Dairy Trends: Cheese sandwiches soar but desserts drop at mealtimes

Wednesday, 31 July 2024

Dairy is a staple product for the majority of consumers, so much so that many don’t think twice when consuming it, unlike other food categories where consumers are more conscious of their needs and requirements. However, the cost-of-living crisis has meant that, on average, consumers are now cooking simpler meals with fewer ingredients in an effort to save money. This is a challenge for dairy, as it is generally used in meals with more ingredients, resulting in dairy occasions dipping over the last year.

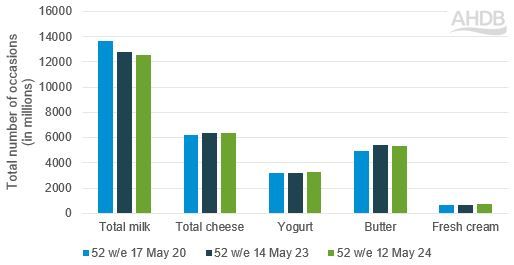

Total cows’ dairy occasions are down 6% compared with the same period in 2020 as consumer budgets have been squeezed (Kantar, 52 w/e 12 May 2024). Yet, the majority of the UK population consume cows’ dairy (91%) and the importance of dairy at mealtimes is clear to see, with dairy products found in 43% of all meals (52 w/e 12 May 2024). So what is driving dairy usage?

Daytime occasions

Milk is the largest dairy category when looking at volume and drives total dairy usage throughout the day. According to Kantar, tea and cereal are the main categories for milk usage in the 52 w/e 12 May, making up 40.5% and 27.1% of total milk occasions respectively, closely followed by coffee (24.7%). Unlike milk in coffee which has increased in share compared with 2020, milk used in tea and cereals has actually slightly declined in share compared with 2020, driving the overall decline in milk and therefore total dairy occasions across the day, specifically breakfast occasions.

Total cows’ dairy occasions by category

Source: Kantar Usage, Total cows’ dairy occasions, 52 w/e 12 May 2024

The next categories with the most occasions are cheese, followed by butter, both of which dominate lunchtime occasions, being found in 24% and 15% of all lunchtime meal occasions respectively. Lunchtime occasions containing cheese have remained stable, while butter has seen lunchtime occasions grow 1.4% versus the same period in 2020. Both categories have also been driving overall growth at dinnertime occasions for the same period.

According to Kantar, just over a quarter of our main meals end with a dessert (12 w/e 21 Jan 2024), but this is the lowest proportion on record and was nearer a third as we went into lockdown. This has had an impact on occasions where dairy is used as an ingredient in desserts, as this has dipped 1 percentage point vs 2020 and currently makes up a quarter of desserts. However, as well as obviously dairy-heavy desserts featuring cream and milk, there will also be ‘hidden’ dairy in dessert occasions, where it isn’t a standalone more raw form of the product, such as cheesecakes or pies. These hidden and less-raw products, while less dairy-heavy in some instances, still highlight the importance of dairy in desserts.

This overall drop in desserts may be down to consumer cost-saving behaviours as they cut costs by cutting out desserts. However, there are clear indications that some consumers still want some form of sweet treat as yogurt occasions have held share over the last year, with yogurt drinks seeing particularly strong performance, likely as they offer a cost-effective dessert option for consumers.

Specific dairy dishes

In terms of specific dishes that lend themselves to dairy at mealtimes, sandwiches are the most important category, with 65.5% of occasions featuring dairy. However, dairy sandwich occasions have fallen in the last year. On the other hand, Italian, Indian and Mexican dishes featuring dairy have gained share of total dairy occasions, staying consistent with trends seen earlier this year, as there has been a resurgence in consumers fancying a change and wanting variation in meals.

Looking at Italian meals specifically, dairy is often used in combination with pasta, with carbonaras, pasta bakes and spaghetti bolognaise seeing occasions grow year-on-year. This aligns with the general trend of dairy being included as an addition in more complex meals with more ingredients. This is illustrated well by cheese, as it is often included in dishes as a secondary ingredient, and these secondary-ingredient cheese dishes are in growth. Cheese is consumed primarily for enjoyment and where it is included in a pasta dish for example, it satisfies key consumer motives, such as being chosen for variety because of ‘pester power’ from family members and being a filling option. Fulfilling as many of these mealtime criteria as possible is essential to get families consuming dairy.

Profile of dairy consumers

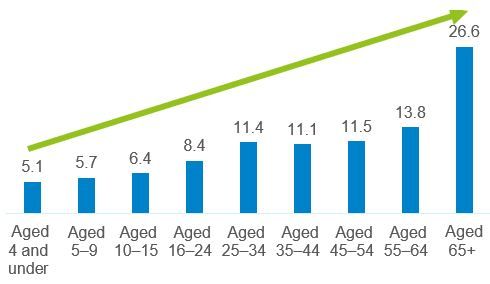

While certain dairy categories are favoured by consumers for certain cuisines, shopper demographics also play a significant role in the consumption of dairy. The key trend is that families have more fromage frais and yogurt drink occasions than the average consumer as these categories are popular with children. The pre-family group also have more treaty occasions in the form of cheese and cream, while older demographic groups are more likely to consume staple dairy categories, especially butter. Moreover, the share of dairy consumption increases with age, with shoppers over 65 accounting for almost double the share of dairy consumption of those aged 55–64.

Percentage share of cows’ dairy consumption by age group

Source: Kantar Usage, Total cows’ dairy, 52 w/e 12 May 2024

Similar trends are seen when breaking down consumption by affluence, as more affluent consumers have more occasions for more indulgent categories like yogurt and cream. However, less affluent consumers rely more on staple dairy categories that meet more basic needs, like margarine and milk.

Opportunities for dairy within home

- Meals have been getting simpler with fewer ingredients as consumers try to save money. This provides a danger for dairy and, as a result, a key focus to boost dairy usage should be on promoting the use of dairy as an extra ingredient to add flavour to meals. Pasta dishes are a key area where this can be achieved, for instance by promoting a number of recipes that vary the cheeses used, like hard continental and soft white cheeses, or by adding cream to boost enjoyment through indulgence

- While dairy presence within sandwiches has fallen as consumers move away from butter and towards margarine, cheese usage within sandwiches is at a five-year high. Consumers are also consuming a wider variety of sandwiches, with more featuring extra-mature Cheddar, and further opportunities for sandwich synergies exist, with ham and cheese sandwich occasions growing. providing a different take on an old classic could help boost usage by tapping into the desire to try something different

- While the squeeze on consumer budgets is forecast to ease throughout 2024, consumers are continuing cost-saving behaviours. With milk usage within coffee increasing, providing inspiration to help consumers recreate more premium out-of-home coffee experiences within the home can help jump on the trend and boost milk usage

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: