Wet spring supports GB animal feed production for April: Grain market daily

Wednesday, 12 June 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £210.95/t yesterday, up £7.15/t from Monday’s close. The May-25 contract also rose by £7.15/t, to close at £218.15/t.

- Russia’s grain union announced yesterday that the frosts in Russia have impacted 15%-30% of the winter grains, notably higher than the approximate 1% estimate from Russia’s agriculture ministry across all crops (including grasses and fodder). Also, while analysts on average expected no change, both the US winter wheat and spring wheat rating good-to-excellent dropped 2 percentage points from last week to 47% and 72% respectively. Furthermore, wheat purchasing from Egypt, Jordan, and South Korea and a tender for food-quality wheat from Japan supported the global demand outlook.

- Paris rapeseed futures (Nov-24) closed at €479.25/t yesterday, up €1.00/t from Monday’s close.

- Coceral reduced their 2024 rapeseed crop production estimate for EU and UK to 19.4 Mt, down 4.0% from their previous forecast. In addition, the agricultural ministry for France forecasted their 2024 winter rapeseed crop production at 4.2 Mt, which would be 1.2% less from 2023. Also, strength in the US dollar has made EU rapeseed oil more competitive. However, a depreciation for Chicago soyabean futures capped gains.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Wet spring supports GB animal feed production for April

Last week, the latest AHDB GB animal feed production figures were published for April 2024. Animal feed production for April 2024 was up by 5.3% in comparison to April 2023, however remains 0.5% down in comparison to production over last year’s marketing year to date (July to April). Pig feed production for April showed a lacklustre rise in comparison to April 2023 as production remains behind last year’s pace by 1.5% over the same period. Poultry feed production rose 4.7% for April in comparison to the previous year, as feed production also continues to remain behind last year to date by 1.0%.

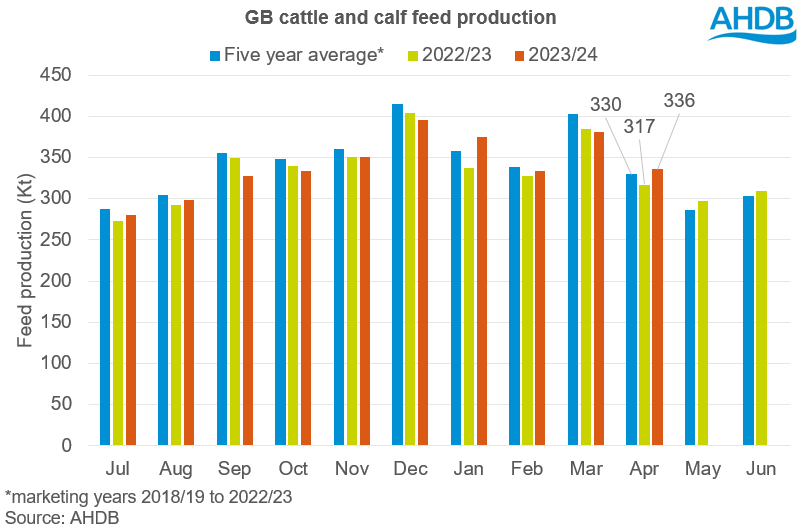

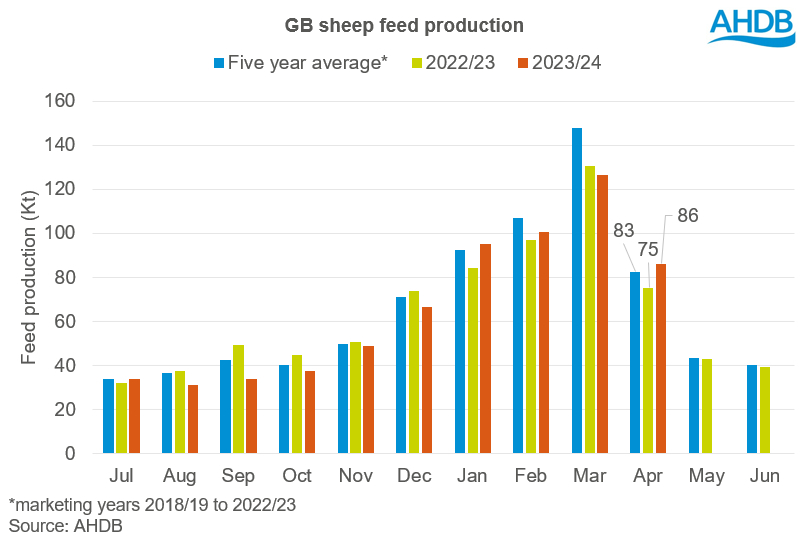

For April, cattle and sheep feed production both saw the largest rises in comparison to April 2023, see below for more.

Cattle feed production

For April, cattle and calf feed production was 335.5 Kt, up 5.8% compared to last year. While both dairy and beef sectors have been experiencing moderate strength in prices recently, supporting animal feed demand, the delayed turnout that many experienced as a result of the wet April weather has likely offered additional support to animal feed demand. From March to April, over the past five years, total cattle and calf feed has fallen by 18.0%, while this year it has been more subdued falling by 12.1%.

Sheep feed production

As well as the wet spring weather potentially hindering the opportunity for sheep to be out on grass for some, the considerable appreciation of sheep prices is also likely to have supported the demand for feed. Deadweight sheep SQQ price for April reached 842.7p/kg, the highest value since at least 2010. Strong demand from religious festivals in Spring as well as a tighter balance has supported domestic prices, despite elevated imports of New Zealand lamb. For April, total sheep feed produced was 86.3 Kt, up 14.5% from last year and above the five year average for April.

Outlook

While animal feed production for April is greater across all sectors in comparison to last year, the underlying support varies. Therefore, the continuation of increased production is reliant upon numerous factors.

For cattle, less extreme rainfall for May, in addition to being the warmest on record, is likely to have supported the opportunity to turn stock out, weakening feed demand. Also, for lamb, while prices remain at historically high levels, the competitiveness of Australian and New Zealand lamb, in addition to the domestic spring crop, could pressure domestic prices and therefore margins, subduing continued animal feed demand. However, as April was the sixth wettest April for the UK since records began in 1836, Forage for Knowledge suggests that grass quality has suffered, and therefore this could offer support for animal feed demand going forwards.

For pig production, the estimated net margin for Q1 2024 dropped £3 from the previous quarter to £16/head, the lowest net margin since Q1 2023. Pressure on margins in the pork industry is likely to weaken demand for animal feed which has recently accounted for more than 60% of production costs. For poultry, while April feed demand rose on the year, commercial layer chick placings were down 4.5% for April from last year and broiler chick placings were down 5.0% over the same period. A slowdown in placings could prevent chicken feed production exceeding last year’s demand pace.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.