How costly is ergot on milling wheat? Grain market daily

Wednesday, 21 August 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £185.75/t yesterday, rising £1.00/t from Monday’s close. The May-25 contract also gained £1.00/t over the same period, to close at £197.75/t.

- UK feed wheat futures found support as the Russian agricultural minister suggested that Russia’s wheat production could be lowered further from 86 Mt due to the unfavourable weather experienced earlier this year and during harvest. Though Russian agricultural consultancy SovEcon raised their Russian wheat forecast yesterday by 0.4 Mt to 83.3 Mt. UK wheat futures also found support from gains in Chicago wheat futures, while continued Euro strength capped gains for Paris wheat futures.

- Paris rapeseed futures (Nov-24) closed at €452.00/t yesterday, down €1.25/t from Monday’s close. The May-25 contract gained €0.75/t over the same period, to close at €456.50/t.

- Paris rapeseed futures generally tracked weakness in the vegetable oils complex however some 2025 contracts found modest fundamental support.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

How costly is ergot on milling wheat?

As at the week ending 14 August, 37% of the UK’s wheat harvest was complete. While the specific weight and hagberg falling number results are encouraging, early reports of milling wheat protein is disappointing. Furthermore, there are reports that ergot is more prevalent this year. So, although many may be required to spend more on cleaning cost, squeezing the margin on milling wheat, the currently high milling wheat premium upholds the attractiveness of the market for growers.

Current outlook of milling wheat crop

In the latest AHDB harvest report, Group 1 wheat varieties have averaged 11.5 - 12.0% protein, which is the first harvest report view regarding wheat and could change as harvest progresses. While this is less than the contractual 13% protein level required from millers, strong imports of higher quality wheat and flexibility of millers’ protein intakes will mean that these lower proteins are usable. The encouraging outlook on specific weight and hagberg falling numbers also adds support to the demand for domestic wheat for milling purposes.

What has caused increased ergot prevalence in wheat?

Anecdotal reports suggest that the increased prevalence of ergot is varied across the UK and is not believed to stem from one sole cause, but several factors which fostered its development. Ergot incidence is higher in some areas where conditions were cool and wet during flowering, which facilitated spore production and prolonged the flowering period. Another factor is that areas with a lot of grassweeds and early flowering grassweeds, such as in margins, may have also seen higher ergot levels. One question being posed is if this increase in ergot is an unintended consequence of flowering margins being planted under SFI? Should this be a consideration of how SFI is used in a rotation for those growing quality crops?

How could it impact the milling wheat premium?

Given the zero visible ergot tolerance policy in the milling wheat trade, the need to clean ergot from wheat prior to hauling to a buyer should be considered if you have noticed its presence. This same advice would hold for feed grains and malting barley. Needless to say, rejection at delivery due to the presence of ergot or if the mycotoxin level exceeds the tolerance limit can incur considerable cost.

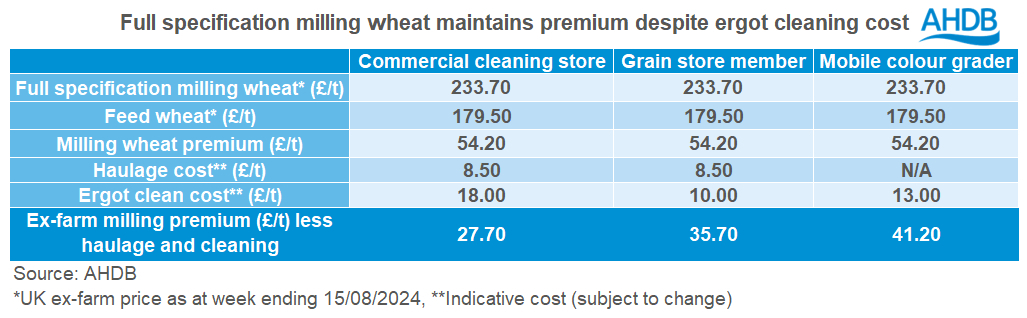

Generally, if you are not a member of a grain store, it could cost approximately £18/t to clean ergot from wheat, while those who are members are usually subject to a discounted rate; with weight loss considerations. While mobile colour graders can price at approximately £13/t, they process around 15 tonnes per hour in comparison to commercial cleaning stores which are able to process approximately 40 tonnes per hour. Therefore, the cost of time may also need to be factored into the decision when considering how you wish to clean grain if necessary. In addition, mobile colour graders are also used to dress seed, and therefore demand for these machines is currently very high and could be subject to a waiting time.

Using the latest ex-farm prices, an indicative haulage price, and the varied cleaning costs, the ex-farm milling wheat premium remains positive. However, it is important to note that this is for full specification milling wheat, so should penalties be incurred as a result of falling short of milling specification, the margins would differ. In addition, it is important to factor in weight loss that can occur during the cleaning process which is approximately 2% of the initial volume.

Looking back, then looking forward

While many have seen a rise of ergot in grain this year, as well as lower protein, the overall condition of the crop has improved significantly since earlier this year. A few months ago there had been notable concerns regarding production, with some estimating a sub-10 Mt wheat crop.

Therefore, as the variable domestic wheat crop appears to be more useable for milling purposes, this is likely to offset some pressure from imports seen during 2023/24. Though, it is also important to note that the forecasted lower wheat area could impact on supply, leading to fundamental support. So, for those needing to clean wheat of ergot, milling wheat margins will of course be squeezed. However, the historically high premium over feed quality wheat continues to make milling wheat an attractive market.

As harvest continues, the improved understanding of the domestic wheat crop will offer further insight into the milling wheat supply going forwards.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.