Chinese pig herd on the road to recovery

Tuesday, 24 November 2020

Last week we highlighted the Chinese pork production forecast made by the United States Department of Agriculture (USDA) in its latest quarterly outlook. Production in China is expected to grow by 9% in 2021 as sow herds are rebuilt following the outbreak of African Swine Fever (ASF) in the country.

2020 could well mark the low point in Chinese pork production. Their first case of ASF was detected in north-eastern China on 3 August 2018. The consequences eventually culminated in the loss of a large part of the sow herd, and an increased demand for imported meat.

If the USDA forecast were to materialise, although import demand will remain higher than usual in the near term, China’s pork imports would fall by 6% to 4.5 million tonnes in 2021. This would put an estimated 300,000 tonnes of product (carcase weight equivalent) back onto the world market. To put this in context, in monthly terms this is around half the volume that Germany was sending to China before discovering ASF in its own wild boar herd. In the year to date, the UK has exported around 130,000 tonnes of pig meat (product weight, including offal) to China. Although only 3% of China’s imports, this represents 45% of UK exports.

The Chinese Government is ultimately aiming to produce 95% of its pig meat demand domestically, through rapid rebuilding of its pig herd following the ASF epidemic. How rapid remains to be seen, and such growth would of course be on an unprecedented scale. But, according to official data, the herd has already been growing at an impressive rate.

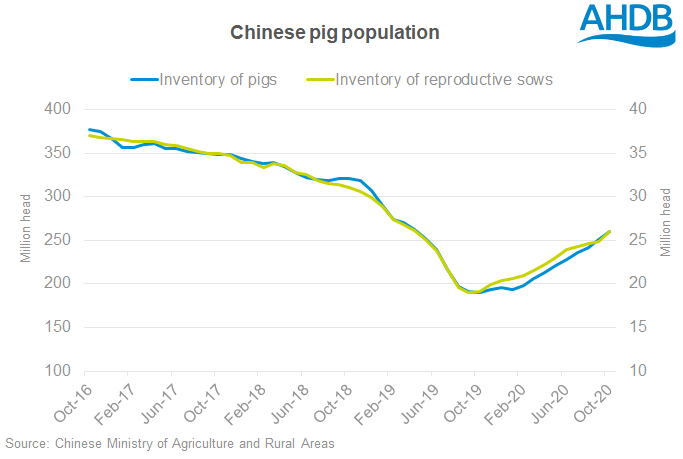

Data from the Chinese Ministry of Agriculture and Rural Areas indicates that the reproductive sow herd numbered approximately 26 million head in October, up from approximately 19 million a year ago. The same data indicates that the sow herd was over 30 million when ASF was discovered, having been in decline for some years. The picture of growth is partly supported by trade data too. China imported 29.5m tonnes of soyabeans in the third quarter of 2020, 12% more than at the same point in 2019.

However, it is not simply a question of sow numbers. A good portion of the herd growth is almost certainly from more productive and biosecure units. China had already been moving away from “backyard” pig farming before the ASF outbreak, and the management of the disease will ultimately accelerate this progress. Improvements in supply chain logistics are also reported to be taking place. Pre-ASF sow numbers may not be needed to produce pre-ASF amounts of pig meat.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.