USDA cuts Russian and European wheat production: Grain market daily

Thursday, 13 June 2024

Market commentary

- Nov-24 UK feed wheat futures closed yesterday at £205.75/t, down £5.20/t on Tuesday’s close. Similarly, the May-25 contract dipped £5.25/t, ending the session at £212.90/t.

- The UK futures tracked global prices down yesterday despite the decreasing Russian crop outlook. Market fundamentals, rain forecast in Ukraine and positioning ahead of the USDA’s supply and demand report released yesterday added to the downward momentum. More on this below.

- Paris rapeseed futures (Nov-24) dropped €5.75/t yesterday, to close at €473.50/t. European rapeseed prices were down yesterday, with Chicago soyabeans and Chicago soyabean meal futures, as market awaited and reacted to the release of USDA’s report. The European markets closed soon after the report’s released.

- LSEG held its 2024/25 EU rapeseed production estimate unchanged at 20.4 Mt despite the mixed weather pattern across the region. This comes after COCERAL and the Ministry of Agriculture in France both downgraded their 2024 rapeseed production forecasts.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

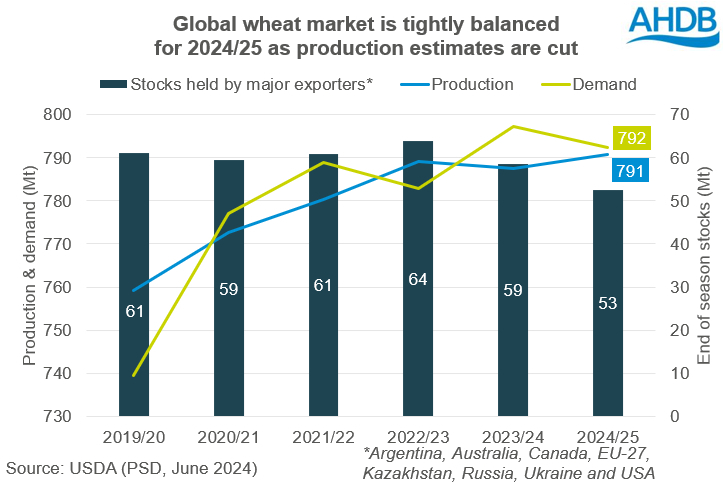

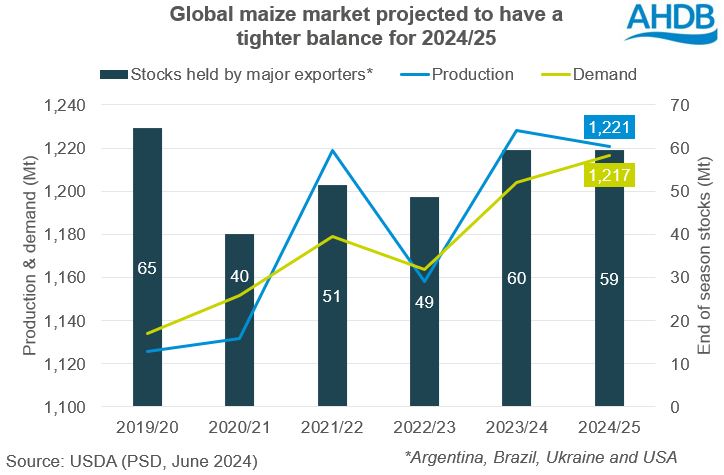

USDA cuts Russian and European wheat production

Yesterday, the USDA released its June World Agricultural Supply and Demand Estimates (WASDE). For wheat, Russia’s production was cut considerably, which, as well as cuts across Ukraine and Europe has consequently tightened the global 2024/25 balance. There was some tightening to the global 2024/25 maize balance too, both compared to 2023/24 and last month. However, 2023/24 production figures for Brazil and Argentina were unchanged, opposing the average analyst expectation of a downward revision for both regions.

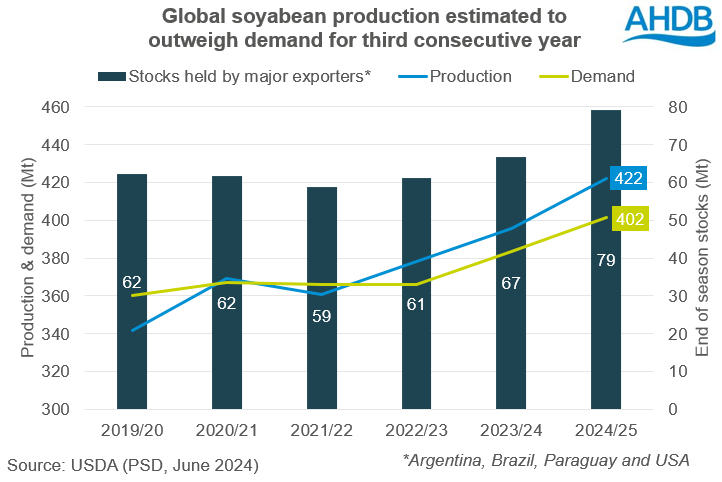

Global soyabean ending stocks for 2023/24 remain the second highest on record (behind 2018/19) despite a marginal cut to Brazilian production. However, this could become the third highest should the projected 2024/25 ending stocks be achieved.

Wheat

Globally, the wheat outlook is reported to have a tighter balance next year (2024/25), largely as a result of the smaller supply. Wheat production in Russia, Ukraine, and the EU has been reduced, outweighing the modest increase in global opening stockings. The hot and dry weather followed by the frosts during May in Russia resulted in the wheat crop being cut from 88.0 Mt in May to 83.0 Mt. This drops closer to forecasts by IKAR and SovEcon of 81.5 Mt and 80.7 Mt respectively.

Despite a modest rise of production in the US (+0.5 Mt) and decrease in global feed demand, the substantial drop of production across key producing regions tightens the global wheat balance for 2024/25 from last month’s estimate.

Maize

For the 2023/24 Brazilian crop, the average analyst expectation for maize production ahead of the report being released was a reduction of 1.1 Mt (LSEG). Meanwhile, for Argentina average expectation was for a 2.1 Mt cut. However, in contrast to average analyst expectations, there was no change on the month regarding the ongoing 2023/24 maize harvests in Brazil and Argentina. As a result, total maize exports rose following slight increases for Russia and South Africa and edged global end of season stocks lower.

Looking ahead to 2024/25, global maize production is relatively unchanged on the month. However, the slightly lower opening stocks and an increase to imports tightens ending stocks to closely align with the average analyst estimate.

Soyabeans

Although on average analysts expected Brazil’s 2023/24 soyabean production estimate to fall to 151.8 Mt, the USDA only cut production by 1.0 Mt to 153.0 Mt. In comparison, Conab’s latest estimate in May was considerably lower at 147.7 Mt, although they are due to publish their June estimates later today (13 June). For Argentina, 2023/24 production was left unchanged on the month at 50.0 Mt, which closely aligns with the average analyst estimate and the latest Buenos Aires exchange estimate of 50.5 Mt. As a result, world ending stocks remain the second highest ever at 111.1 Mt.

For 2024/25, estimates remained relatively unchanged on the month. World ending stocks are forecasted at 128.5 which, if achieved, would be the largest ending stocks on record. This is largely supported by Brazil’s projected record crop of 169.0 Mt.

Looking ahead

On June 28, the USDA are due to release its acreage report, which will provide survey-based indications of planted and harvested area. The upcoming weather will continue to be influential regarding the condition of the US soyabean and maize crop. Both of these are scoring substantially better than this time last year at 74% and 72% good-to-excellent condition respectively. Also, as wheat harvesting progresses across the Northern Hemisphere subsequent yield and quality news will offer further direction for global wheat markets.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.