December 2023 dairy market review

Thursday, 11 January 2024

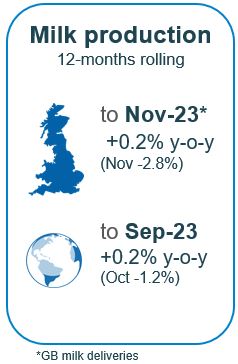

Milk production

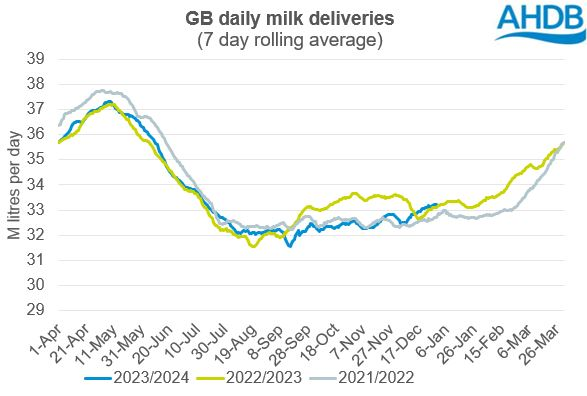

GB milk deliveries declined less than expected in December, falling back by 0.3%, compared to November’s 2.8% year-on-year decline. Production for the milk season to date (April to December) totals 9,272 million litres, slightly behind (-0.5%) the same point in 2022. This is currently running ahead of the latest forecast revision.

Reasons for the less-than-expected decline in December deliveries include annualisation against a snowy December last year, a shift in favour of Autumn block calving and a need for some to drive short-term revenue.

Cow numbers

Cow numbers have remained stable, despite increased pressures on farm margins. In October the GB milking herd stood at 1.66million head, a slight (0.1%) increase on the same month of the previous year. In contrast, youngstock (under 2 years) declined by 24,000 head (2.5%) year-on-year to stand at 926,000 head. The slight increase in the total milking herd was driven by an increase in the number of cows aged 2-4 years.

This raises questions over whether we might see a decline in cow numbers going forwards.

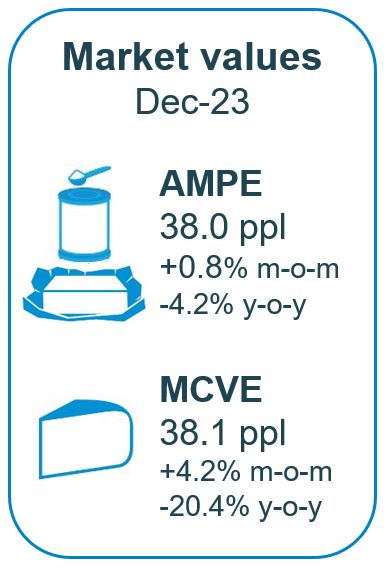

Wholesale markets

Overall price movements on UK wholesale markets continued to see some steady growth in December. Positive movements were recorded for cream, butter, and mild cheddar, however SMP saw prices ease. Generally, a seasonal uptick in demand and limited product availability are reported to be supporting markets. In December, butter rose by £160/t, cream prices improved by £69/t, mild cheddar up by £110/t, SMP was the exception losing £50/t.

The GDT echoed this positive sentiment and has now improved for the past three consecutive periods.

As of December, milk market values (which is a general estimate on market returns and the current market value of milk-based products on UK wholesale price movements) are moving in a more positive direction. AMPE rose by 0.8%, to 38.0ppl, MCVE rose by 4.2% to 38.1ppl. Both indicators in the UK remain much lower than a year earlier, with AMPE and MCVE down by 4% and 20% respectively.

Farmgate milk prices

The latest published farmgate price was for October with a UK average of 37.0ppl. Latest announced farmgate prices for January were relatively positive, with most processors announcing increases or no change to their pricing. On retail aligned contracts, Tesco and M&S continued to hold their prices from November, while Sainsbury’s and Co-op saw increases of 0.08ppl and 0.03ppl respectively, following lower pricing last month. Waitrose was the only retailer to announce a price drop for January, lowering their milk price by a further -0.50ppl.

On non-aligned liquid contracts, all members of the AHDB league table continued to hold their prices. This results in no change for Crediton since July, however Freshways, Muller Direct, and Paynes Dairies adjusted their prices in the autumn.

Cheese and manufacturing contracts generally saw more positive movements than liquid contracts.

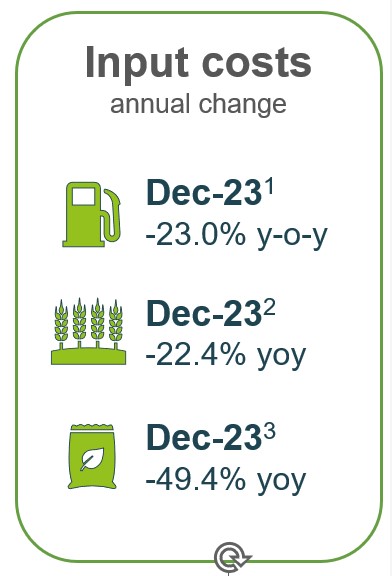

Input costs

Input costs continue to move in a positive direction but are still ahead of where they were prior to inflation rocketing.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.