Outdoor bred pork performs well despite its premium price

Thursday, 14 November 2024

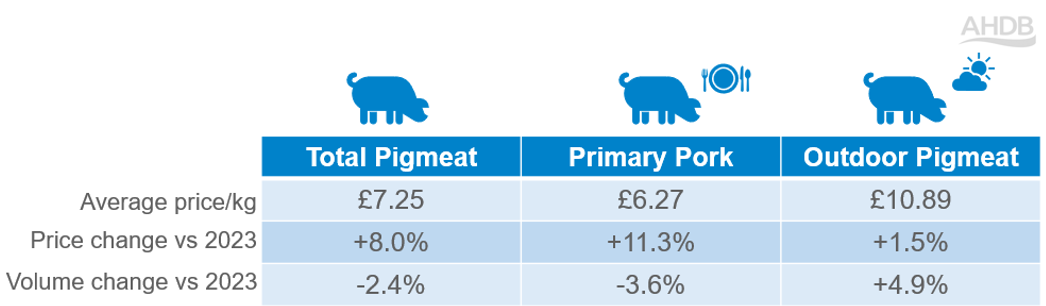

In retail, total pig meat, which makes up almost 30% of meat, fish and poultry (MFP) sales, saw a slight volume decline of 2.4% year-on-year over the 52-week period ending 9 June 2024, as smaller volumes were purchased per shopper. However, volumes sold of total outdoor bred pigmeat have increased significantly by almost 5%. (Kantar, 52 w/e 9 June 2024).

Price and volume changes

Source: Kantar, 52 w/e 9 June 2024

How does price influence primary pork performance?

- Over the last year, primary pork (Kantar defined as raw whole cuts such as joints and steaks) performance dropped, as shoppers switched into other MFP categories. Although pork is generally a cheaper option, most switching has been to an even lower cost protein, primary poultry. Pork has versatility credentials, and emphasizing its unique flavours and qualities could help to build consumer preference for pork meat. AHDB’s Love Pork campaign promotes the delicious taste of British pork with inspiring, budget-friendly recipes.

-

Some of the more expensive cuts that dominate share within primary pork, such as chops and steaks, experienced lower shopper numbers over the past year. These cuts have also underperformed for other proteins, indicating that cost has been a key driver for cutting back across multiple categories. Pork mince however has remained a popular cut, thanks to its lower price point compared to lamb and beef mince.

-

‘Economy’ options were the only tier to show significant growth within primary pork. However, as the bulk of the share comes from standard tier, its performance was not enough to advance the overall category.

-

Though it has not been enough to counteract the loss of older shoppers, growth within primary pork has been seen in younger demographics. The new shoppers are primarily pre-family and young family groups, who over index in cuts like mince, pork belly, and ribs. Highlighting the value-for-money aspect of pork may help to raise its profile to more consumer groups.

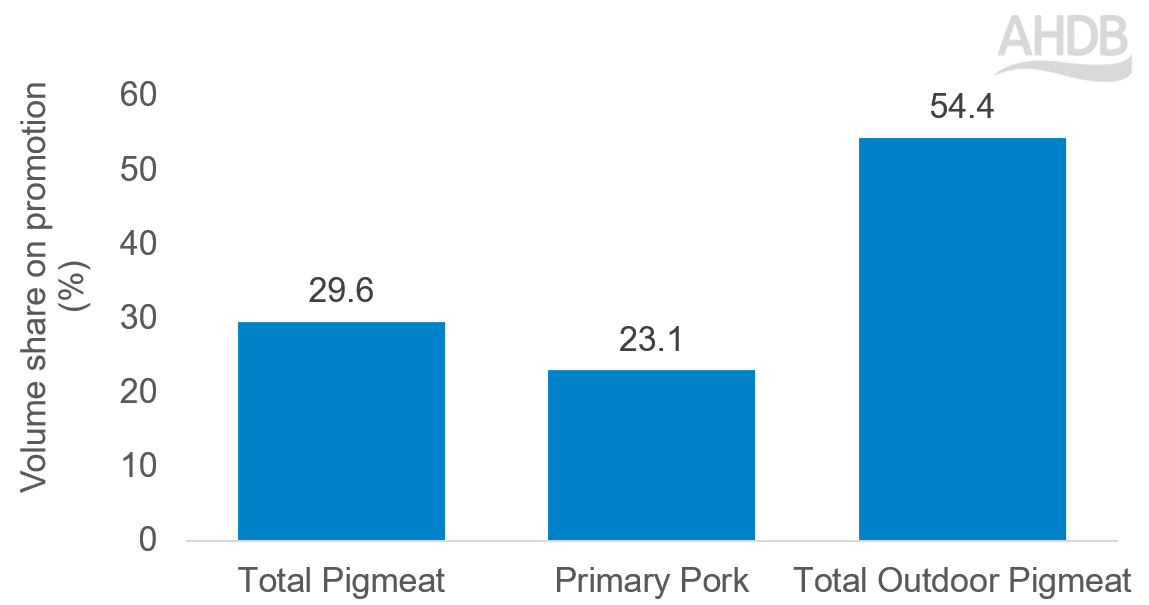

Are temporary price reductions enough to mute inflationary pressures?

Depth of promotion for primary pork was at its highest level in 5 years, which contributed positively towards volume sales.

Pork is less likely to be promoted than other proteins, with 23.1% on promotion compared to 28.0% on average across total MFP. Balancing promotional activity with efforts to build long-term product loyalty will be key to tackling the challenges facing the primary pork market. A focus on the categories which are dominating the market, such as steaks and roasting cuts is key for overall growth. Additionally, maintaining engagement with older shoppers, who represent the bulk of the market, will be crucial for long-term sustainability.

Outdoor bred pigmeat growth: Are percieved premium qualities being reprioritised by consumers?

Pork with outdoor credentials were worth 10.1% of the total pig meat category last year, so the 4.9% volume increase has been valuable to the overall category. This definition covers primary and processed pork with outdoor labelling such as outdoor bred, outdoor reared and free range (including organic). Note that some of this growth will be as a result of retailer range changes. For example, a retailer has changed all their top-tier primary pork products to outdoor bred. While we have seen other retailers drop their outdoor claims from some product ranges. It is likely these changes in retail strategies have driven growth, rather than an overall increase in demand.

Outdoor pork promotions have been influencial to performance, with more than half of volumes sold coming from promotions. The majoirity of growth in outdoor pork came from sausages, which tend to be a more highly promoted cut.

Volume share on promotion

Source: Kantar, 52 w/e 9 June 2024

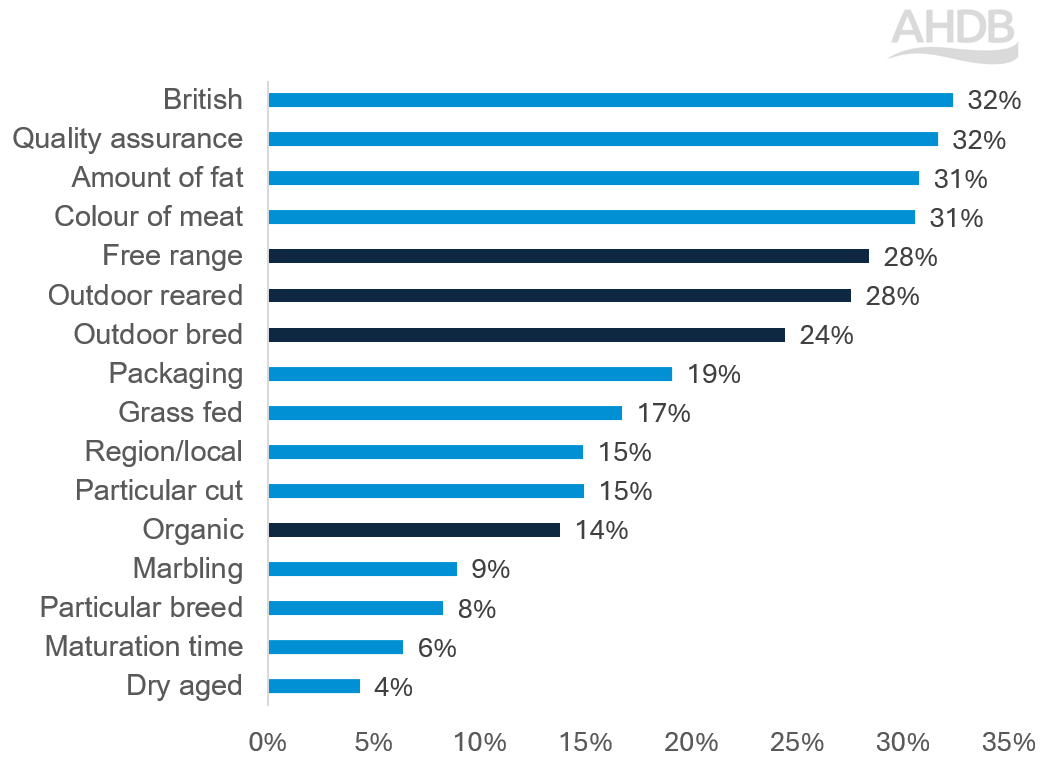

The outdoor pork buyer differs significantly from the total pig meat buyer

The outdoor pork category has even more reliance on older shopper groups compared to primary pork, as 80.4% of outdoor pork buyers are over 45 years old, versus 69.1% for total primary pork. While retired shoppers are also in decline for outdoor pork, there has been growth from all family groups. However, it is debatable as to whether these shoppers are making a deliberate choice to purchase outdoor products, or if their preferred outlet has an overrepresented or possibly exclusive selection. Research by AHDB and YouGov showed that only 24% of consumers say that outdoor bred claims are important to them when buying premium pork products (May 2024), though this has increased by 3 ppts since November 2023. While not a term often used on pork products, free range has a similar level of appeal to shoppers as outdoor reared.

What are the most important factors when buying premium pork?

Source: AHDB/YouGov May 2024

Considering the premium price, outdoor pork unsurprisingly attracts a more affluent shopper base; who are prepared to pay the considerable price difference. Some consumers perceive outdoor pigmeat products to have added benefits, such as higher quality, welfare, and environmental factors.

Price still plays a role in outdoor pork performance, and promotions have been influential for increasing basket size. Targeting family demographics with cost saving deals and rewarding repeat purchases could help to maintain growth in these groups.

As inflationary pressures ease, improving consumer sentiment may well alter consumer priorities, which could benefit outdoor and organic categories.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.