China’s dairy imports down in 2023: What’s the outlook for 2024?

Thursday, 29 February 2024

China is an important buyer on the world dairy markets, with a strong influence on global demand that plays into price dynamics. Imports of dairy products to China continued to decline in 2023, driven by increased domestic production and weaker consumer demand.

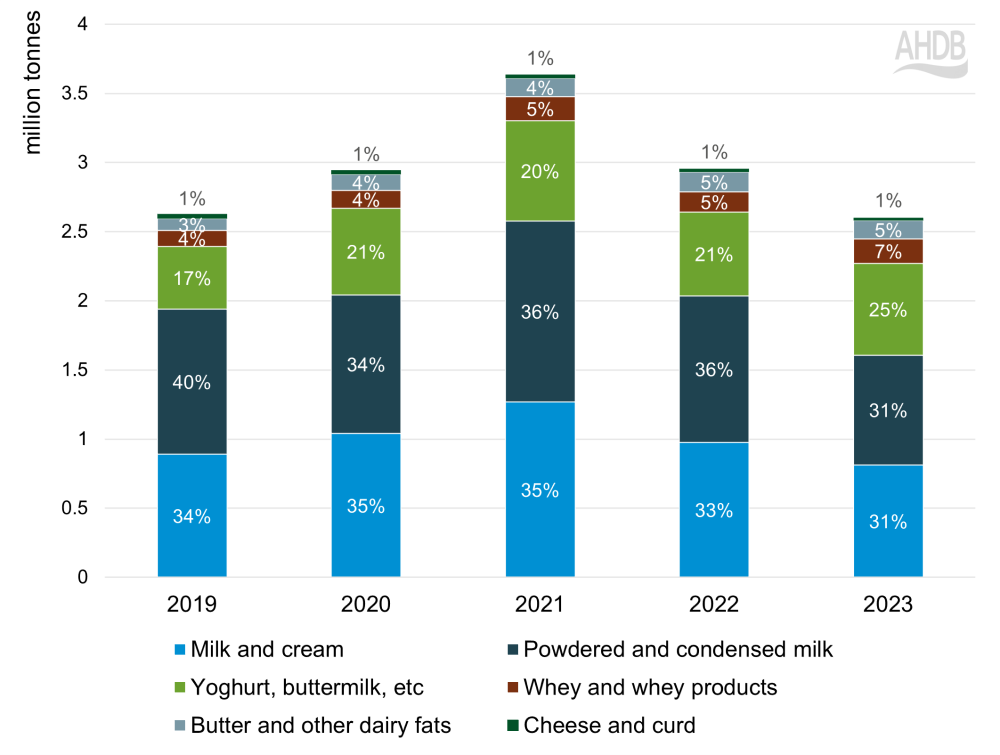

Imports of dairy products into China totalled 2.6 million tonnes in 2023, down 12% compared to the previous year. Looking across the different dairy products, we see that imports of milk powders and liquid milk and cream were both down year on year, while yogurts and whey products saw increased import volumes. The decrease in powder imports was driven by a significant reduction in WMP volume, down 38% year on year. In contrast, SMP imports saw mild growth, with volumes up by 3% in 2023 compared to 2022.

Chinese imports of dairy products

Source: Trade Data Monitor LLC

Increasing domestic production

These changing trends in product imports are, in part, driven by increased domestic production in China. USDA figures show Chinese milk production totalled 41 million tonnes in 2023 – up 4.6% from the previous year and a 28% increase compared to 2019.

The other major driver of this change is the Chinese economy and its influence on demand, particularly for dairy in foodservice and elsewhere. The economy has not recovered in the way many had hoped post-COVID, with a pessimistic outlook for 2024, which reduces demand as consumers tighten their purse strings. This is seen especially in foodservice, where dairy is often incorporated in treaty dishes such as pizza or baked goods.

As domestic milk production increases, the need to import liquid milk and powders reduces. This is a trend we are already seeing come into effect through 2023 and expect to continue into 2024 and beyond. As milk and powders make up a substantial proportion of the Chinese import portfolio, these reductions are likely to have knock-on effects on global dairy trade, reducing demand, which may in turn soften prices.

Global trading dynamics

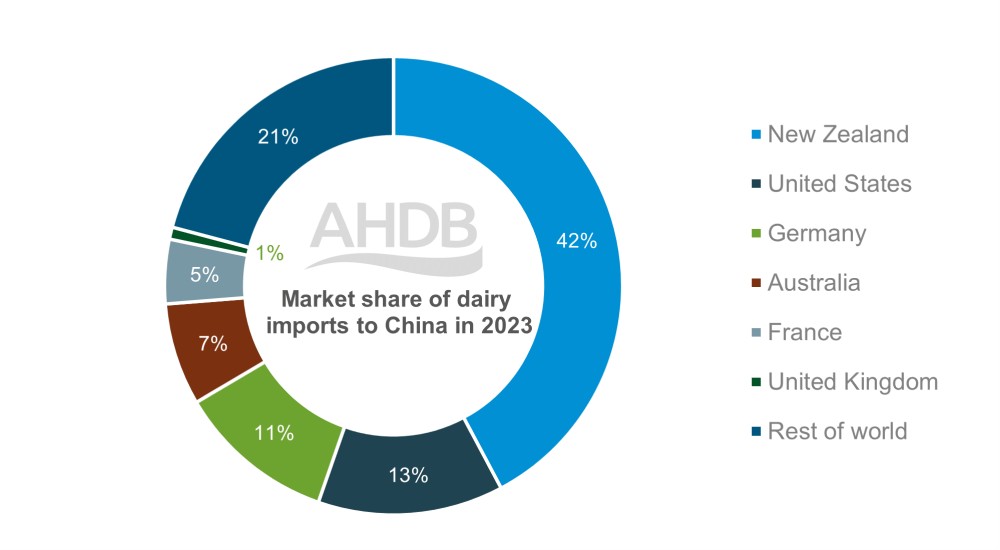

New Zealand remains the largest exporter of dairy product to China, with a 42% market share in 2023. Just under half (49%) of this volume is made up of powders, with milk and cream making up a further 30% in 2023. Other key importers include the United States, Germany and Australia, while the UK holds a market share of just below 1% in Chinese dairy imports.

Looking at products in these key importers, 90% of US product imported in 2023 was whey or whey products. Meanwhile, UK imports to China were made of 72% milk and cream in 2023, equating to 16,000 tonnes.

Exports to China accounted for only 0.6% of total dairy exports from the UK in 2023, with a volume of 7,300 tonnes. Although export volumes are low, the influence of China’s trading and demand on the global market and dairy prices are important factors in our UK market.

Market share of dairy imports to China in 2023

Source: Trade Data Monitor LLC

Import volumes declined for all key regions into China, with New Zealand imports down nearly 183,000 tonnes in 2023 from the previous year. This may create a shift in global trading patterns, with New Zealand looking for alternative markets for products or diversifying production – for example, into cheese.

Looking forward

Industry outlooks predict a slowing of the population growth in China, which in turn will slow the consumption growth that has been seen in dairy products over the past decade. Coupled with an increase in domestic production, supported by policy measures, it is likely that dairy import demand from China will soften, particularly for liquid milk and powders.

On the other hand, China’s domestic production of high-value products, such as butter and cheese, is limited by processing capacity, meaning there is potential for import demand growth in this area. This is hinged on the economic conditions in China, with heightened demand for butter in particular, for use in bakeries and foodservice, usually seen in times of economic growth.

Chinese cheese consumption has increased over the last few years, with a 16% compound annual growth rate between 2012 and 2022. In volume terms, Rabobank predicts that China’s cheese import demand will reach between 270,000 and 320,000 tonnes by 2030. This presents an opportunity for UK exports, particularly if catering to Chinese tastes in milder, creamy cheeses and cheese snacks.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.