Energy inputs – Natural gas and fertiliser prices: Grain market daily

Thursday, 17 July 2025

Market commentary

- UK feed wheat futures (Nov-25) fell yesterday closing at £177.20/t, down £1.20/t (-0.7%)

- Domestic futures followed European futures, which were weighed on by the surge of the euro against the US dollar. The euro finished at $1.1634 yesterday (LSEG). Paris milling wheat futures (Dec-25) closed at €207.75/t, down €1.50 (-0.7%)

- Paris rapeseed futures (Nov-25) closed at €479.50/t, down €5.50/t (-1.1%) on the day. Downward pressure came from the Canadian Winnipeg canola futures (Nov-25) which closed down 2.1% on the previous day, and below its support level of CAD$680/t

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Energy inputs – Natural gas and fertiliser prices

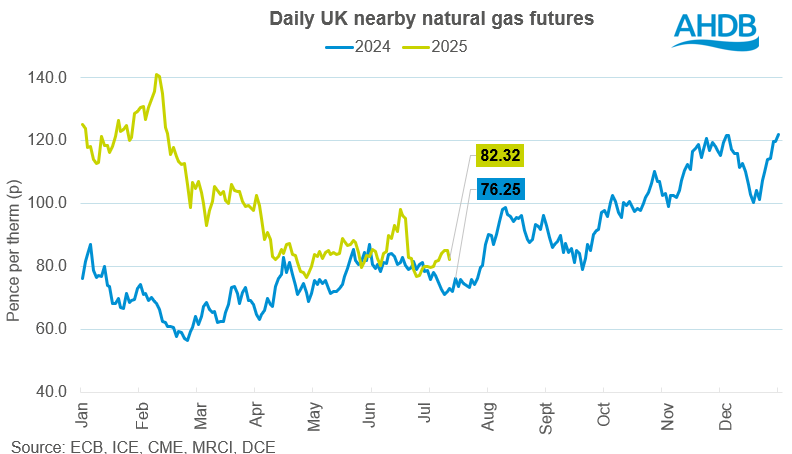

Natural gas prices are a major driver of nitrogen fertiliser costs, typically making up an estimated 60–80% of the cost of producing it (Fertilizers Europe). That’s why it’s important for farmers to keep an eye on what’s influencing the gas market as it directly affects fertiliser prices, like ammonium nitrate (AN).

UK natural gas prices have remained elevated into July but have dipped from June as tight supply and strong import demand still surround the market. The nearby UK natural gas contract averaged around 82.0p/therm so far (1–16) in July, down from 85.8p/therm in June but 4.5p/therm higher than in June 2024.

Key drivers

Weather remains a key factor. The European Commission reports that cooler-than-average conditions in northwest Europe kept residential gas demand elevated longer into the year than expected. Intermittent wind generation added to gas-fired power generation needs.

Europe is increasingly turning to liquid natural gas (LNG) to replace Russian pipeline gas, which has been largely cut off since early 2022. As of 15 July, EU gas storage was just 63.6% full, well below 81.4% this time last year (Gas Infrastructure Europe, GIE).

With European inventories behind schedule, strong Liquified Natural Gas (LNG) imports are likely to continue, and the usual summer slowdown may not occur. This may keep upward pressure on prices as buyers secure supply.

In the UK, a 10-year deal signed in June by Centrica with Norway’s Equinor, starting in 2025 will supply around 10% of UK gas demand. Current stores of LNG in the UK are at 28.9% full as of 11 July (GIE). Norwegian natural gas flows to Europe are expected to be higher during the summer of 2025 compared to the two previous years due to a less extensive maintenance programme.

Fertiliser market trends

.png)

UK-manufactured AN (34.5% N) held steady at £383/t in June, slightly up from May but £50/t above June 2024 levels. Despite some easing in gas prices since winter, fertiliser prices lag due to cost effects and limited domestic production flexibility.

Imported AN followed a similar trend to prices for UK AN at £376/t in June, up £46/t from a year ago – a slightly smaller year-on-year rise compared to the UK.

Looking ahead

Forward gas prices into winter 2025/26 remain above nearby contracts, reflecting storage shortfalls and ongoing geopolitical uncertainty. While summer 2026 contracts are cheaper, they are costing in risks high than historic norms.

Nutrient planning can help manage costs, which could be important when considering price trends so far for the 2026 crops. The AHDB Nitrogen Fertiliser Calculator is a key tool to guide efficient application rates based on crop and cost scenarios.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.