Arable Market Report - 03 October 2022

Monday, 3 October 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

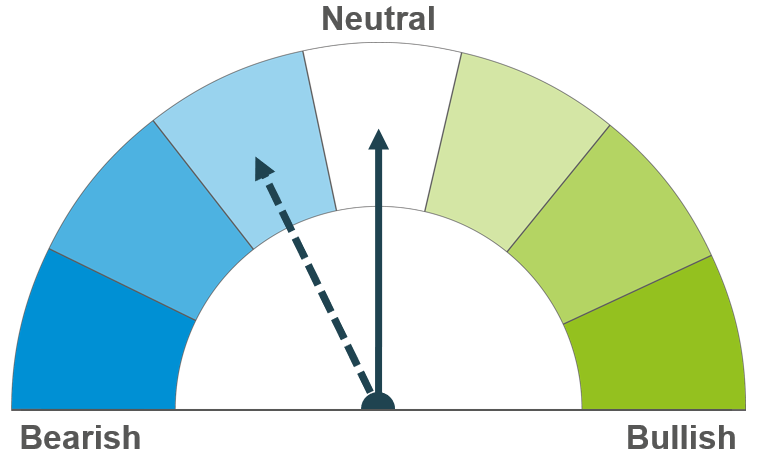

Grains

Wheat

Maize

Barley

Global wheat supplies keep tightening, with revisions to US production. Conflict between Russia and Ukraine continues to keep markets supported. Demand is in focus as to whether a recession could change global demand dynamics.

Tight global supply keeps prices supported. US harvest is underway but some scattered rains across the Midwest could slow progress over the next 7 days. Long term focus is turning towards the South American weather market and plantings.

Barley markets continue follow wider grain movement, with supply outlooks remaining tight.

Global grain markets

Global grain futures

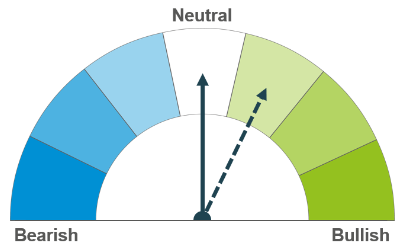

There was support for global grains last week as both Chicago wheat and maize futures (Dec-22) gained 4.7% and 0.1% respectively, Friday to Friday. Driving this was the continued escalation in the Black Sea region as Russia annexed parts of occupied Ukraine, and the US quarterly grains stocks and USDA Small Grains 2022 Summary.

Chicago wheat futures (Dec-22) gained 2.8% last Friday due to cuts to US wheat production estimates. The USDA estimated the US wheat crop at 44.9Mt. This is below analyst’s expectations of 48.4Mt (Reuters Poll) and the latest USDA World Agriculture Supply and Demand estimate (September) of 48.5Mt. The crop is revised down as western parts of US growing regions had heavy crop abandonment due to dry soils, this will be the second smallest US wheat crop in the last 20 years.

In the USDA grain stocks report all wheat stocks (as at Sept 1, 2022) were estimated at 48.3Mt. This is in line with expectations, but slightly up on the year. For US maize, stocks were estimated at 35.0Mt, up from last year but lower than trade expectations of 38.4Mt. We saw maize markets climb off the back of this on Friday.

This tightening of the US wheat crop, and continued uncertainty in Ukraine, is keeping the bullish sentiment in markets even as Ukrainian export continue to flow out the region. The Ukrainian ministry announced that grain exports for the 2022/23 season-to-date are down 40.3% year-on-year, at almost 8.6Mt. But pace is gradually increasing. For September, Ukraine grain exports dropped 23.6% on the year, to 4.3Mt, but reached the highest point since the Russian invasion (according to Agriculture Ministry data).

In other news, the EU Commission on Friday cut its forecast for this year’s maize harvest in the EU to 55.5Mt from 59.3Mt. This was due to the prolonged summer drought. This estimate still sits above Stratégie Grains current estimate of 52.9Mt.

With tightening northern hemisphere grains supply focus is now on South America. Argentina’s maize plantings are behind last year’s pace due to a prolonged drought. 5.8% of area for maize has currently been sown, this is down on 11% on last year (up until 28 Sept, Buenos Aires Grains Exchange). This is a close watchpoint as we are heading into the third successive La Niña weather event, which could continue this prolonged dryness to Argentina and parts of Brazil.

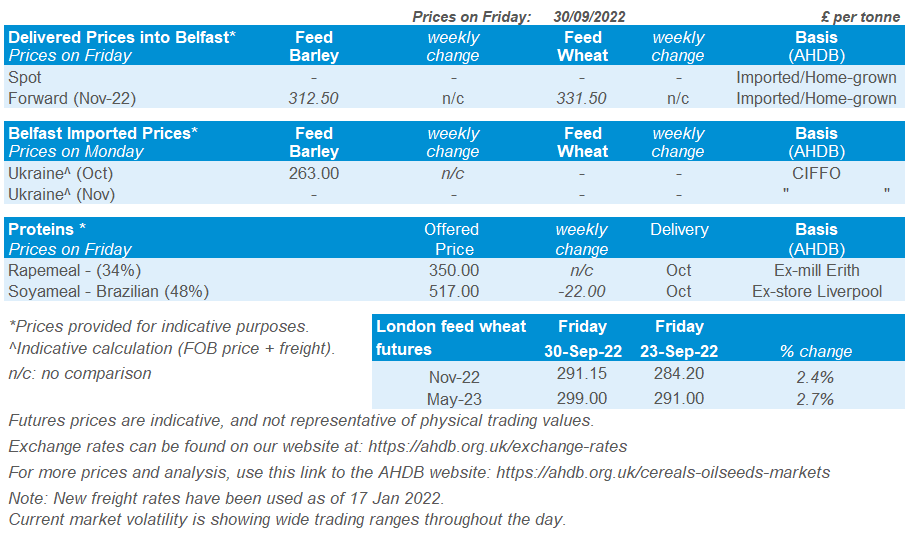

UK focus

Delivered cereals

UK grain market followed the global market up across the week. UK feed wheat futures (Nov-22) closed Friday at £291.15/t, gaining £6.95/t across the week.

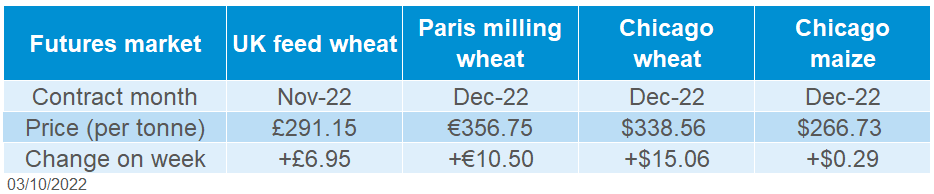

UK delivered prices followed futures contract movement Thursday to Thursday (+£5.35/t). On Thursday, feed wheat delivered into East Anglia (October-22 delivery) was quoted at £285.00/t. February-23 delivered into the same location was quoted at £290.50/t, up £6.00/t across the week.

Bread wheat delivered into the North West (October delivery) was quoted on Thursday at £351.50/t.

Feed barley delivered into East Anglia (October-22) delivery was quoted at £255.00/t, gaining £6.50/t across the week.

Last week, the sterling reached a low on Monday (26 Sep) against the US dollar and euro, following the UK’s biggest tax cut for 50 years on top of the mini-budget. Though, the sterling gained back some strength against both the US dollar (+2.8%) and euro (+1.7%) across the week, to close Friday at £1 = $1.116, €1.139.

The end of season (2021/22) UK cereal supply and demand estimate was released on Thursday. Wheat carry-in stocks for the 2022/23 season are forecast at a relatively comfortable 1.846Mt, which is in line with the previous five-year average. However, barley 2022/23 opening stocks are estimated at a 10 year low, read more on this analysis here.

In order for Defra and the Fertiliser Industry Taskforce to better understand the fertiliser use of farmers in 2022, and what is likely to be used and imported for the 2023 harvest, AHDB have created a short informal survey to gather information. If you are willing to take part, please follow this link.

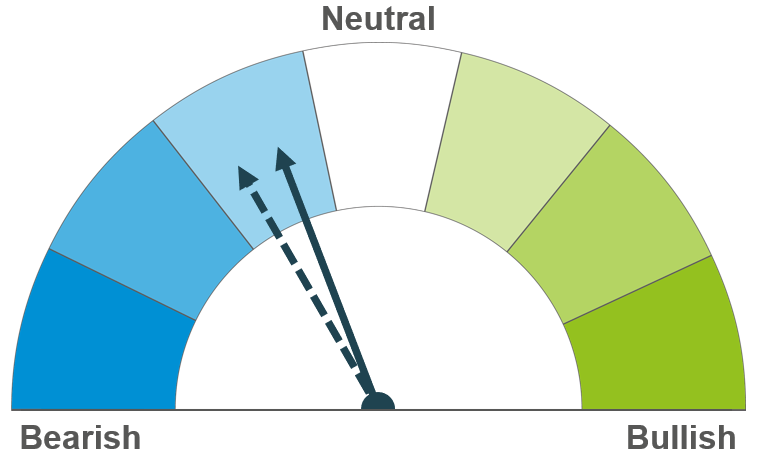

Oilseeds

Rapeseed

Soyabeans

Short-term rapeseed markets continue to react to news on Ukrainian exports and Canadian weather (impacting the end of harvest). Longer term, the wider oilseed complex, a large Canadian canola crop, and soyabean direction could pressure the market.

Progressing US harvest and larger US stocks continues to pressure the market short-term. Whilst long-term, increased South American production and demand concern from recessional fears keeps a bearish market tone.

Global oilseed markets

Global oilseed futures

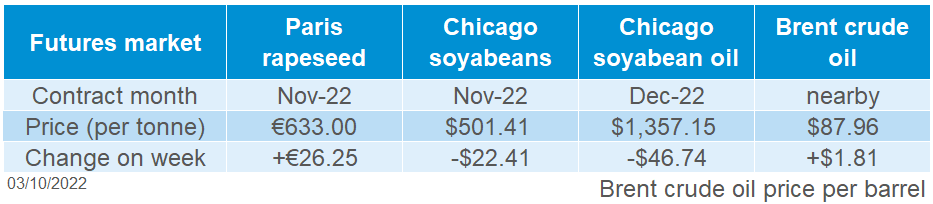

Chicago soyabean futures (Nov-22) lost $22.41/t across last week, closing at $501.41/t on Friday. Across the week soyabean prices tracked sideways until Friday, when the market dropped $16.90/t following the USDA’s release of the US soyabean stocks (as at 01 Sept 2022). These are up 7% in comparison to last year, at 7.5Mt.

On Wednesday, the Buenos Aires Grains Exchange estimated that Argentinian soyabean production will rise by 15.5% this season (2022/23) in their first estimate, to 48Mt. This is due to the increased soyabean planted area, with soyabeans reportedly preferred over maize due to high fertiliser prices. Anecdotal reports point to concerns over soil moisture levels following drought too (IGC). This crop is set to arrive in the new calendar year.

On Wednesday Malaysian palm oil futures (Dec) hit a 20-month low, with demand concerns growing for vegetable oils on recessionary fears (Refinitiv). Wider markets for oils also dropped on this day, on a broad-based market reaction and a strengthening US dollar.

Though overall, brent crude oil (nearby) was up $1.81/barrel across the week, closing at $87.96/barrel on Friday. This was due to a weaker US dollar and talks OPEC could cut crude oil production. Today, the nearby market has increased to $88.91/barrel (as at 15:25) with OPEC considering reducing daily output by 1M barrels. OPEC’s next meeting is on Wednesday (05 Oct).

Rapeseed focus

UK delivered oilseed prices

After initial pressure at the start of the week due to global economic recessionary concerns, Paris rapeseed futures (Nov-22) climbed to €633.00/t on Friday, up €26.25/t Friday to Friday.

Rapeseed felt support from Canadian markets due to slow farmer selling and worries of lower yields.

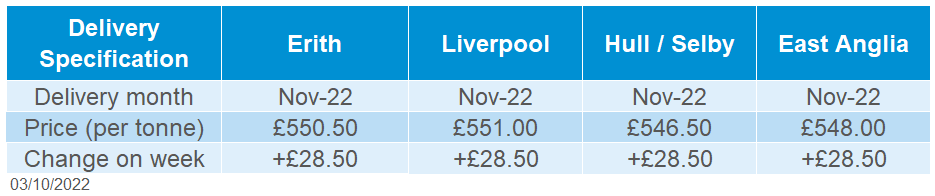

Domestic prices tracked global futures markets as delivered rapeseed into Erith (Nov-22) was quoted at £550.50/t, up £28.50/t week-on-week.

Stratégie Grains have increased their 2023/24 EU rapeseed acreage forecast to 5.95Mha, up 2.52% compared to the current marketing year. EU rapeseed production was also revised up 310Kt compared to August’s forecast, totalling 19.46Mt (2.46Mt more than in 2021/22).

2022 UK cereal and oilseed production

Due to reduced data availability from UK regions, Defra are not in a position to publish provisional UK cereal and oilseed production estimates on Monday 10 October; Defra will now publish estimates for England only. AHDB will be in discussion with levy payers, stakeholders and Defra over the next week to define a method for producing a UK production estimate for inclusion in the supply and demand balance sheets, in October and November. Please contact Millie Askew (millie.askew@ahdb.org.uk) for more details.

Norhern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.