Chinese beef imports rise as consumer tastes evolve

Thursday, 26 November 2020

By Felicity Rusk

Chinese imports of beef have recorded impressive growth this year. In the year to September, China imported 1.57 million tonnes of fresh and frozen beef, according to Chinese government statistics. This is almost 40% more than the same period in the previous year. This is a due to a combination of a national protein deficit following the decimation of the pig herd by ASF, and the growth in the middle class influencing consumer purchasing and consumption patterns.

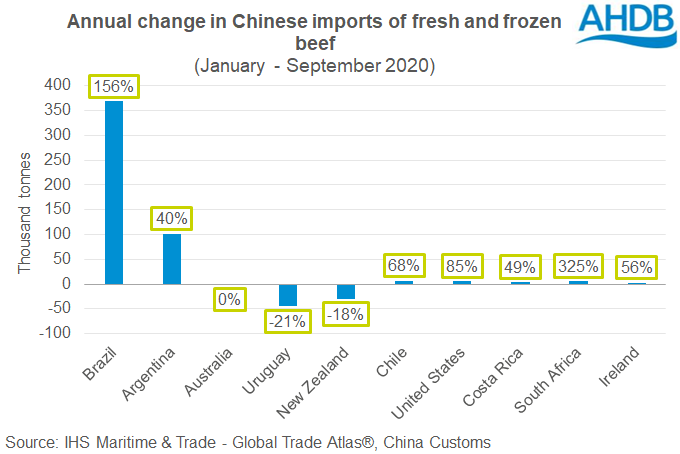

While imports have continued to rise, there have been some sizable changes from where the beef is imported. Brazil has drastically increased its market share this year, with the nation now accounting for almost 40% of China’s beef imports, compared with 22% the previous year. Brazilian beef is highly price competitive, with prices per tonne lower than Australia and New Zealand in dollar terms, which has enabled Brazil to capture some of these nations’ market share.

Shipments from Argentina have also increased this year, totalling 335,000 tonnes. However, the nation’s market share has remained relatively stable at 23%.

Looking ahead to 2021, the USDA expects that Chinese beef imports will reach 2.9 million tonnes CWE, which if realised will be 4% more than the forecast for 2020 (2.75 million tonnes CWE). Imports are expected to be supported because of modest domestic production growth and ever evolving consumption habits. Brazil will be in a strong position to meet this growing demand, with an expanding herd and competitive export prices on the global market.

However, the expected growth in imports would be the smallest in half a decade, due to the expectation of substantial growth of the Chinese pig herd.

What about the UK?

The UK has had market access to China for beef for a little over a year now. There is however some final paperwork that needs to be put in place to allow trade to begin. This is reported to be imminent, and volumes are expected to flow in 2021. While the UK is not in a position to cater to the mass market in the same way Brazil is, it is geared towards to meet the needs of consumers looking for high-quality beef. Nevertheless, now that beef has become a more established part of the Chinese diet, the nation represents a key opportunity going forward.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.