Stronger sterling hampering UK feed wheat futures: Grain market daily

Thursday, 23 May 2024

Market commentary

- Nov-24 UK feed wheat futures closed yesterday at £220.25/t, down £0.60/t from Tuesday’s close, and tracking global market trends on the day.

- Global wheat markets experienced an early rally yesterday, with Dec-24 Chicago wheat futures reaching a 10-month high on concerns about the declining weather situation in Russia. However, prices retreated later on mainly due to profit taking and an improved weather forecast for Ukraine.

- Paris rapeseed futures (Nov-24) steadied at €496.25/t, up €8.50/t from Tuesday’s close.

- Support in European rapeseed markets yesterday came from climbs in the wider oilseeds complex. Nov-24 Chicago soyabeans were up $1.93/t yesterday. LSEG also report expectations of a cut in Canada’s canola production estimate for 2024/25 due to spring acreage shifts to wheat on the back of poor growing conditions.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Stronger sterling hampering UK feed wheat futures

Over the past fortnight, a rise in the strength of sterling has offset some of the gains in global wheat markets for UK feed wheat futures.

Rise in the strength of sterling

Sterling has generally risen over the past fortnight due to better-than-expected economic growth in the first quarter of 2024. The data out earlier this month also showed that the UK had emerged from recession.

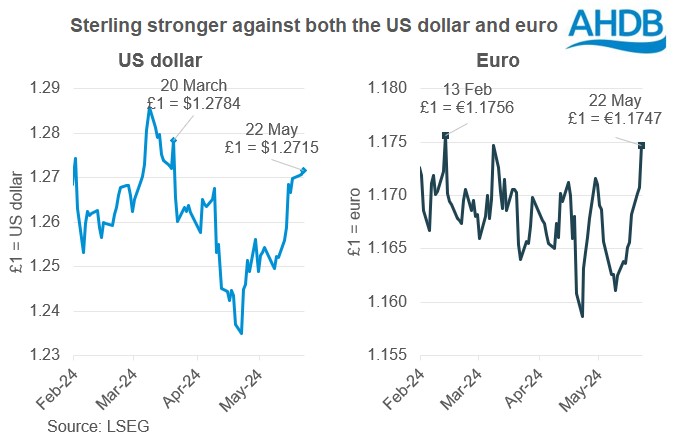

Yesterday, sterling reached a two-month high against the US dollar and the highest level since early February against the euro (LSEG). One pound was reported as worth $1.2715 and €1.1747 yesterday.

The UK’s Consumer Price Index (CPI), a measure of inflation, rose by 2.3% in the 12 months ending 30 April. The rate at which UK prices are rising fell largely due to the lower energy cap introduced on 1 April. The CPI was notably lower than for the 12 months ending 31 March (3.2%).

However, Reuters report that it was higher than economists and the Bank of England (BoE) expected. The CPI also remains above the BoE target of 2.0%.

As a result, the market feels interest rates are now less likely to cut be in June. This potential for interest rates to stay at current levels for longer, supported sterling against the US dollar and euro.

Multiple news sources suggest the announcement of a General Election for 4 July had little impact on the exchange rate.

Impact on UK wheat futures

Since 8 May, Dec-24 Paris wheat futures have gained €18.00/t or 7.29%, closing yesterday (22 May) at €264.75/t. Dec-24 Chicago wheat futures gained $19.66/t or 7.9% over the same period to $269.70/t.

These gains reflect the ongoing worries about wheat production in the Northern Hemisphere, especially Russia. There’s also influence from speculative traders buying back previously sold positions.

However, over the same period sterling gained 1.8% against the US dollar and 1.0% against the euro (LSEG). This contributed to UK feed wheat futures recording smaller gains than the global wheat market. Between 8 and 22 May, the Nov-24 contract gained £7.50/t, or 3.5%.

Where next?

If sterling remains strong against the euro and US dollar, it’s likely to continue to impact the relationship of UK wheat prices to the global wheat market. While a weaker sterling could help support UK prices relative to the global level.

The exchange rate for sterling against the euro and dollar will be influenced by economic and inflation data in the UK, Eurozone and USA. A couple of dates to look out for are the next BoE decision on interest rates, due on 20 June, while the European Central Bank (ECB) meets on 6 June.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.