Analyst insight: UK cereals S&D – past, present and future

Thursday, 29 September 2022

Market commentary

- Nov-22 UK feed wheat futures closed yesterday at £290.50/t, up £2.50/t from Tuesdays close. The Nov-23 contract settled at £276.35/t, gaining £2.60/t over the same period.

- Paris rapeseed futures (Nov-22) closed at €607.25/t, up €4.50/t from Tuesdays close.

UK cereals S&D – past, present and future

Today, the end-season UK supply and demand estimates for the 2021/22 season were published by AHDB, which included a ‘residual’ for wheat and barley. The final balance sheets incorporate all the official supply, usage, and stocks data for the season. In theory, you would expect all the official data to add up to produce a ‘balanced’ balance sheet. However, there is always going to be a certain margin of error, as much of the information is collected via a survey and not a full census of each area. Therefore, this often leads to an imbalance or a residual/deficit.

For wheat, the residual for 2021/22 is estimated at 333Kt, which equates to 2% of total supply for the season and for barley the residual is at 50Kt, 1% of total supply.

Where could the residual sit?

With all surveys there is always a certain margin for error and there is also the fed on farm estimate, which is just that, an estimate based off market insight. However, it is unlikely that all the residual grain belongs in fed on farm, especially with such high grain prices last season. In my opinion, I believe the imbalance this season, is largely due to the official Defra production figure being slightly overstated and the on-farm stocks data being slightly understated, especially for wheat, given the market signals at the time.

As we continue to live in unprecedented times, with a war in Europe, changes to agricultural policy and being potentially on the brink of a domestic and global economic crisis (to name a few), it is integral that the industry have up to date, accurate information on the UK’s position to aid decision making. AHDB, with industry input, have worked with Defra over the past few years to help improve the accuracy of some of the key outputs, including the production and on-farm stocks survey and we will continue to aid with this.

What about this season, 2022/23?

Residual or not, wheat carry-in stocks for the 2022/23 season (according to the official figures) are forecast at a relatively comfortable 1.846Mt, which is in line with the previous five-year average. On the other hand, 2021/22 barley closing stocks, and therefore 2022/23 opening stocks, are estimated at 928Kt. This is the lowest level of stocks in 10 years.

What about production? With combines back in the shed now for another year, we wait to see what harvest 2022 has brought us. Despite concerns earlier on in the summer, that the hot dry conditions may lead to shrivelled-up, low-yielding crops, yields haven’t fared too bad at all. According to the final ADAS harvest report, the GB average winter wheat yield this year is between 8.4-8.6t/ha, which is higher than the previous five-year average. Winter and spring barley yields are also expected to be higher than average at 7.2-7.4t/ha and 5.7-6.1t/ha respectively.

At the end of August, Defra released its final crop area estimates for England. With no ‘official’ figures for the other UK nations released yet, we can estimate the results for Scotland, Wales and Northern Ireland from the AHDB planting and variety survey and add the Defra England area to give us an idea of planted area for cereal crops in the UK for harvest 2022. For wheat, this would give an area of 1,804Kha, 437Kha for winter barley and 671Kha for spring barley.

To calculate possible production scenarios, I have used the above areas and applied an adjusted yield. The adjusted yield has been derived by the taking the ADAS average, scaling it using historic Defra yield trends and adjusting it to allow for lower moisture content this season.

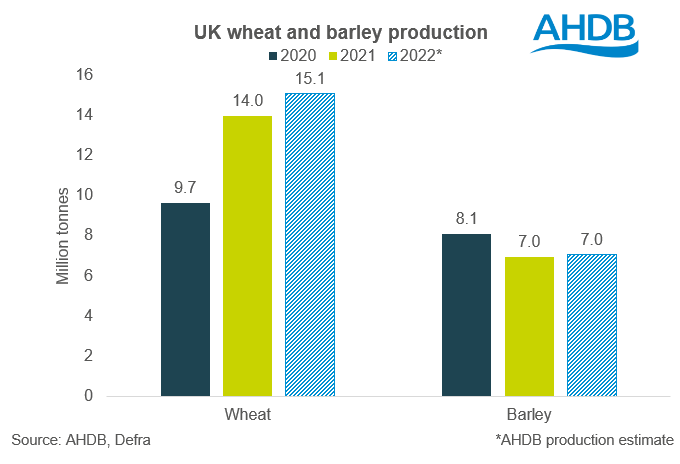

As you can see from the graph below, using this data, we could be looking at a c.15Mt wheat crop for this season and a c.7Mt barley crop. In essence, we are looking like we are starting the season with an ample wheat supply (higher production and higher carry-in stocks). However, the situation for barley looks to be relatively tight again, with another c.7Mt crop and smaller carry-in stocks. It’s important to note that these are just production scenarios, based on a set of assumptions and others may use different figures to produce production estimates.

Subdued demand?

While H&I demand for wheat looks to remain buoyant this season, with both bioethanol plants expected to be in operation, it is still too early to paint the picture for the full season. There are several factors that may influence bioethanol demand this season, including if margins are squeezed, there are prolonged maintenance periods/closures or if maize becomes more competitive.

For the time being, barley demand is expected to remain buoyant by the malting sector, with new distilling capacity coming online in Scotland. Furthermore, if we do slip into recession, looking at historical trends it is likely that any impact on barley demand would be felt in the following season.

It would be remise not to mention the milling sector. Demand is likely to remain stable this year, but there have been questions around the quality of this years milling crop. While moisture content, specific weights and Hagberg falling numbers are generally good, protein content is looking below par. This is likely due to the hot dry conditions impacting AN uptake at the last application. Therefore, we could this season see millers slightly reducing specs or importing more, although the latter is not looking very competitive at the moment.

One of the major impacts on demand for cereals this season is going to be animal feed usage. All sectors are experiencing squeezed margins given rising input costs, with animal feed demand expected to be down on the back of this. On top of that there is the pressure of bird flu on the poultry sector. However, with the hot, dry conditions impacting grass growth and therefore forage this year, we could see more ruminant producers having to substitute feed compounds and straights to compensate.

Overall, we could see a drop off in cereal demand this season driven by a reduction in animal feed usage, with uncertainty around bioethanol demand rumbling in the background too.

To conclude

While we are living in very uncertain times, it is important that we have up to date, timely and accurate information. AHDB continue to converse with industry and Defra to ensure the right information is available when it is needed.

In terms of supply and demand for this season, these are just my initial ‘back of the envelope’ thoughts on what could happen. On 18 October, we will be publishing the Early Balance Sheets for wheat and barley, which will shed some more light on how S&D could play out this season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.