Global maize outlook going forward: Grain market daily

Friday, 23 September 2022

Due to technical difficulties, we were unable to publish yesterday’s grain market daily publication. Apologies for any inconvenience this caused.

Market commentary

- UK feed wheat futures (Nov-22) closed at £282.00/t yesterday, down £0.50/t from Wednesday’s session. The Nov-23 contract ended down £2.00/t over the same period, closing at £266.30/t.

- The International Grains Council (IGC) raised it’s 2022/23 global wheat production forecast by 14Mt to 792Mt yesterday.

- The Nov-22 Paris rapeseed contract gained €25.75/t yesterday, closing at €605.75/t.

- In Refinitiv’s analysis, Canadian 2022/23 rapeseed production estimates have been trimmed to 20.1Mt due to unfavourable rains across Manitoba. However, this estimate still sits above USDA (20.0Mt) and StatCan (19.1Mt) estimates (Refinitiv Commodities Research).

Global maize outlook going forward

Global maize futures have climbed over the last few weeks on relatively low global supply prospects. The Dec-22 Chicago maize contract closed at $270.96/t yesterday, up $15.06/t compared to four weeks prior. With the five-year average for UK maize imports sitting at 2.5Mt, maize plays an important part in the domestic grain supply. Therefore, it is important to explore the global maize outlook going forward for the rest of the 2022/23 marketing year.

Tighter maize supplies in the northern hemisphere

As is well known, EU and US maize production has been greatly affected by hot and dry weather earlier on in the season. Recent rains have also slowed the maturation of the crop in parts of the US, and EU yields were cut to 6.39t/ha on Tuesday in the latest Monitoring Agricultural ResourceS (MARS) report, down 19% year-on-year.

According to the most recent USDA World Agricultural Supply and Demand Estimates (WASDE), EU and US maize exports for the 2022/23 season are forecast down 53.4% (-3.1Mt) and 8.1% (-5.1Mt) from the previous year, respectively. Currently, the global maize (excluding China) 2022/23 stocks-to-use ratio sits at 11.1%, down from 11.5% last year. Going forward, the market will be relying on the large South American supplies coming to market going into 2023.

South American maize supplies

There is still a lot to play out for global maize supply as plantings have only just begun in South America. With such tight supply across the northern hemisphere, high global maize prices are likely to only be pressured by larger than expected South American crops. In the recent WASDE report, the USDA pegged Argentinian and Brazilian production at 55Mt and 126Mt for the 2022/23 season, up 3.8% and 8.6% respectively from the previous year.

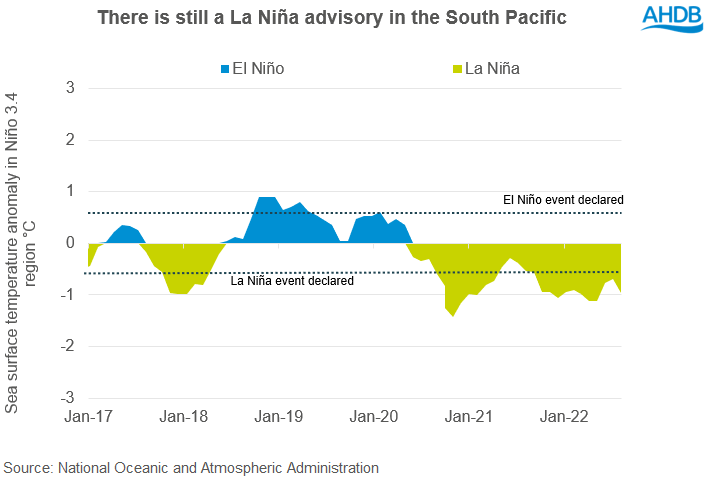

However, these figures could change as plantings progress, especially as we head into the third successive year of La Niña, which brings dry and cold weather to the region. The effects of La Niña have already resulted in a slow start to plantings in Argentina, with weather experts warning of a drought that could see farmers switching intended maize acreage to soyabeans.

When temperature anomalies surpass -0.5°C, a weak to moderate La Niña event occurs. As shown above, historically, the most extreme La Niña events have occurred around January time. This year, La Niña is said to have a 91% chance of continuing into September-November, decreasing to a 54% chance in January-March 2023 (National Oceanic and Atmospheric Administration). In Brazil, due to the seasonality of La Niña, the greater impacts on yield could be to the second maize crop, normally planted from January onwards.

Conclusion

For now, due greatly to adverse weather in the northern hemisphere, global maize supply remains tight, and any extreme weather in the South Pacific will be a key driver in maize markets later in the season. While larger than expected South American crops could put pressure on prices, ultimately weather will dictate how much harvested maize area we see from the region.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.