Arable Market Report – 21 July 2025

Monday, 21 July 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

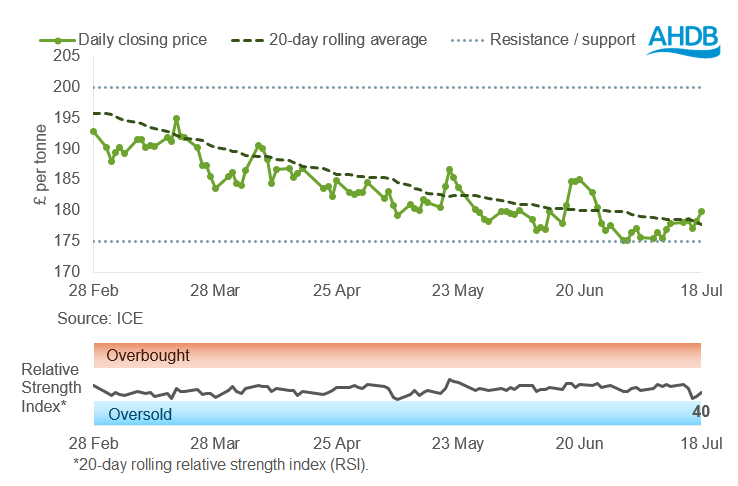

UK feed wheat futures (Nov-25)

UK feed wheat futures rose last week (Friday–Friday), closing above the 20-day moving average. However, the relative strength index (RSI) dipped from 47 to 40, pointing to softer momentum. Prices may be stabilising, but the market lacks clear upward drive.

Find out more about the graphs in this report and how to use them here.

Market drivers

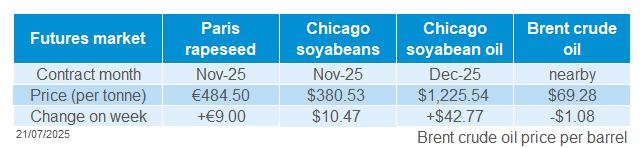

Global wheat futures firmed last week (11–18 July), providing support to domestic prices. UK feed wheat futures (Nov-25) rose by £1.95/t (1.1%), closing at £179.95/t. Paris milling wheat and Chicago wheat futures (Dec-25) also saw gains of 1.1% and 0.3% respectively. The upward movement was driven by easing US harvest pressure, weather concerns, currency movements, and signs of renewed global demand.

In the US, Chicago wheat futures rebounded on Friday after hitting a two-month low earlier in the week. With the winter wheat harvest nearly complete and farmer selling slowing, market pressure has eased. Strength in maize markets, supported by adverse weather and short covering, also contributed to wheat price gains.

Across Europe, France’s wheat harvest is ahead of usual pace, with 71% completed by mid-July. However, the hot and dry conditions have impacted the development of French maize, with crop ratings falling to 72%, the lowest for this time of year since 2018. Rain is forecast, which may offer some relief. In Germany, wheat output is expected to exceed last year’s, although persistent wet weather could affect milling quality.

Harvest progress in the Black Sea region remains slow. Russia had harvested 11.0 Mt by 11 July, less than half the volume gathered by the same point last year. Ukraine’s harvest is also behind usual pace. Russian wheat exports are being held back by slow farmer selling and limited port arrivals, particularly for high-protein wheat (LSEG).

Argentina’s wheat production forecast has been lowered to 20.0 Mt from 20.7 Mt by the Rosario Grains Exchange. Despite the downgrade, output remains ahead of last season’s levels.

The International Grains Council kept its 2025/26 global wheat forecast at 808 Mt last week, up 8.0 Mt year-on-year.

International demand is showing signs of some recovery, with tenders emerging from Thailand, Jordan, and Taiwan, and confirmed purchases by Algeria. Over the weekend, Bangladesh signed a five-year agreement to import 700 Kt of US wheat annually, aimed at securing tariff relief from the US government. This renewed demand will be important to monitor in the weeks ahead.

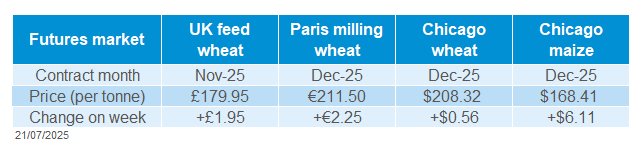

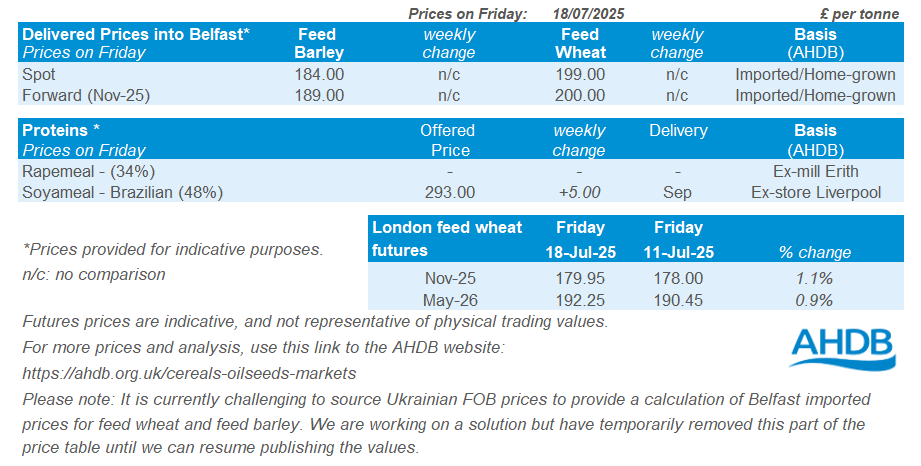

UK delivered cereal prices

Feed wheat delivered into East Anglia for November delivery was quoted at £176.50/t on Thursday, up £1.00/t on the week. October delivery of bread wheat into the North West was quoted at £226.00/t.

Rapeseed

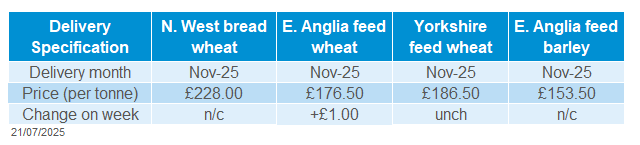

Paris rapeseed futures in £/t (Nov-25)

Last week (Friday–Friday), Paris rapeseed futures (in £/t) climbed just above the 20-day moving average, closing at just over £419/t. The relative strength index (RSI) fell back from 41 to 39 this week showing another weekly drop in market momentum.

Find out more about the graphs in this report and how to use them here.

Market drivers

Paris rapeseed futures (Nov-25) edged up last week closing at €484.50/t on Friday, up €9.00/t (1.9%) on the week. This followed upward trends seen across the oilseeds complex in the US and Canada.

Last Monday, the USDA reported that as of 13 July, 70% of the soyabean crop was in good to excellent condition, the highest July rating since 2016 and above analyst expectations (Reuters). Warm weather and timely rains across the Midwest boosted optimism.

However, support emerged later in the week with Chicago soyabean oil (Dec-25) futures up 3.6% Friday–Friday. US biofuel policy is forecast to lift soyabean oil usage by 26.5% next year, with over half of supply destined for biofuel. Forecasts for excessive heat in late July also raised concerns, potentially threatening crop development.

The US and Indonesia signed a new agreement with a focus on agricultural products last week, lifting demand prospects. With Indonesia being one of the largest importers of US soyabeans.

The US reported exports of 120 Kt to an undisclosed destination and with Chinas import volumes below average for the time of year, it is suggested to be heading to the country. China also approved the return of Australian canola, allowing five trial cargos after lifting disease-related restrictions that have been in place since 2020, raising competition for Canadian exporters.

In Canada, rapeseed crop conditions remain mixed in Saskatchewan, Canadas largest growing region. Eastern regions report near-ideal progress, while the south-east faces more variability due to uneven rainfall and heat stress in a key development stage. This provided support to prices, with Friday’s close seeing Winnipeg canola (Nov-25) up 2.6% on the week.

On Wednesday, Argentina’s Buenos Aires Grain Exchange revised its soyabean harvest estimate upwards to 49.5 Mt, up from 48.5 Mt citing better-than-expected yields in major producing provinces. This was above analyst expectations (Reuters) and will be a watchpoint for the wider oilseeds complex looking ahead.

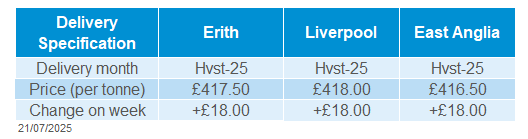

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in November was quoted at £427.50/t on Friday, up £15.50/t on the week. Liverpool and East Anglia delivery in November were quoted at £428.00/t and £426.50/t respectively, also both up £15.50/t on the week.

Extra information

The second harvest report is due to be released this Friday (25 July), with the latest update on harvest progression by region, including data on yields and quality.

For top tips on straw, sampling and more this harvest, visit our Harvest Toolkit.

AHDB released the latest GB fertiliser figures last week with UK produced AN holding steady month-on-month. Last week's Grain market daily looks at how natural gas is impacting domestic fertiliser prices and what may happen going forward.

Help shape the future of UK farming, join AHDB’s Cereals & Oilseeds Sector Council and make your expertise count.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.