat futures prices retreated slightly yesterday, after ending last week higher. The size of the Russian wheat crop is a factor, along with profit-taking by speculative traders.

- Russian wheat production was forecast at 82.5Mt by IKAR yesterday, 0.5Mt higher than last Monday.

- UK feed wheat futures followed the global trend and closed at £166.15/t, down £0.10/t from Friday’s close.

- The spring barley yield forecast for the EU-27 increased from 4.33t/ha to 4.39t/ha in yesterday’s the EU crop monitoring (MARS) report and is now 9% above average. Meanwhile, the winter barley yield was reduced by 0.13t/ha to 5.51t/ha, 4.2% below average.

More questions raised over Northern Hemisphere maize crops

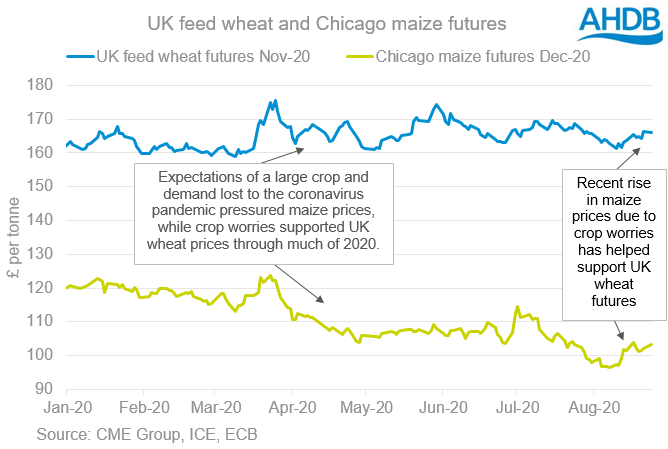

Maize is likely to continue to influence global and so UK wheat prices this week, as more questions are raised over maize crop sizes in the US and Europe (detail below).

Global grain production is forecast to reach 2,231Mt in 2020/21, nearly 61Mt more than in 2019/20 and over two-thirds of this increase (42Mt) is due to the forecast increase in US maize production. As a result, markets are likely to remain uneasy until harvest provides clarity on the situation.

Maize is likely to play a big part in UK grain pricing this season due to the expected small UK wheat crop, increasing our grain import requirements. European trade association Coceral yesterday forecast the UK wheat crop at 10.0Mt. As James discussed here, maize is likely to be the feed grain of choice due to the competitiveness of the grain and the proposed import tariffs on maize and wheat from 1 January.

A smaller than expected global maize crop, could provide some support to global maize prices and so in turn provide some support to UK grain prices. However, that would be subject to the demand matching or exceeding forecasts – something that is more uncertain than usual due to the coronavirus pandemic.

US crop conditions slip further

US maize crop condition scores were downgraded again by the USDA yesterday. As at 23 August, 64% of the crop was now rated as ‘good’ or ‘excellent’, down from 69% a week earlier and 71% on 9 August. The reductions follow drier than usual weather in some areas and the severe storm that affected Iowa a fortnight ago.

The condition scores are now below 2018, meaning more doubt that the US average yield can exceed 2018’s record as the USDA currently forecast. The rating in Iowa, which usually produces about 18% of US maize, is a particular worry. It fell from 69% to 50% in a fortnight and is now the lowest since 2013. Crops are now starting to reach maturity, which will soon limit the potential for any further improvements or downgrades.

European yield forecasts reduced

Meanwhile, there is also less confidence in European maize production. The EU’s crop monitoring service (MARS) downgraded its yield forecasts for the crop from 8.2t/ha in July to 8.0t/ha. This follows hot, dry weather over the past month in France and Germany, parts of Poland, Romania and Bulgaria.

Coceral yesterday forecast the EU-27 maize crop at 64.4Mt, now 0.2Mt smaller than last year’s crop.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.