Black Sea concerns supporting wheat and soyabeans going strong: Grain market daily

Friday, 18 February 2022

Market commentary

- UK feed wheat futures (May-22) gained £0.35/t yesterday, to close at £218.00/t. New crop futures (Nov-22) gained the same amount closing at £200.00/t.

- Chicago soyabean futures (May-22) gained another $1.74/t yesterday, to close at $586.37/t. The Nov-22 contract climbed $1.93/t, to close at $536.68/t.

- Paris rapeseed (May-22) closed yesterday at €695.75/t, down €6.50/t. The Nov-22 contract fell just €25/t, closing at €614.50/t. A likely influence could be crude oil prices retreating, as well as repositioning against other vegetable oils.

Black Sea concerns supporting wheat and soyabeans going strong

UK feed wheat futures followed global wheat futures up yesterday. Chicago wheat (Dec-22) climbed $6.98/t, to close at $296.49/t. Price drivers come from tensions between Russia and Ukraine, and expectation that wheat demand could shift to US origin. With global supply and demand tight this season, the old-crop market is sensitive to news of impacted availability. This means that volatility and underlying support is likely to continue for wheat markets, until tensions calm down.

Wheat purchasing by Egypt’s and Algeria’s state purchasers also supported wheat prices yesterday. Additionally, the Taiwan Flour Millers Association has purchased 54.9Kt of US milling wheat today.

Looking ahead, 95% of France’s soft wheat crop was in good to excellent condition to the 14 February (FranceAgriMer). That is unchanged from a week earlier but above last year (86%). Weather conditions have been reportedly moderate, with adequate moisture. This builds into a marginally bearish picture for new crop, at least in Europe.

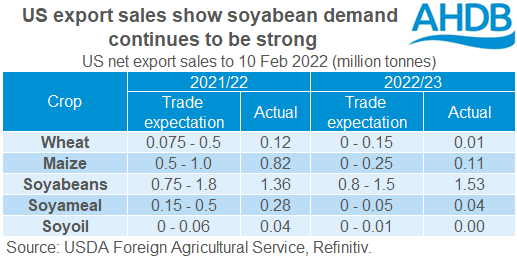

US export net sales out yesterday, for week ending 10-Feb show soyabean sales were particularly strong. Old and new crop sales totalled 2.89Mt. Sales to destination unknown continue to build, reportedly against trend at this point in the season. New-crop (2022/23) US soyabean net export sales exceeded expectations, mostly to China and unknown.

What does all this mean for the UK?

Well, Black Sea tensions are difficult to predict. As such, volatile markets will likely continue for both grains and oilseeds as the situation develops. Longer term, as we head into the new season, a larger global wheat crop is currently expected. Though question marks remain for dry US conditions. However, global opening stocks will be tight, keeping some support for prices.

For rapeseed, tensions between Russia and Ukraine will also likely cause price volatility either way. However, fundamental support remains for oilseeds short and long term. The global soyabean supply and demand picture continues to look tight. The wider vegetable oil complex also looks well supported with continued demand, and concerns on global availability. Argentina is due some marginal rainfall in the next few days, followed by heavier rainfall towards the end of February. This could be disruptive for maize harvest but potentially beneficial for soyabean crops.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.