Shall I dry my barley for the export market? Grain Market Daily

Friday, 15 May 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £163.80/t, up £0.20/t on Wednesday’s close. Paris wheat futures (Dec-20) closed at €187.25/t, up by €1.25/t on Wednesday’s close.

- The gains were limited on the domestic market as sterling strengthened against the euro to close at £1 = €1.1315.

- How is the global market reacting to coronavirus? David Eudall, Head of Arable Market Specialists talks to Arnaud Petit, Executive Director of the International Grains Council. Arnaud discusses the work of the IGC over recent weeks, how global supply chains are coping with the issues caused by coronavirus and how the market may continue to evolve over the coming months.

Rounding up the barley week

As we conclude our barley week it is fair to say we have a very bearish outlook for the next 12 months.

Is there a cost benefit to drying your barley for an export market? In this piece of analysis, we will focus comparing drying barley for the domestic vs export market.

Although the UK is going through a transitional period with the EU. The current market we export to is not guaranteed post-December 2020 without tariff’s that could be imposed by the EU.

What export markets could a barley grower access?

For a trade flow to occur you inherently have to be price competitive, and one way of maintaining competitiveness is geographical location.

From previous trade data over successive years the UK has managed to successfully export to North African and Middle Eastern states situated around the Mediterranean Sea.

Although these nations do have the climate and capacity to grow grains, they are all usually net importers, with imports depending on domestic production and vegetative growth.

Forecast production for 2020 has been reduced for some North-African states as pockets of drought in places like Morocco will increase import demand for the 2020/21 marketing year. Vikki and Thomma explained in detail the demand outlooks for these markets on Tuesday.

However, there are conditions for accessing these markets, the two main points being:

- Price – with a bearish outlook for the 2020/21 marketing year and proximity to the Mediterranean Sea we need to be price competitive.

- Moisture content – many North-African states require the moisture content to be less than 14%.

From our maritime climate that brings some great British summers, moisture content at harvest cannot always be controlled or predicted.

Is it worth drying barley for export markets?

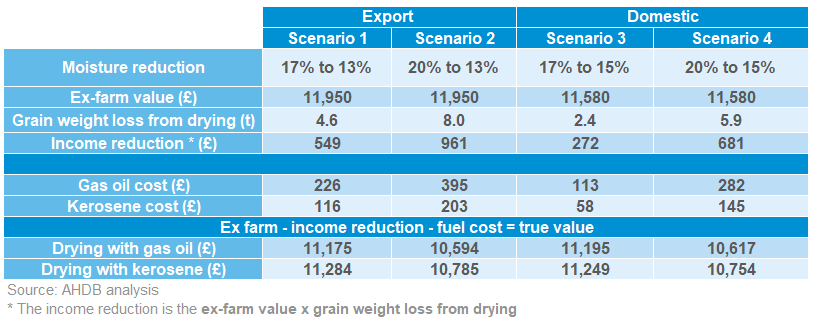

Therefore, it’s key to analyse four different scenarios to see is there is a cost benefit in drying barley for the domestic or export market using gas oil or kerosene.

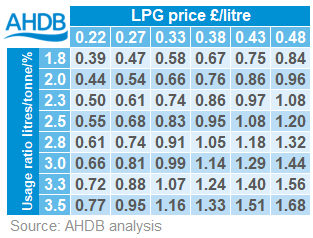

Kerosene is the most common fuel used as it burns cleaner than diesel reducing risk of tainting the crop. Drying by gas produces excessive moisture so requires increased thermal input to dry the grain.

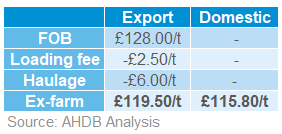

In the table below the ex-farm price has been quoted from the AHDB’s latest Corn Returns. Furthermore, the ex-farm export price has been calculated from Tuesday’s published Free-on-Board export price with loading and haulage taken into consideration to quote an ex-farm price in proximity to a port. Please note this price will change depending on geographical location and increased haulage rates to ports.

Do I dry my grain for a domestic or export market?

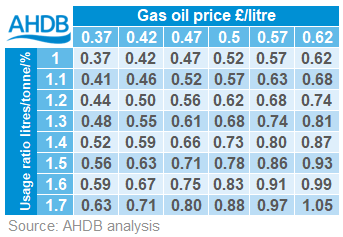

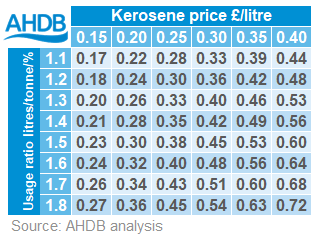

Assumptions have been made that the fuel usage rate (how many litre of fuel it takes to dry 1 tonne of grain by 1%) of gas oil and kerosene is 1.2L and 1.32L, respectively. These are based on industry benchmarks.

Furthermore, all these figures are based on the sale of 100t of barley. Within this calculation, gas oil and kerosene have been assumed to cost £0.47/L and £0.22/L, respectively. (for additional information, see charts at the end).

Drying for export economically viable?

As we can see from the results drying your barley for an export market could be an economically viable option.

It appears that drying with kerosene is the cheapest way to dry grain, but it is critical to note this can all fluctuate with the global economy and fuel prices.

Another key point is to note this is a snapshot at this current moment, of prices and input costs, therefore this could all change over time.

We should also remind the reader that extra haulage costs for port movement may need to be included in order for grain to move from surplus areas to ports.

To calculate the weight loss associated with drying cereals be sure to check out AHDB’s grain moisture calculator.

An extremely bearish outlook

Throughout this marketing year we have seen barley at a significant discount to wheat, based on the latest delivered cereals survey (07/05) for May delivery into Avonrange barley was quoted at £131.00/t, a £25.50/t discount to Avonrange feed wheat.

Furthermore, Paris maize futures (Nov-20) closed yesterday at €165.50/t, a €21.75/t discount to Paris wheat futures (Dec-20), which again will bare pressure on feed grain prices across Europe.

Therefore, I am going to coin the notion that there is an extremely bearish outlook for barley going into the new marketing year, and possibly beyond.

By extremely bearish, I mean that this large discount to wheat will continue going into the 2020/21 marketing year and downard pressure from a potentially oversupplied maize market may come to the fore as we move into the 2020/21 season.

What is paramount going into the 2020/21 marketing year is to understand the risks, and that includes engaging with export trade in the Mediterranean Sea and beyond.

If weather allows, getting barley harvested at a lower moisture content than normal could open doors to export markets without the need to put grain through the drier. A little bit of pre-harvest planning could pay many dividends.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.