How the coronavirus lockdown has impacted sales of meat-free products

Thursday, 21 May 2020

The growth of meat-free products appears to have slowed during the coronavirus (COVID-19) lockdown in the UK.

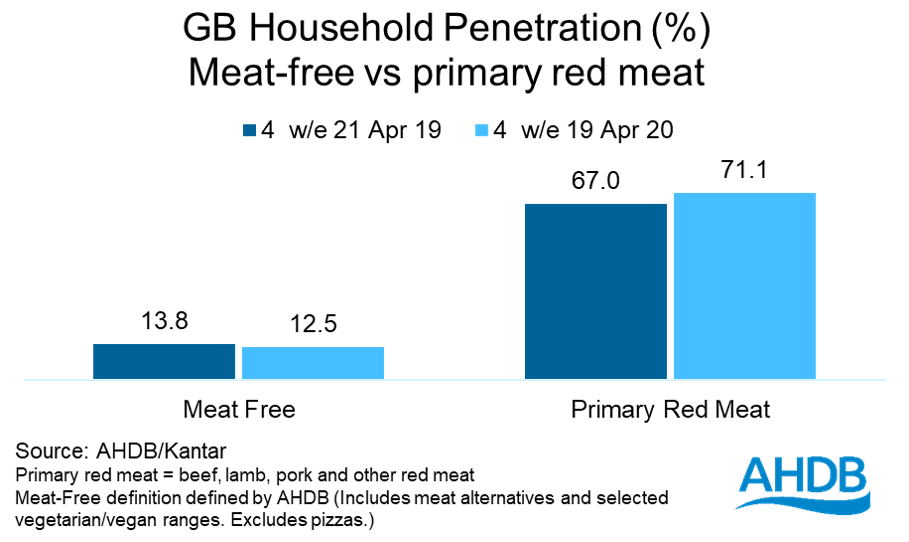

While the value of the meat-free category* still rose by 15% year on year, the proportion of households actually buying meat-free products dropped back, according to the latest Kantar data for the four weeks ending 19 April 2020. In those four weeks, 12.5% of British households bought in to the meat-free category, down from 13.8% during the same period in 2019. During this same time, household penetration of primary red meat rose to 71.1%, up from 67% a year ago.

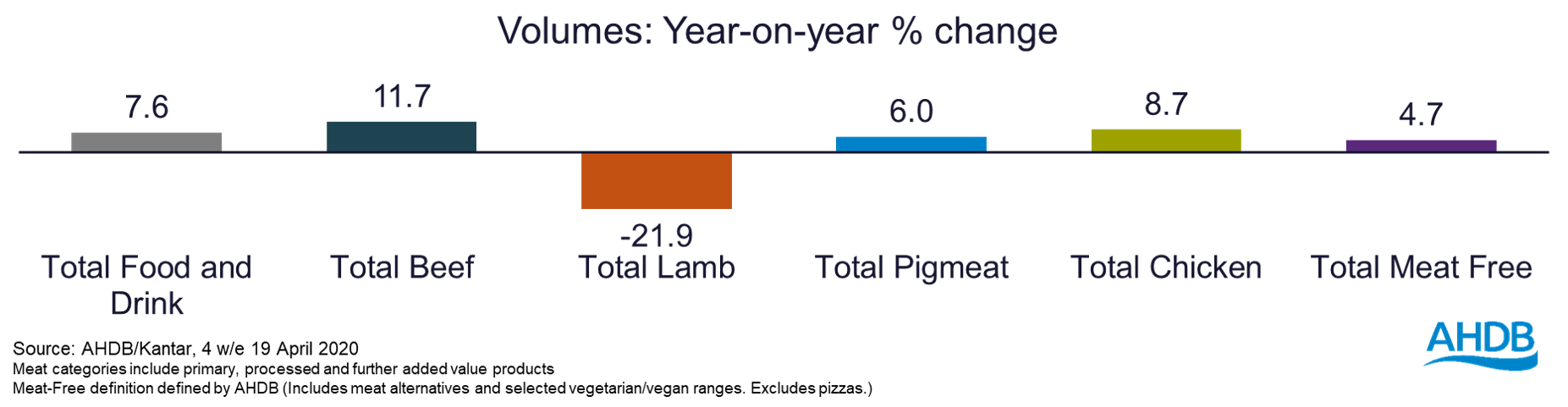

Of the volume growth which meat-free has seen in the last four weeks, the majority has been through repeat shoppers and those adding it to their repertoire. Meat-free volumes were up 5% in the four weeks ending 19 April 2020, behind beef and pigmeat, which rose 12% and 6% respectively.

Some shoppers have made a conscious decision to reduce their purchases of meat substitutes since lockdown. The AHDB/YouGov Consumer Tracker shows that, of those who have bought meat substitutes, nearly a quarter claim to have bought less since the lockdown, significantly higher than the 12% who claim to have bought more.

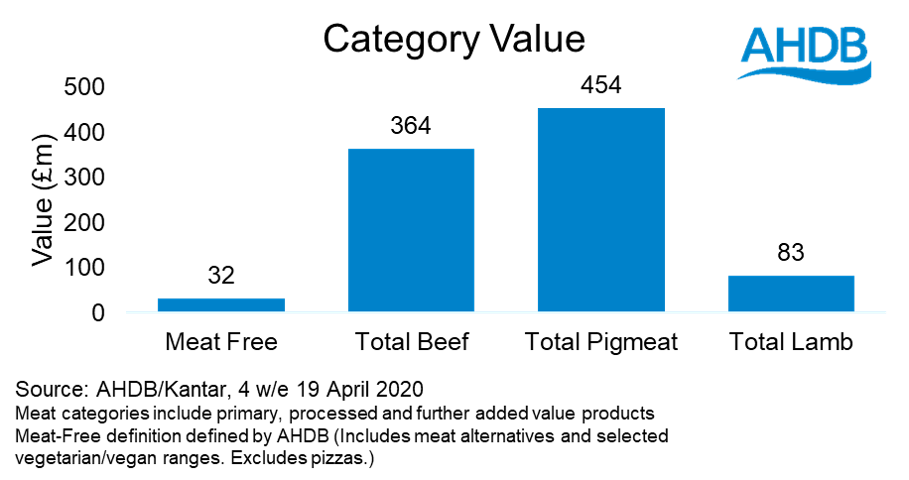

The average price of meat-free products, at £7.35/kg on average, means they are more expensive than the main meats (with the exception of lamb) and supports value gains for the category. The 15% value growth for meat free, in the four weeks ending 19 April 2020, equates to £4.1m of additional sales across Great Britain as a whole. Due to the differing scale of the categories, while the value of total meat, fish and poultry was up 5% overall, this resulted in an uplift of £71.1m, driven by pigmeat and beef.

This higher price point of meat-free products could be a contributing factor to the recent reduction in household penetration for this category. Results from CGA’s BrandTrack survey in mid-April highlighted that 85% of consumers are worried about the long-term financial implications of COVID-19. Price is always a priority but right now many shoppers will have a heightened focus on what they are spending.

*Meat-Free definition defined by AHDB (Includes meat alternatives and selected vegetarian/vegan ranges. Excludes pizzas.)