How global grain prices have reacted to US storm damage: Grain Market Daily

Tuesday, 18 August 2020

Market Commentary

- UK wheat futures (Nov-20) closed at £165.50/t yesterday, an increase of £4.25/t on the previous Monday. Markets opened this morning at £165.85/t and are currently up slightly.

- The Russian wheat crop has benefited from higher yields in some regions than previously anticipated. IKAR have raised the total production figure for the 2020 Russian wheat crop to 82Mt an increase of 1Mt.

- Ukraine’s volume of wheat available for export has been capped at 17.5Mt for 2020/21 by their economy ministry, according to Reuters. This is a notable reduction on 2019, where the Ukraine exported in excess of 20Mt of wheat globally according to the State Customs Committee of the Ukraine.

How global grain prices have reacted to US storm damage

As the extent of storm damage in the US becomes clearer, global grain markets have been trading on the news of reduced US harvest potential, despite the figures released in the latest WASDE report. Chicago maize futures for both (Sep-20) and (Dec-20) contracts are up notably on the week. US soybean prices have also been increasing with continued demand from China helping to support prices.

Hopes of a bumper US maize crop have been some-what downsized by severe storms in the Mid-West decimating areas of maize and soybeans.

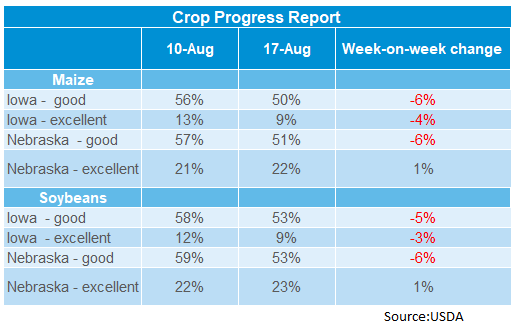

The USDA’s latest crop progress report shows week-on-week reductions in crop conditions in these areas. 59% of maize in Iowa is currently in either good or excellent condition, compared to 69% the previous week. Nebraska crop conditions are also down with 73% of crops now in good to excellent condition down from 78% last week.

The latest WASDE report released on August 12 has yet to consider much of the storm damage, although more recent announcements in the US have confirmed the large scale of damage caused by the storms.

In Iowa, 3.3Mha of maize and 2.3Mha of soybeans have been damaged by sweeping winds caused by the Derecho storm, totalling 5.6Mha of damaged crops within the region. Alongside the damage to crops, the damage to infrastructure is a real concern for the region with many grain silo’s being damaged or even destroyed by the high winds.

Other US regions have also been suffering in recent weeks. North Dakota and Nebraska are suffering from drought conditions and in need of rain, according to Reuters. Crop watch 2020 has seen a reduction in crop conditions in these areas in recent weeks.

What does this mean for UK farmers?

The USDA had previously anticipated a large maize and soybean harvest for 2020 and any reduction in the size of the harvest area and crop conditions are likely to have an impact on global grain prices. CBOT markets recently saw a spike for the month and UK markets will continue to follow this same trend for the short-term.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.