Arable Market Report – 17 June 2024

Monday, 17 June 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

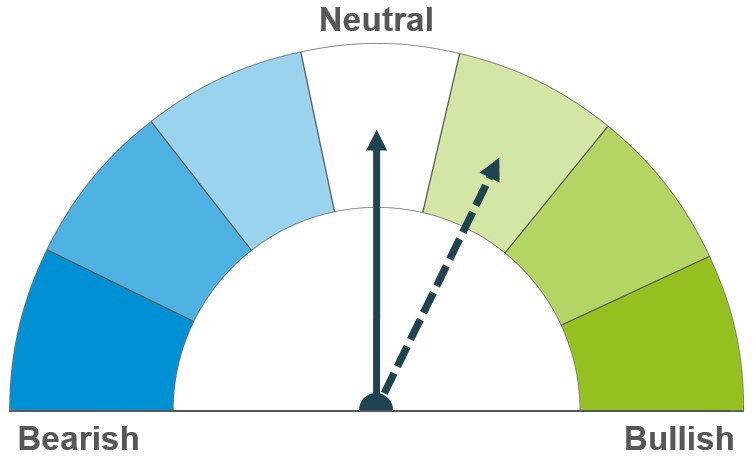

Wheat

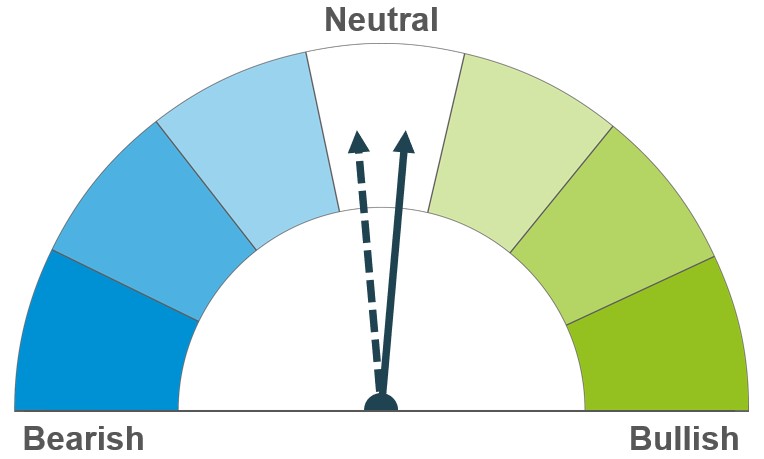

Maize

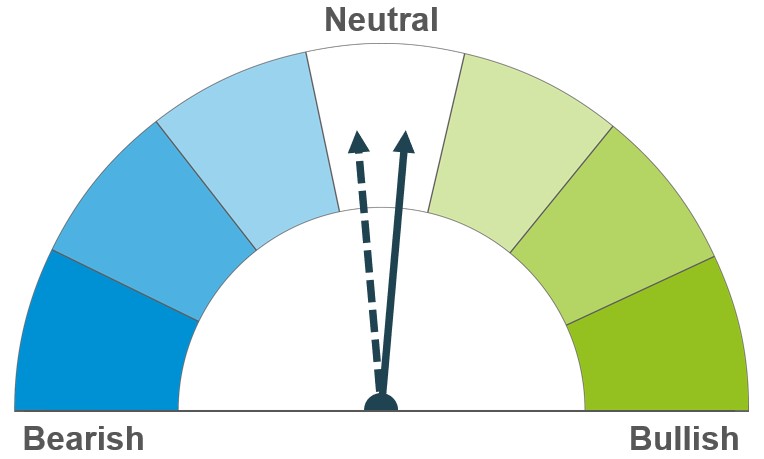

Barley

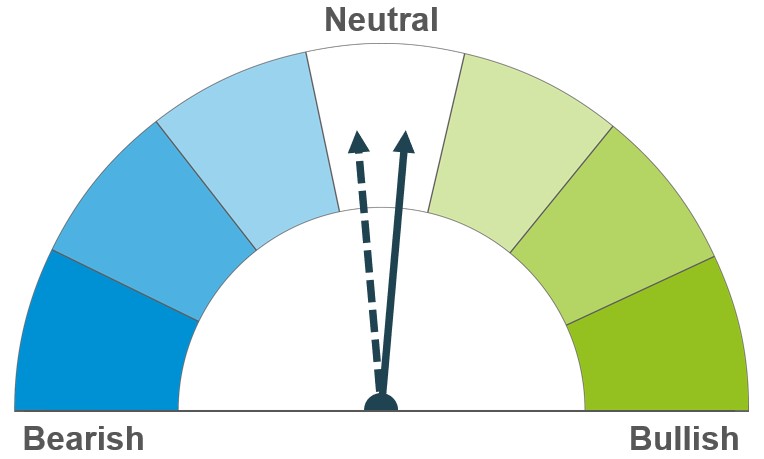

Global demand and exports remain in focus in the short term, as well as expectations of smaller crops in major exporting countries. Condition and harvest results of crops in the Northern Hemisphere will be followed closely.

Weather conditions in the US maize belt remain in focus short term. Longer term, there are predictions of comfortable global maize supply, but this is partly dependent on favourable weather during the key yield forming period for US crops in July.

Expectations of a yearly rise in global output continue, with barley prices likely to continue to follow the wider grain markets in the month ahead.

Global grain markets

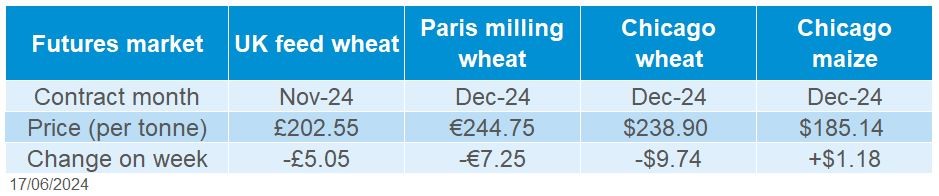

Global grain futures

Over the past three weeks, global wheat markets have seen a steady decline, with Chicago wheat prices falling by more than 10%. The downward price momentum continued last week (Friday to Friday), despite the USDA’s World Agricultural Supply and Demand Estimates (WASDE) report indicating smaller wheat crops for major producers such as Russia, Ukraine, and the European Union.

Dec-24 Chicago wheat futures and Paris Milling wheat futures (Dec-24) fell $9.74/t and €7.25/t respectively. The pressure on prices came mainly from an improved wheat crop outlook in the US (based on harvest results so far) and rain forecast in dry parts of Russia and Ukraine.

Dec-24 Chicago maize futures reached a two-week high on Thursday, but closed just marginally (1%) higher on the week on Friday. Outlooks of dry and hot weather conditions in the maize belt provided support for the markets and this will be a key watchpoint in the near term.

Wheat and barley harvesting is now underway in parts of Europe. Stratégie Grains, in its latest monthly crop report, showed tighter EU balance sheets for barley compared to last month. This follows poorer-then-expected yields in certain areas, and a surge in French exports due to increased Chinese demand.

The USDA’s crop progress report, due to be released later today, will give us more insight into price direction short-term. The four-month ban on wheat imports from Turkey, lower stock levels in India, and improved crop conditions in the United States are also potential swing factors in the near and longer term.

UK focus

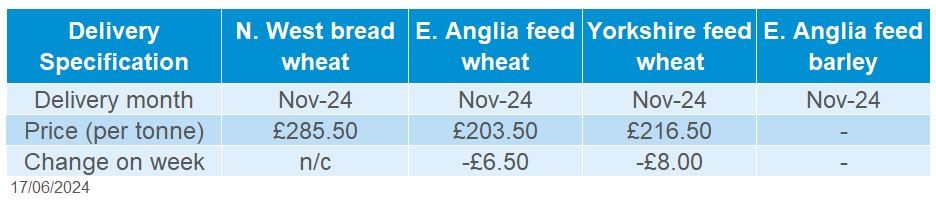

Delivered cereals

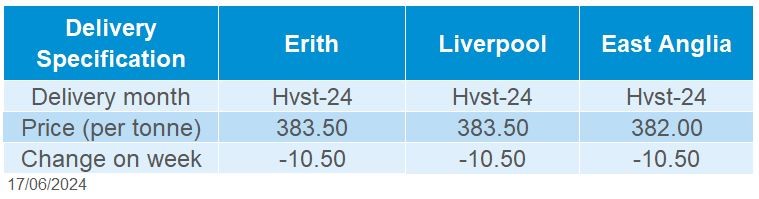

Domestic wheat futures followed global price movement down last week (Friday-Friday). UK feed wheat futures (Nov-24) ended the week down £5.05/t, to close at £ 202.55/t.

Similarly, domestic delivered prices fell in line with the UK futures Thursday to Thursday. Feed wheat delivered into East Anglia, for harvest delivery, was quoted at £197.50/t on Thursday, down £8.50/t on the week.

Bread wheat delivered into the North West (for harvest delivery) was quoted at £279.50/t with no weekly comparison available.

Analysis conducted last week shows GB Animal feed production for April 2024 was up by 5.3% in comparison to April 2023. This however remains 0.5% down in comparison to production over last year’s marketing year to date (July to April). Find out more here.

Oilseeds

Rapeseed

Soyabean

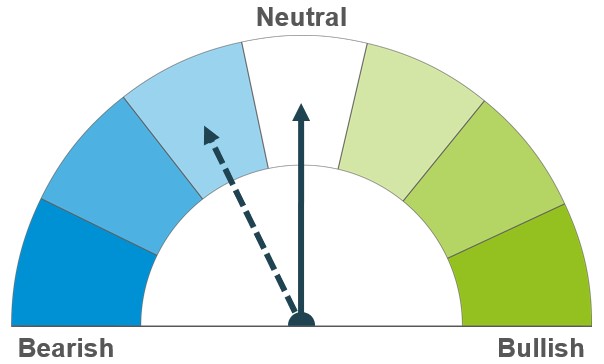

Rapeseed’s premium over soyabeans seems to have stabilised. This means that while global rapeseed supplies continue to look tighter year-on-year, soyabeans are driving prices again for now.

Building risk premium amid a less certain weather outlook for the US offers some support to prices short term. Longer-term, barring a major weather issue, the market continues to look well supplied.

Global oilseed markets

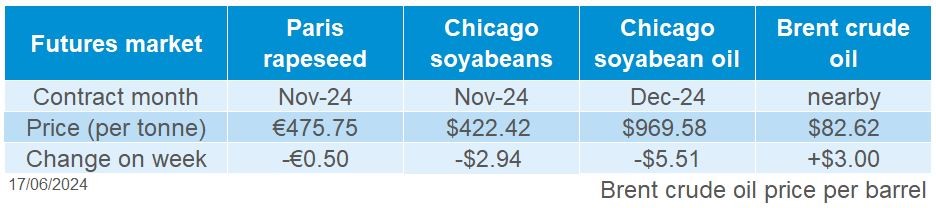

Global oilseed futures

Global oilseed markets ended last week mostly slightly lower, though prices fluctuated across the week.

Re-positioning ahead of the latest USDA global supply and demand estimates supported prices at the start of the week. However, confirmation of a good start for US soyabeans and continued expectations for ample global supplies in the USDA report pressured prices midweek.

Forecasts for hotter weather in key US soyabean growing areas supported prices on Thursday, with risk premium being built. The key period for US soyabean yield development will be in August, but conditions will be increasingly important over the coming weeks.

Profit taking by speculative traders, along with a drop in crude oil prices, brought Chicago soyabean futures down on Friday to end the week mostly lower. Palm oil futures prices also dropped on Friday ahead of a three-day weekend.

Conab further trimmed its estimate for the 2023/24 Brazilian soyabean crop, down 331 Kt to 147.4 Mt. This was mainly due to lower yields in Rio Grande du Sol after heavy May rainfall. Conab’s figure is now 5.7 Mt below the USDA.

Chicago futures will be closed on Wednesday for the Juneteenth federal holiday.

Rapeseed focus

UK delivered oilseed prices

Despite fluctuating within last week Paris futures (Nov-24) ended the week only slightly (€0.50/t) lower at €475.75/t. This echoed the trend seen in Chicago soyabean futures.

While relatively stable against the US dollar, sterling gained sharply against the euro after a snap French election was called last week. On Thursday, LSEG reported sterling reached its strongest level against the euro since August 2022 (£1 =€1.1883), before easing slightly on Friday.

Stronger sterling / weaker euro makes imports comparatively cheaper and so pressures UK prices compared to European values. As a result, UK delivered rapeseed prices fell more than Paris futures. Rapeseed for delivery to Erith in Nov-24 was quoted at £394.50/t on Friday, £10.50/t lower than on 7 June.

The winter French rapeseed crop is forecast at 4.21 Mt by the French government. This is down 1.2% from 2023, mostly reflecting a smaller planted area. Last week, trade body Coceral projected EU-27 production at 18.5 Mt vs 20.2 Mt last year.

Planting is nearing completion in key Canadian provinces. In top producing province, Saskatchewan, crop conditions are encouraging, though crop development is notably delayed after planting delays.

Carbon Footprinting Survey

We want to understand the cost to complete an online carbon footprint assessment for individual farms, as this is a growing requirement for many farm businesses to complete, either now or in the future. To understand the cost implication of this process, we need your help. Please fill out this short survey by 12 July 2024, by following this link.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.