Arable Market Report - 27 August 2024

Tuesday, 27 August 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

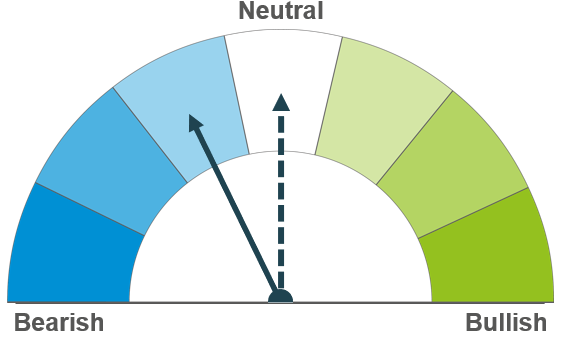

Wheat

Competition for export demand from Russian wheat has been weighing on markets, along with currency shifts. Tighter wheat global supplies year-on-year could offer some support longer-term.

Maize

Expected record US yields are being weighed against the heatwave in the Midwest and issues in parts of Europe as crops progress towards harvest.

Barley

The pressure in wheat markets has been weighing on global barley prices recently, but demand levels will be key to the price relationship longer-term.

Global grain markets

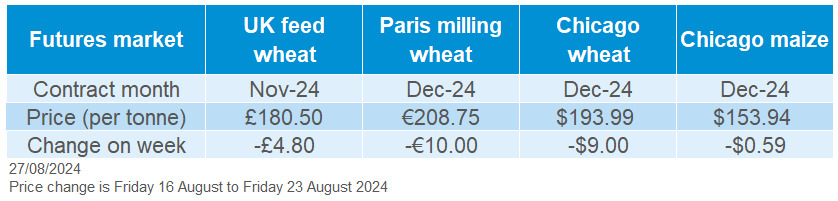

Global grain futures

Wheat markets declined last week (Friday to Friday) as Black Sea supplies continue to outcompete for export demand. Shifts in exchange rates and selling by speculative traders also contributed. The euro hit a one-year high against the US dollar on Thursday due to weaker US economic data and potential for an interest rate cut in September.

EU common wheat exports were running 22% behind last season’s pace by 18 August. This is despite the EU Commission predicting total supply would be 7% lower year-on-year in July.

Poor French specific weights and some lower protein levels stand out in the provisional 2024 quality data from Avarlis and FranceAgriMer. Meanwhile in Germany, protein levels are reported by the farmer’s association DBV as similar to 2023’s low levels, with production down 15%. German analysts AMI report that prices for top protein content wheat rose last week amid tight supplies, while those for other grades fell.

Maize prices also edged lower as the ProFarmer crop tour in the US showed maize yield potential in key producing states was variable but overall positive. The final yield assessment is 1.1% below the USDA’s prediction earlier this month, but still a new record.

The EU’s crop monitoring service MARS cut its expectation for maize yields yesterday from 7.24t/ha to 7.03t/t, following the very hot weather in Eastern Europe. This is now 4% below average. Soft wheat and winter barley yield estimates were also lowered based on harvest results.

Yesterday, benchmark Dec-24 Paris and Chicago wheat futures lost 1.7% and 0.6% respectively due to the ongoing export situation and selling by speculative traders. For Chicago maize futures, strong US crop prospects remained the key driver, with the Dec-24 contract down 1.2%.

UK focus

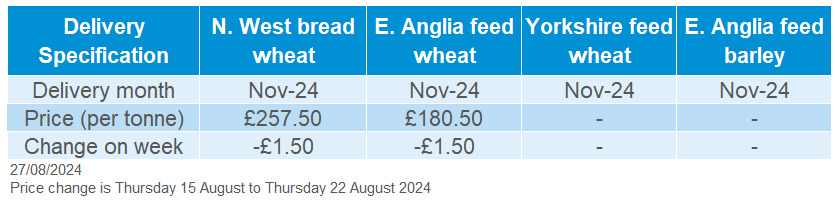

Delivered cereals

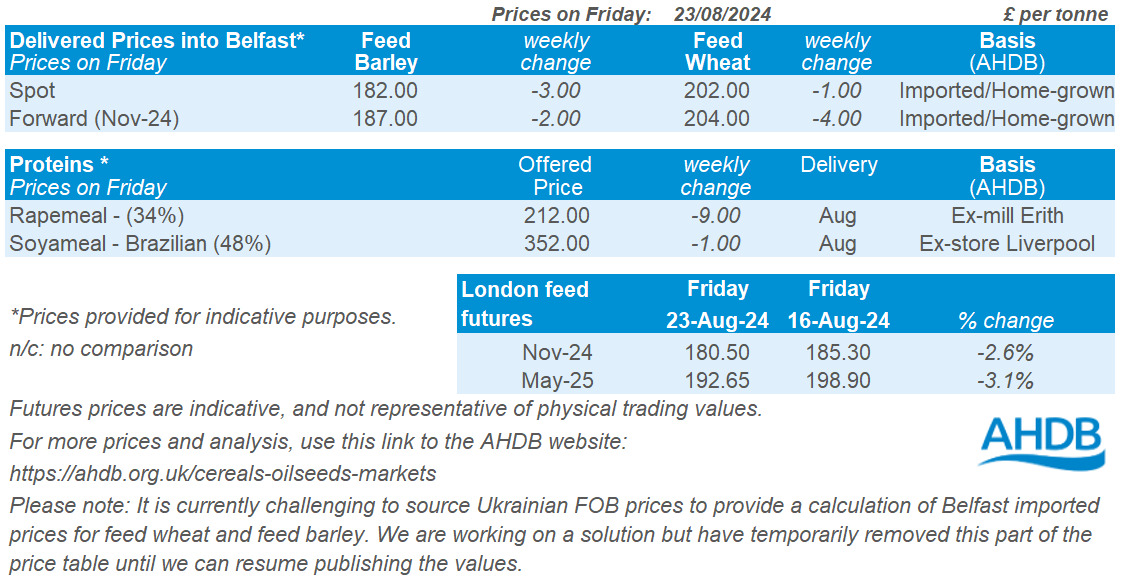

UK feed wheat futures for Nov-24 settled at £180.50/t on Friday, down £4.80/t from 16 August and the lowest price since early March. Smaller falls were recorded in delivered prices, though these still followed the futures trend from Thursday 15 – Thursday 22 August.

As anecdotal reports suggest a higher prevalence of ergot this season, we look at the cost of ergot cleaning on full specification bread wheat premiums.

Total stocks of wheat held by merchants, ports and co-operatives in the UK at the end of June 2024 were 43% higher than a year earlier (AHDB). Meanwhile, Defra estimated a 35% rise in on-farm stocks in England and Wales. While this isn’t the full picture yet, the data suggests a notable rise in carry-out stocks which could soften the impact of lower production in 2024, though historically high imports will still be needed.

Friday’s Grain market daily gave an initial indication of how much wheat could be produced this year, ahead of Defra’s provisional estimate of area in England, out this Thursday (29 August). Using current area and yield estimates points to wheat production being in the range of 10.8 – 11.7 Mt, well below the five-year average of 13.9 Mt.

AHDB’s next UK crop progress report is due on Friday. Look out for highlights in Grain market daily; click here to subscribe.

Oilseeds

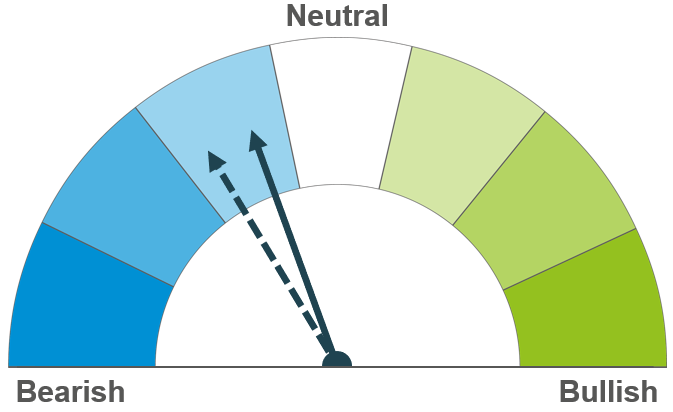

Rapeseed

Ample global soyabean stocks will continue to weigh on the oilseed complex including rapeseed. However, the globally tight balance for vegetable oils offers support longer-term.

Soyabeans

Strong US soyabean production estimates weigh on the outlook, though the current weather adds a watchpoint. In addition, while Chinese demand for US soyabeans has improved on the week, it remains behind previous years.

Global oilseed markets

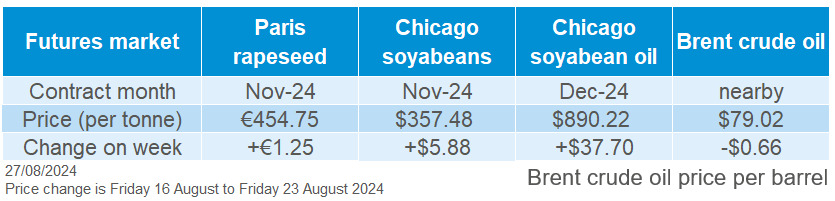

Global oilseed futures

Chicago soyabean futures (Nov-24) rose 1.7% last week (Friday – Friday) following increased demand for US soyabeans and some dry weather concerns. Yesterday, the contract gained 0.8% in response to strengthening in soyabean oil and weather concerns (higher than usual temperatures) for the US Midwest.

On Thursday, the USDA reported that soyabean export sales during 09 – 15 August (2024/25 marketing year) totalled 1.7 Mt, overtaking the previous week’s record weekly sales of 1.3 Mt. Demand from China largely supported the rise in sales, as it purchased 0.9 Mt over the period. Chinese demand continued into last week too; the USDA daily reports announced that China had purchased a total of 0.8 Mt from Monday to Thursday, including notable 0.3 Mt purchase on Monday 19 August.

Earlier last week, forecasts of dry weather around the Mississippi Delta lead to some concerns regarding soyabean yields as the US crop progresses through its final growth stages. This factored in some weather risk premium to Chicago soyabean futures.

The 2024 ProFarmer Crop Tour, which is a compilation of scout reports regarding potential corn and soyabean production in key US states, took place last week. ProFarmer forecasts the US soyabean crop up 15.3% on the year to 129.0 Mt, with yields up 10.5% over the same period. This exceeds the USDA, which forecast soyabean production up 10.2% on the year to 124.9 Mt, with the average yield up 5.1%.

Malaysian palm oil futures (Nov-24) gained 5.1% on the week (Friday to Friday) after four consecutive weeks of declines. Support came from improved Chinese demand, strengthening in oil markets, and the Indonesian government announcing plans to implement a mandatory 40% palm-oil based blend for biodiesel, up from 35%.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-24) gained 0.3% on the week (Friday to Friday), falling short of the rise seen in Chicago soyabean futures (Nov-24) over the same period. This was partly due to the euro rising against the US dollar.

Paris rapeseed futures also found some modest support from plans of a rail strike in Canada on Thursday (22 August). However, the parties involved have since been able to come to a resolution and the rail network returned to operation yesterday.

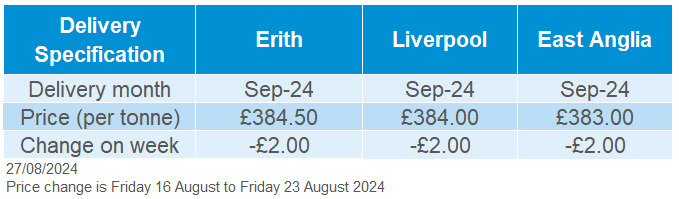

Delivered rapeseed prices followed the trend of global prices at the time of the survey (late Friday morning). Rapeseed delivered into Erith for September was quoted at £384.50/t on Friday, falling £2.00/t on the week. Meanwhile, delivery in May was quoted at £396.50/t losing £1.00/t over the same period.

Last week, Agriculture and Agri-Food Canada released its monthly Principle Field Crop Report. Despite the unfavourable conditions in July, the cooler weather in early August improved the outlook for canola (rapeseed) crops that were planted later. Canola production remained at 18.6 Mt, with a 0.5 Mt rise in exports from July’s estimate to 7.5 Mt.

Ukraine’s rapeseed exports so far in the 2024/25 marketing year have shown a strong pace. Exports for July 2024 totalled 411 Kt, up 63.7% from July 2023. Exports for August are estimated at 900 - 1000 Kt, which would be a record high (LSEG), with 408 Kt shipped in the first half of the month (01 – 15).

Yesterday, the EU MARS report reduced the rape and turnip rape yield for the fourth consecutive month to 3.07 t/ha, below the five-year average of 3.17 t/ha.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.