UK barley exports – where in the world could they go? Grain Market Daily

Wednesday, 13 May 2020

Market Commentary

- New-crop Chicago wheat futures (Dec-20) closed lower yesterday as the USDA published its first new crop supply and demand estimates. Stocks of both wheat and maize are forecast for large increases.

- New-crop Chicago maize futures, moved higher despite the increases to ending stock figures, suggesting that the market feels they have been somewhat underestimated. Old crop maize stocks were only up 150Kt, despite the huge cuts we’ve seen to US ethanol production in the past month.

- UK feed wheat futures (Nov-20) dropped by £0.55/t yesterday, to close at £164.35/t, a weakening of sterling preventing the full extent of losses in Paris wheat futures from filtering into the domestic market.

UK barley exports – where in the world could they go?

In these current uncertain times, the concerns around how we will leave the EU almost seem like an earlier lifetime. But they are still very real. The UK is scheduled to exit the Union on 31 December 2020 and unless a trade deal is struck, UK barley exports into the EU may be subject to a hefty tariff.

Considerations

Given that the UK is a net exporter of barley, and yesterday's analysis highlighting that the UK may have record barley production in excess of 8.3Mt, we need to look for possible alternative homes. Our attention turns to potential third country export destinations that may be more economically viable, should their demand be sufficient.

We can see that there will be an import requirement from third countries for the coming season, in markets where the UK has previously exported to. However, with a large volume of barley on global books, the heaviness in the market could well weigh on prices going forward.

In addition, there may be costs associated with ensuring the crop is at the right specification to export into these markets. Third country markets trading at 13.5%-14% moisture may prove tricky for UK exports which usually trade at 15% into European markets. Drying cost considerations needs to be made. The barley focus of Grain Market Daily this week will allow this thought process to formulate with a focus on drying this Friday.

Expand the sections below to read more detail on demand trends.

- Largest global importer of barley

- Primarily supplied by the Black Sea region, but open to global tenders

- Reduced demand forecast for 2020/21, due to subsidy policy change

Saudi Arabia is the world’s largest barley importer. The market is exclusively to service livestock feed demand, with no malting industry in the Kingdom. Only a very small volume of barley is produced within the Kingdom, this being for human consumption.

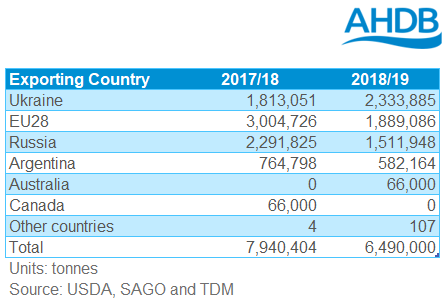

The Saudi Arabian Grain Organisation (SAGO) releases several tenders throughout the marketing year and over the past two seasons, these have largely been fulfilled by Ukraine, EU28 and Russia.

So what are the prospects for the main exporters in the coming season? Ukrainian barley area is decreased for harvest 2020, largely due to low domestic prices and a diminishing margin. Equally, crop conditions in the south have deteriorated, leading yield forecasts to be downgraded by up to 6%. So we may see a reduced exportable surplus here.

Overall EU barley area is forecast to increase slightly, with production levels similar to the current marketing season, at 62.3Mt. However, the current coronavirus pandemic is significantly reducing demand, and adding heaviness to an already weighted market.

A watch point could be Australia. As reported recently, with China expected to announce tariffs that could end barley trade, Australia could well end up with a glut of barley needing to find a home.

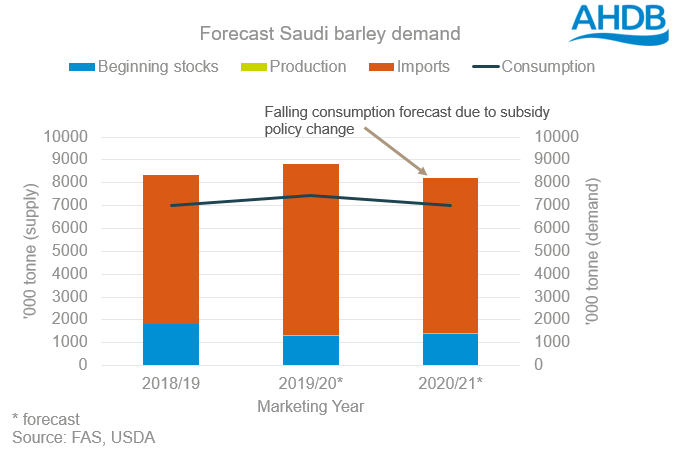

In addition, Saudi Arabia has been reducing its imports this marketing year, with the slump largely resulting from a domestic large production of forage crops. However, while historically Saudi Arabia has looked to shore up its stocks, a subsidy policy change in January 2020 may see a move away from barley to more compound feeds.

Previously, Saudi animal feed subsidies (up to the value of $1.5 million in 2018) allowed barley to be imported and distributed at below the market rate. Approximately two thirds of the total subsidy was apportioned to barley. The changes, which have been rolled out over the past few months, include eliminating import subsidies for all feeds and ingredients.

Additionally, the government has raised barley prices and plans to remove the barley subsidy. Theoretically, this should encourage producers to turn to more compound feed, aiming to reduce costs and increase productivity. However, the Bedouin herders, who are largely the exclusive users of barley imports, are firmly wedded to barley use, so convincing them to switch may prove challenging.

It is important to remember that exports to Saudi Arabia need to be at a certain specification. These could potentially carry cost implications for the producer, with extra drying costs etc.

- Unfavourable weather has hit domestic production, predicting an import requirement for the coming season

- Consumption driven predominantly by animal feed

Several North African countries have received UK barley exports over the past three seasons, in particular Algeria and Tunisia.

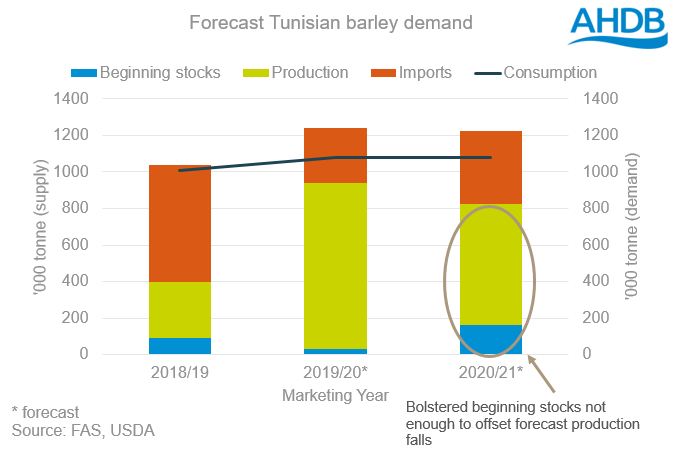

Tunisia is forecast to have a greater barley import requirement for the coming marketing year, again used almost exclusively for animal feed. While 2018/19 recorded a bumper production year, with sizeable carry out stocks forecast, this is not enough to offset the predicted fall in production.

Unfavourable weather delayed planting, and crops have still not received adequate rainfall to date. Some are forecasting a fall of between 30-50% in production compared with the year earlier.

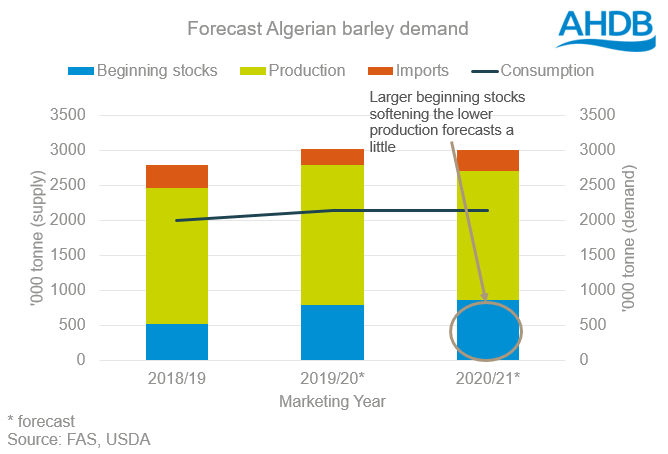

Barley consumption in Algeria is a function of pasture conditions, with unfavourable grass growing weather pushing up import requirements. In addition, there has been an increase in livestock numbers in recent years and with a new development programme encouraging camel and goat breeding in the south of the country, domestic demand is forecast to increase proportionally.

Looking towards the 2020/21 marketing season, the current weather conditions are challenging for both the domestic barley crop and pasture, which could support import requirements for the country. However, during this marketing season, the domestic sale price support for barley has been removed, which has subdued demand to a degree.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.