Analyst insight: Sell or store your grain during harvest time?

Thursday, 18 June 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £164.80/t, down £0.60/t on Tuesday’s close.

- The Paris milling wheat contract (Dec-20) remained unchanged, closing at €182.50/t.

- However, the Chicago wheat futures contract (Dec-20) closed at $184.82/t, down $2.39/t due to continued harvest pressure. The domestic market was partly sheltered from this drop as the sterling weakened against the dollar.

- US soyabean futures (Nov-20) closed yesterday at $322.06/t, up $1.29/t on the day before. Continued commitment to purchasing US soyabeans by China helped support the market.

Sell or store your grain during harvest time?

As the UK enters the 2020/21 marketing year, when wheat supplies are expected to be tight, we are currently seeing less pressure on feed wheat prices for harvest delivery.

Currently it may be more economically viable than usual to sell a proportion of this grain during harvest time and to avoid some storage costs.

Spike in harvest selling

With many winter crops now heading, we are closing towards 2020 harvest. At harvest we often see a spike in spot selling due physical space constraints on farm and cash flow requirements, amongst others. Prices received when selling for harvest delivery can be reduced as a result. Bigger reductions, or more harvest pressure on prices, is often seen in years with high production such as 2019.

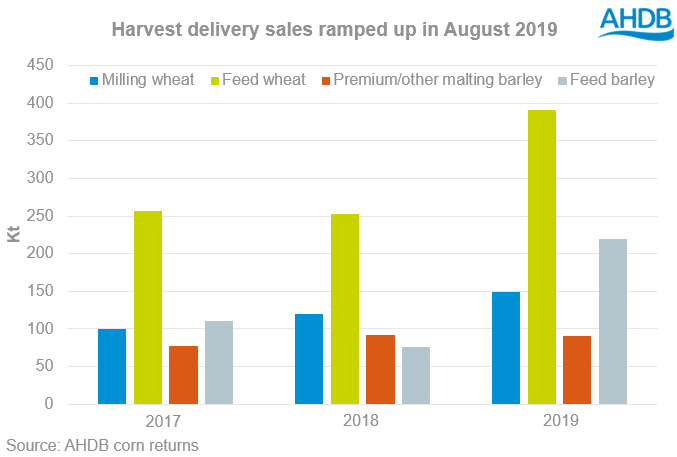

In the graph above is the ex-farm sale of grain for harvest delivery in August. As we can see feed wheat and feed barley selling significantly increases in 2019 as we harvested large crops.

As the UK heads into a lower grain domestic outlook for the 2020/21 marketing year, we are currently seeing less harvest pressure on prices this year.

Reduced supply for the next marketing year, reduced harvest pressure?

Our previous analysis, such as the crop production outlook and the barley production outlook, suggests we are expecting to harvest around 10.7Mt of wheat and 8.1Mt of barley. This is based on the areas reported in the Early Bird Survey and historical yields.

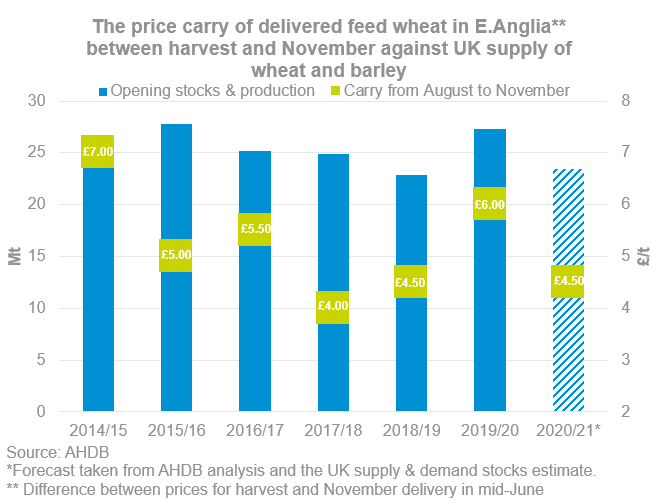

Using the latest UK supply and demands estimates, we are going to have combined 2019/20 end-season stocks of 4.6Mt at the end of June 2020, of wheat (3.4Mt) and barley (1.2Mt). Therefore, our outlook supply for wheat and barley in the 2020/21 marketing year will be 23.5Mt, below the 5-year-average of 25.6Mt.

Also in the graph above is a snapshot of the second week in June of the AHDB’s delivered cereal price survey. It shows the difference in price in between feed wheat delivered into East Anglia at harvest and November.

As at 11 June 2020 delivered feed wheat into East Anglia (Hvst-20) was quoted at £165.50/t, while the Nov-20 price was quoted at £170.00/t. Providing an incentive of £4.50/t to hold onto wheat until November.

This is much less than last year, where we were heading into a grain surplus. For example, in the same week in June delivered feed wheat into East Anglia (Hvst-20) was quoted at £147.00/t, while Nov-19 delivery was quoted at £153.00/t, providing an incentivising carry for £6.00/t to store grain.

So, to store or not?

The current data that we are working off indicates there is currently less harvest pressure on prices for feed wheat as we approach harvest 2020.

For feed wheat, this means there is less penalty for harvest selling this year and sales straight off the field could avoid storage costs. The key point to take away is to financially consider, it is worth it? Cost of labour time, storage, and logistics all need to be assessed for your own situation.

For feed barley we may see significant some pressure as we entered the next marketing year due to the high supply outlook. Also, if you are storing your barley at harvest, bear in mind that EU export markets post-December 2020 may not be economically viable. Therefore, it is important to consider drying to meet specifications to export to third countries, recent analysis have shown this could be an economically viable option.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.