Analyst Insight: Rapeseed market influences – where next for soyabeans?

Thursday, 22 June 2023

Market commentary

- UK feed wheat (Nov-23) futures closed yesterday at £207.50/t, up £5.55/t from Tuesday’s close. Nov-24 futures gained £5.35/t over the same period, to close at £212.55/t.

- Domestic futures followed gains on Chicago and Paris wheat contracts, and Chicago maize futures. Concern continues for whether the Black Sea Initiative (Ukraine export corridor) will be extended, as well as dry weather across the US Midwest trimming crop conditions for maize, spring wheat and soyabeans (more below).

- Germany’s 2023 wheat crop is forecast to fall 2.9% on the year to 21.87 Mt, according to the association of farm cooperatives. This is back from May’s estimate as plants wilt under dry, hot weather.

- Paris rapeseed futures (Nov-23) closed yesterday at €463.25/t, down €9.75/t from Tuesday’s close. Rapeseed futures followed some pressure seen across wider vegetable oil markets, despite gains for Chicago soyabean markets.

- Today, the Bank of England announced interest rates would be increased by 0.5% to 5%. Deciding whether to store, or sell at harvest 2023 and put the money in the bank? Read our analysis here.

Rapeseed market influences – where next for soyabeans?

Chicago soyabean futures (Nov-23) have seen consecutive daily gains since close on Friday 9 June. The contract has gained a total of 14% ($61.72/t) over this period, to yesterday’s close at $505.91/t. This is the highest point since 6 March. Last week especially, we saw the support from soyabean markets lead to rapeseed market gains too. So, what is causing support to prices?

US drought conditions

We have talked recently in detail about US dryness concerns for US spring wheat, maize and soyabean crops. The US crop is forecast to account for 30% of new season global soyabean production and 31% of new season global exports (USDA), and therefore is important for global availability.

Last week, positioning of managed money played into support seen for Chicago futures prices ahead of a long weekend. Factoring in risk of dry weather/changing forecasts whilst US markets were closed.

Latest maps show 51% of the soybean acreage to be in drought conditions (Soybean and Corn Advisor), and Tuesday’s USDA crop report brought larger-than-expected cuts to ‘good to excellent’ conditions to US soyabeans.

This season (2022/23) the US saw smaller production and stronger domestic crushing demand year-on-year. As such, the most recent soyabean stocks numbers reflect this. The market looks to a large crop next season to alleviate this tighter balance, and any news will continue to move markets. The next US stock numbers are due out on 30 June and with markets focus currently on next year’s supplies.

Chinese buying of Brazilian soyabeans

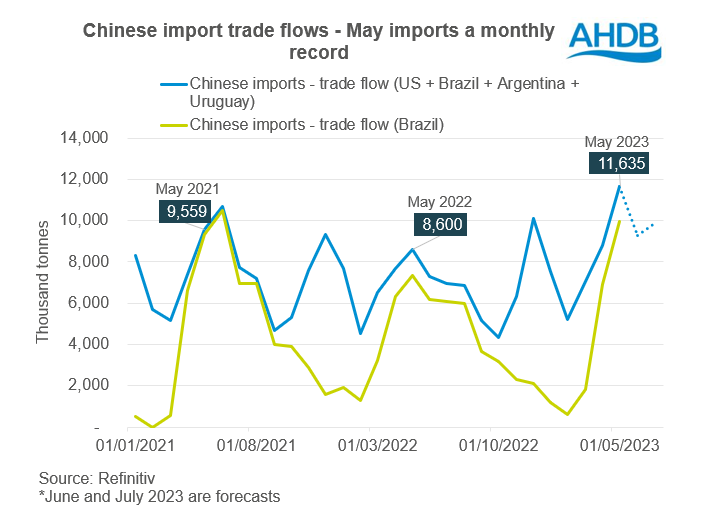

Another supporting factor in the background, is strong Chinese purchasing of soyabeans. In May, it is estimated China imported 11.6 Mt of soyabeans using Refinitiv trade flow data from Brazil, US, Argentina, and Uruguay (we can expect Chinese customs data available later this year). This is up 35% from May 2022 and reportedly the largest volume recorded in a single month (Refinitiv). Of this, Brazil accounted for around 10Mt, up 36% from May 2022.

After a slow start for Brazilian harvest, competitively priced Brazilian supply is now heading into China to rebuild stocks. In June and July, Refinitiv forecast Chinese imports to total 9.3 Mt and 9.9 Mt respectively, which if realised could bring Chinese imports for the 2022/23 season (September to July) to 12% ahead of the same period last season. Though low hog prices and an abundance of cheap wheat for animal feed does pose a longer-term question of how much China will need to import.

What does this mean?

Though Chinese demand will be important to monitor going forward, the soyabean market still expects large crops in the new season from the US and Brazil, which if realised could weigh on prices longer-term. However, before then, drought concerns in the US will be watched closely, especially considering the US might see some tight stocks carried into the new season. July into August will be a particularly key months as the crop pod fills. Into the start of July, some rain is due across much of the Midwest and High Plains, but this remains below average.

Though soyabeans are important to the overall oilseed balance into the new season and may provide some support short term especially for rapeseed, it is important to consider global rapeseed supply next season is expected to be larger. Large carry-in stocks as well as a big production forecast in the EU continues to weigh on the price outlook for rapeseed, especially when harvest begins.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.