Boneless product continues to dominate UK pig meat imports

Wednesday, 28 June 2023

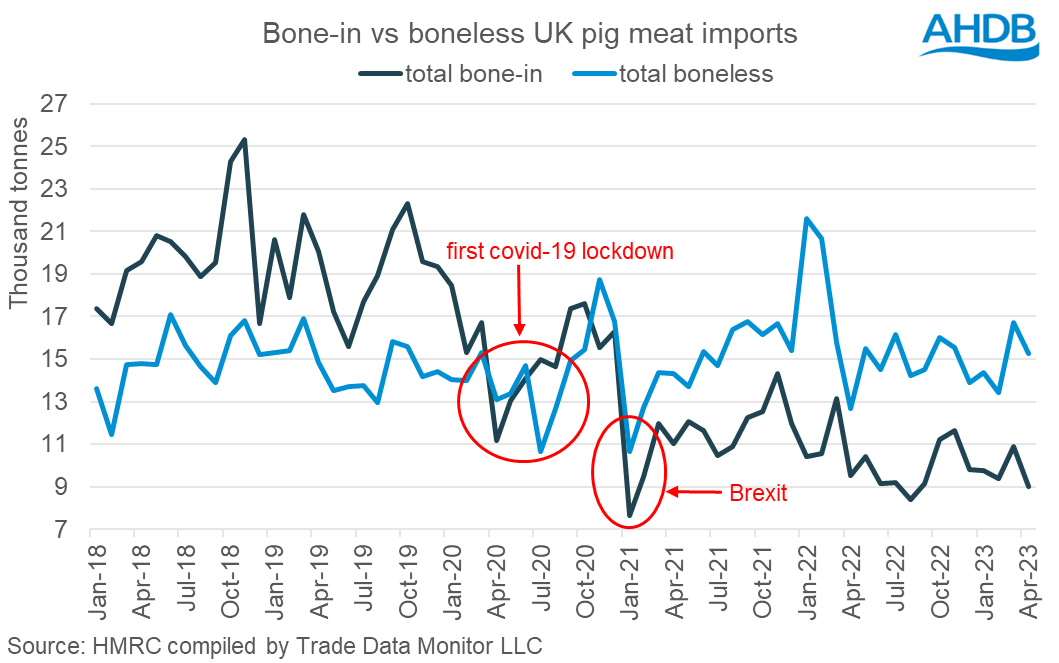

In April, the UK imported 25,300 tonnes of fresh/frozen pig meat. Of this, 15,300 tonnes (60%) was boneless product, while 9,000 tonnes (36%) was made up of bone-in product. For the year to date (Jan-Apr) the volumes stand at 102,200 tonnes of total fresh/frozen, made up of 59,800 tonnes (58%) boneless and 39,000 tonnes (38%) bone-in.

This signals that we are continuing to make use of butchery capacity abroad, a trend which begun in early 2020 as a result of the first Covid-19 lockdown in the UK and as we approached the end of the Brexit transition period. Both of these events severely impacted our domestic butchery, with skilled staff either off sick or deciding to leave the UK.

However, with UK pig meat production forecast to end the year down 15%, domestic processing capacity is currently facing an economic challenge rather than one of capacity; the restructuring we’re witnessing within the processing sector regrettably evidences this.

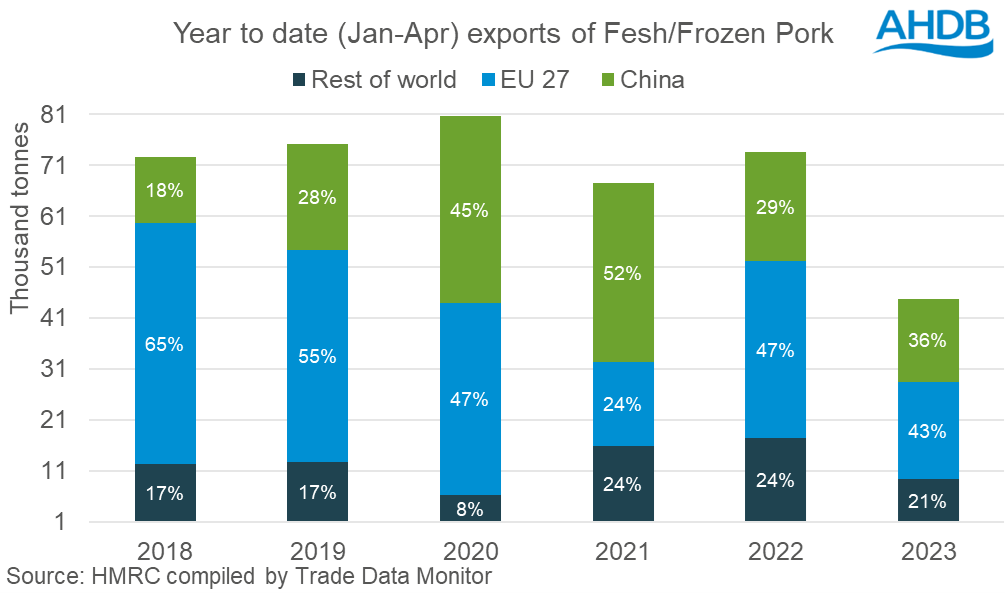

Exports have not seen the same change in product type as imports, as bone-in product has always been more dominant. In April the UK exported 10,100 tonnes of fresh/frozen pork, of which 5,400 tonnes (53%) was bone-in, while 1,300 tonnes (13%) was made up of boneless product. For the year to date (Jan-Apr) 44,800 tonnes fresh/frozen pork has been exported from the UK: 24,100 tonnes (54%) of this being bone-in with only 5,700 tonnes (13%) of bone-less.

However, exports have seen a changing picture to the destination of product over the past 5 years. Historically, the vast majority of our fresh/frozen pork exports were shipped directly into the EU, but the outbreak of ASF in China in 2018 led to vastly increased import demand, with China overtaking the EU as our main export partner in 2021. This was reversed in 2022 due to a plethora of factors, including Covid-19 restrictions being lifted in Europe and the UK, increasing demand closer to home, while the Chinese government's zero-Covid policy limited demand there.

This appears to be a trend that is continuing into 2023 despite the zero-Covid policy being lifted. Import demand in China has not bounced back to pre-pandemic volumes as domestic production has grown and a slow economic recovery leaves consumers feeling tight with their disposable incomes.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.