Arable Market Report - 28 May 2024

Tuesday, 28 May 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

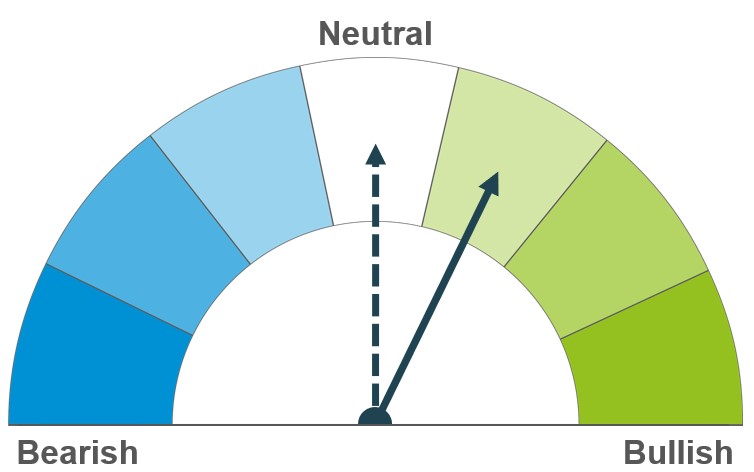

Grains

Wheat

Maize

Barley

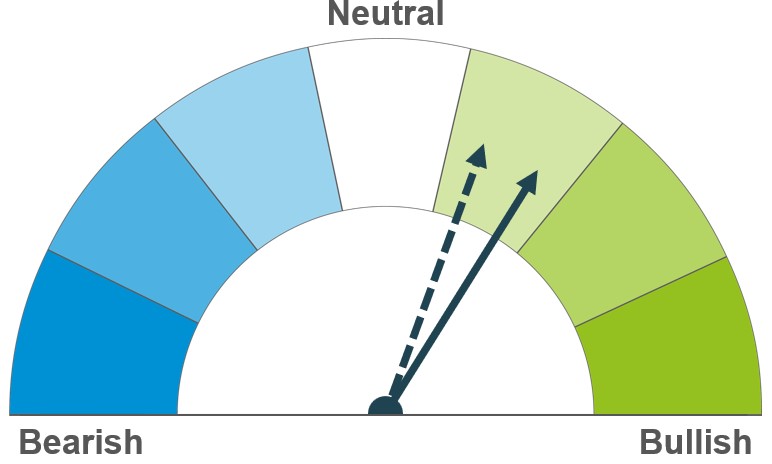

Concerns for Russian wheat production continue to build and the next few weeks are critical for the Northern Hemisphere wheat outlook. Longer-term, the potential for global demand to soften due to price rises also needs to be monitored.

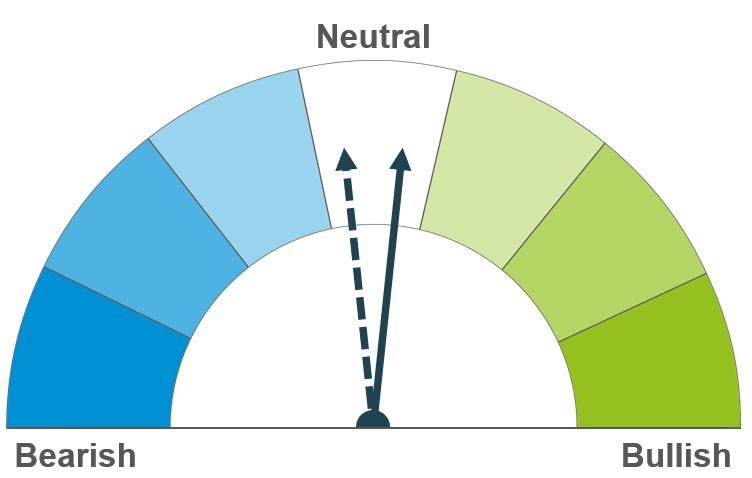

Planting progression in Europe and the US remain watchpoints for the maize market, alongside nerves over what the Brazilian Safrinha harvest may show. Heavy maize supplies are expected longer-term, though ongoing concerns over wheat could push further feed demand onto maize.

Building dryness in Australia, plus the condition of barley crops across the Northern Hemisphere are watchpoints. Larger crops are currently forecast for 2024/25, though this is expected to be matched by increased demand.

Global grain markets

Global grain futures

The global grain market ended higher last week as prospect of crop losses due to adverse weather conditions in Russia continued to influence the price direction. Prices rallied earlier in the week, then eased back slightly on profit taking.

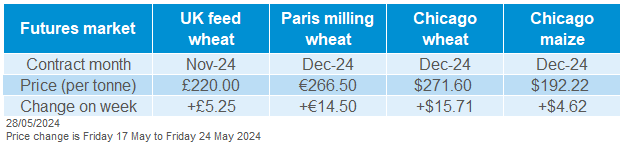

Chicago wheat futures (Dec-24) gained $15.71/t across the week (Friday-Friday) to close at $271.60/t. Paris milling wheat (Dec-24) rose €14.50/t over the same period, ending the week at €266.50/t. The Dec-24 Chicago maize futures moved in a similar direction, up $4.62/t for the same period as doubts over South American crop production filters through.

During the week, Russian forecaster, IKAR dropped its Russian wheat harvest estimate for 2024/25 to 83.5 Mt from 86.0 Mt, with exports decreasing by 2.0 Mt to 45.0 Mt. This due to dry weather concerns and the previous frosts impacting crops in the country. Just yesterday (Monday), the firm further trimmed down these figures to 81.5 Mt (production) and 44.0 Mt (export). This led to further rises in Paris milling wheat prices.

The International Grains Council (IGC) also trimmed its forecast for the 2024/25 global wheat output by 3.0 Mt to 795 Mt. This follows downgrades to the Russian and Ukrainian crop outlooks to 85.5 Mt and 23.7Mt, from the previous projections of 90.4 Mt and 24.5 Mt respectively. The global maize production forecast for the same period was lowered 6.0 Mt to 1.22 Bt, driven mainly by the outbreak of leafhopper insect in Argentina.

The Brazilian maize market has continued to weigh the impact of drought on the country’s second maize harvest, which represents 70%-80% of total production. Only about 1% of the crop has been harvested (Conab).

The EU Commission reported significant delays in the planting of barley in western and northern Europe due to extremely wet conditions. Countries in eastern Europe completed planting early as they experienced more favourable weather conditions. The yield forecasts for winter and spring barley were increased slightly from April.

UK focus

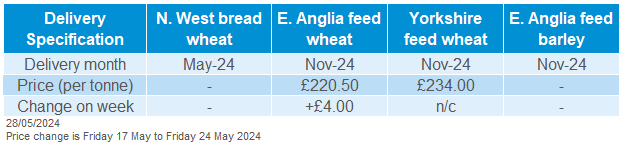

Delivered cereals

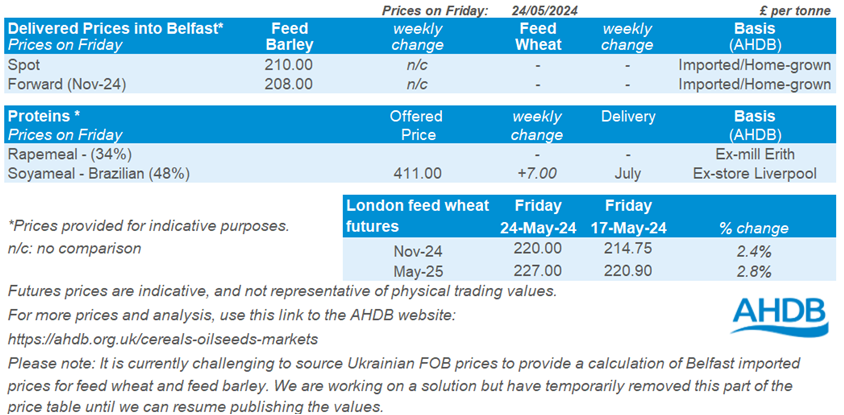

UK feed wheat futures gained less than the global market last week, due to sterling rising against both the euro and US dollar. Nov-24 UK feed wheat futures gained £5.25/t or 2.4% last week to close at £220.00/t. However, Dec-24 Paris wheat futures rose by 5.8% and the Dec-24 Chicago wheat futures gained 6.1% over the same period.

The price for feed wheat delivered into East Anglia in Nov-24 rose £4.00/t between 16 and 23 May and was reported at £220.50/t. This echoed the trend seen in new crop futures prices Thursday – Thursday, while old crop delivered prices eased over the same period. We were unable to publish a bread wheat price last week; the market was described as thinly traded.

The latest AHDB analysis on the Sustainable Farming Incentive (SFI) looks at the concerns over how much productive land could be entered in the scheme.

Data from AHDB’s Farmbench shows how wheat net-margins in the UK have fluctuated for the past five harvest years (2018 -2023). Click here to read more.

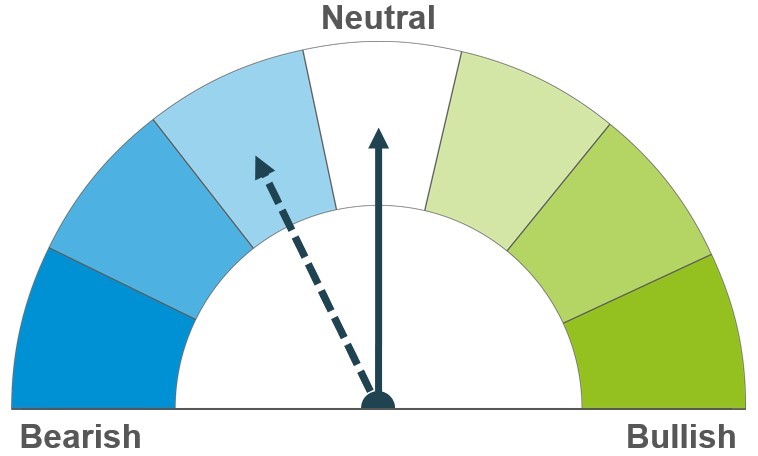

Oilseeds

Rapeseed

Soyabeans

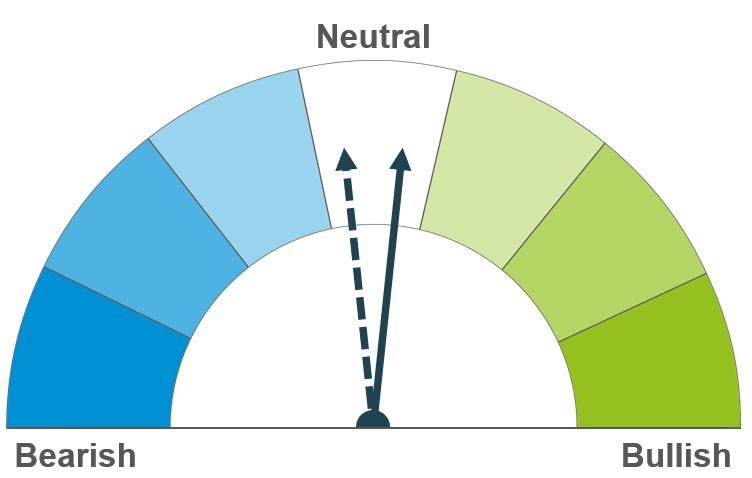

Concern about crop sizes in key producers continues to extend rapeseed’s price premium over soyabeans. The predictions of a draw-down in rapeseed stocks offers support to prices compared to soyabeans.

Uncertainty over the impact of flooding in Brazil and strong soyameal prices are supporting soyabean prices short term. However, the longer-term outlook continues to show heavy global supplies.

Global oilseed markets

Global oilseed futures

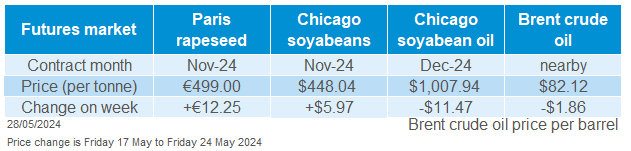

Global oilseeds markets rose last week, led by soyameal and rapeseed (see below for more). The rapid export pace for US soyameal and buying by speculative traders supported Chicago soyameal prices. US exports and commitments for the 2023/24 season totalled 11.81 Mt by 16 May, up from 10.56 Mt a year ago and a record pace. A slower crushing pace in Argentina, following harvest delays, supports US soyameal exports.

This rise in soyameal prices, along with ongoing concerns about the impact of flooding in Brazil on soyabean production, led to rises in soyabean prices. Buying by speculative traders also supported at intervals during the week. Chicago soyabean futures (Nov-24) gained $5.97/t last week to close at $448.04/t. The market was closed yesterday due to the Memorial Day public holiday.

Forecaster Datagro trimmed its estimate of the Brazilian 2023/24 crop by 0.4 Mt to 147.6 Mt on Friday. Lower yield expectations for flood-hit Rio Grande do Sul outweighed increases to the overall cropped area estimate. Datagro’s figure matches Conab’s May estimate and is 6.9 Mt lower than 2022/23.

However, the International Grains Council (IGC) estimated the Brazilian crop currently being harvested at 150.0 Mt last week, up 0.7 Mt from its April estimate. The IGC also raised its forecast for next seasons’ Brazilian crop. The IGC now predicts even larger global surpluses for both the 2023/24 and 2024/25 seasons than in April.

Rapeseed focus

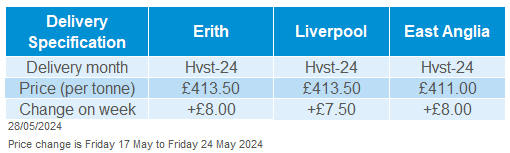

UK delivered oilseed prices

Paris rapeseed futures (Nov-24) gained last week (Friday to Friday), with a modest fall yesterday. Last Thursday, new crop (Nov-24) futures reached an 11-month high and closed at €502.75/t. Yesterday, the contract slipped back to €497.75/t but this is still €11.00/t higher than the price on 17 May.

Rapeseed futures were supported by soyabeans futures markets (see more above) and dry weather reported in western and southern Australia. The weather is pressuring canola (rapeseed) planting across the affected areas, with Australian Crop Forecasters predicting production down 5% year-on-year to 5.4 Mt.

Rapeseed delivered into Erith for June delivery was quoted at €406.50/t on Friday. For November delivery, rapeseed was quoted at €425.00/t, gaining €9.50/t on the week (Friday – Friday).

Oilworld (www.oilworld.biz) expects Australia’s and Ukraine’s rapeseed export surplus to lessen next season, leading to a potential increase in demand for Canadian rapeseed. UGA, a Ukrainian grain traders union, forecasts Ukraine’s rapeseed 2024/25 exports at 3.4 Mt, down from 3.6 Mt for 2023/24.

In the latest EU MARS report, the average EU rapeseed yield for 2024 was forecast at 3.21 t/ha, down by 2% from April’s report. However, this is still up 1% over the five-year average. Germany, the second largest producer of rapeseed in the EU, is forecast to produce 3.87 Mt of winter rapeseed for 2024 by its national association of farm co-operatives. This is down 8.4% from last year impacted by the wet autumn.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.