Arable Market Report - 05 June 2023

Monday, 5 June 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

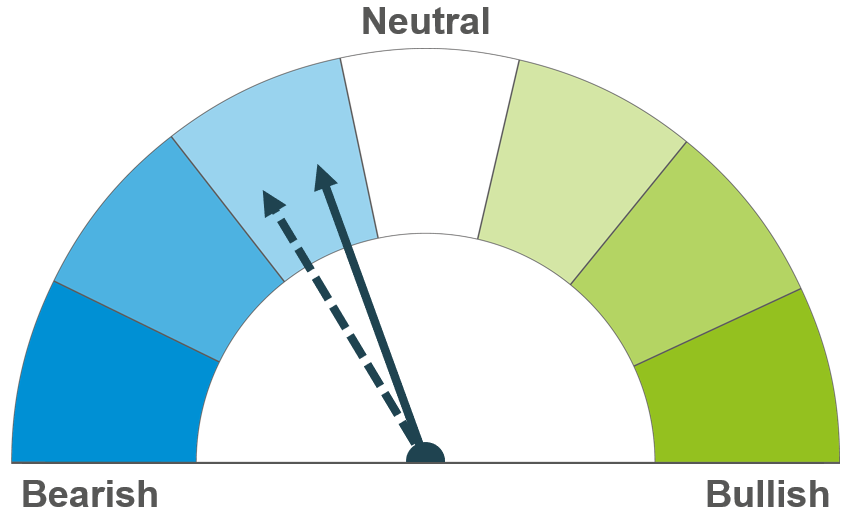

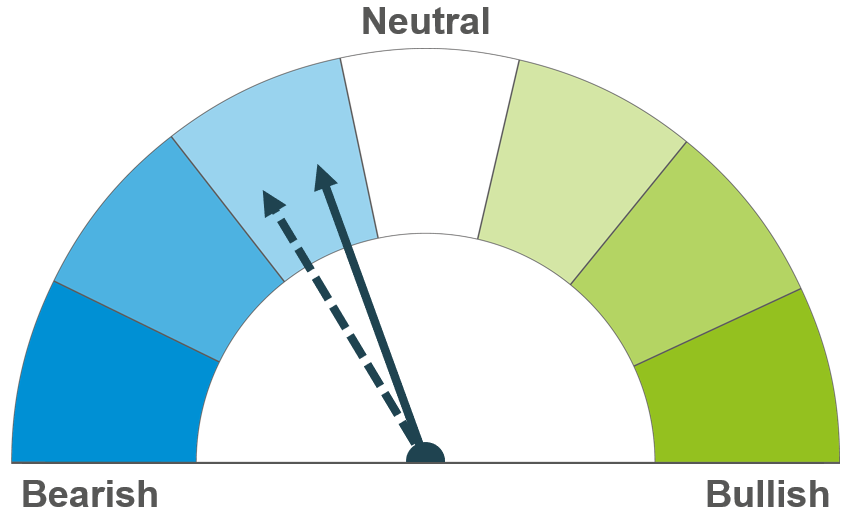

Short term, volatility can be expected as markets react to news on Black Sea tensions. However, new crop global supplies still look heavy, and weather conditions in the US and China are forecast to improve over the coming days.

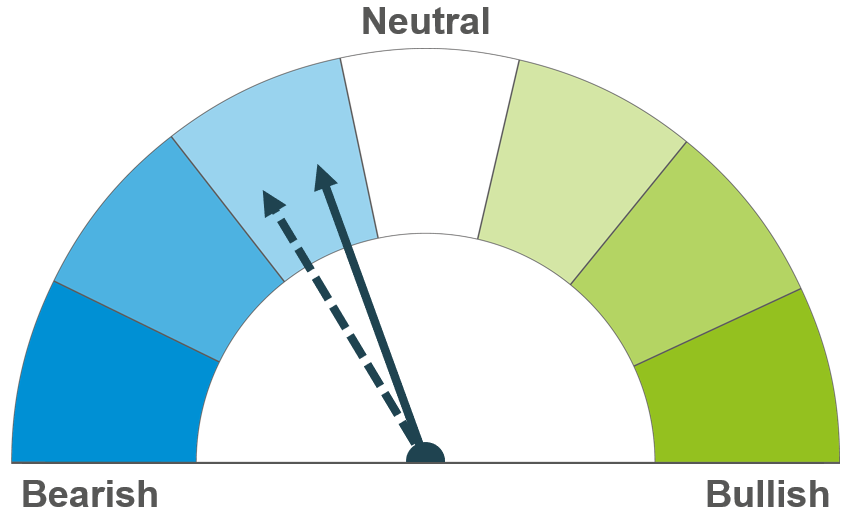

Improved weather in the US Midwest could weigh on global maize markets short-term. Longer term, global maize supplies look ample.

Global barley prices continue to follow price movement in the wider grains complex. New crop feed barley into East Anglia for November delivery was quoted at £164.50/t on Thursday, at a £19.00/t discount to feed wheat.

Global grain markets

Global grain futures

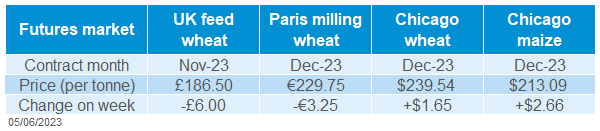

US grain markets were slightly supported overall last week (Friday to Friday). Continued dryness in key growing regions in the US Midwest, combined with concerns over Black Sea supplies at the end of the week and crop damage in key consumer China, contributed to the gains. Chicago wheat futures (Dec-23) were up 0.7% on the week, while Chicago maize futures (Dec-23) gained 1.3% over the same period.

Tensions in the Black Sea region continue. On Friday, Ukraine’s Agriculture Minister said that despite the export deal, Russia had already blocked the use of one of their major ports, Pivdennyi, and was allowing only one ship a day through the corridor. According to Refinitiv, Russia has said it will allow more ships through if all parties in the deal allow the transit of Russian ammonia via a pipeline through Ukraine. However, Ukraine’s Agriculture Minister also said that his government could offer insurance guarantees for companies to continue shipping without a new deal. Global grain markets will remain reactive to any news on this over the next few days.

Excessive rains in China’s largest wheat-growing province of Henan damaged the country’s wheat crop last week, threatening domestic supply. However, while supporting global prices slightly, it’s not thought to be a major threat to global supply. China already has a surplus of cheap wheat. There is also forecast to be limited rain over the next week in the key production regions.

Dryness in parts of the US Midwest also remains a watchpoint this week. Rapid planting and emergence progress means that the June weather will likely be more impactful on the US maize crop than normal. Currently, the US Midwest is forecast widespread dryness and warmth throughout June. Shorter term, up to 1.5 inches is forecast across some key maize areas over the next seven days. The impact of this weather on crop conditions will be something to monitor in the USDA’s weekly crop progress updates.

UK focus

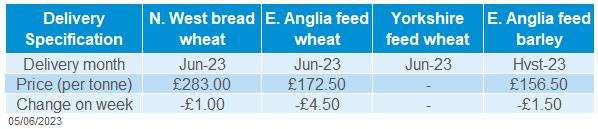

Delivered cereals

Despite tracking global climbs at the end of the week, UK feed wheat futures (Nov-23) were pressured overall last week, down 3% Friday to Friday. New crop futures (Nov-24) were down 1% over the same period.

Delivered prices followed futures movement last week. Feed wheat into East Anglia for June delivery was quoted at £172.50/t on Thursday, down £4.50/t on the week. Bread wheat delivered into the North-West for June delivery was quoted at £283.00/t on Thursday, down £1.00/t over the same period.

On Thursday, AHDB published updated UK human and industrial and GB animal feed cereal usage data including data up to April. Total GB animal feed production from July to April totalled 9.39 Mt, down 6.6% on the year. Total wheat milled for human and industrial consumption totalled 5.03 Mt, up 1.2% over the same period. Barley usage by the brewing, malting and distilling sector was up 5.6% on the year over the same period too.

On Friday, the May crop development report was published. Generally, GB crop prospects are looking positive, with recently improved weather enabling farmers to catch up on late sowing and spray applications. To the week ending 30 May, 85% of the GB winter wheat crop was in good/excellent condition, ahead of 82% at the same point last season. The GB winter barley crop is also faring well, with 88% in good/excellent condition, compared to 82% last year. For more information by crop type, please follow this link.

Oilseeds

Rapeseed

Soyabeans

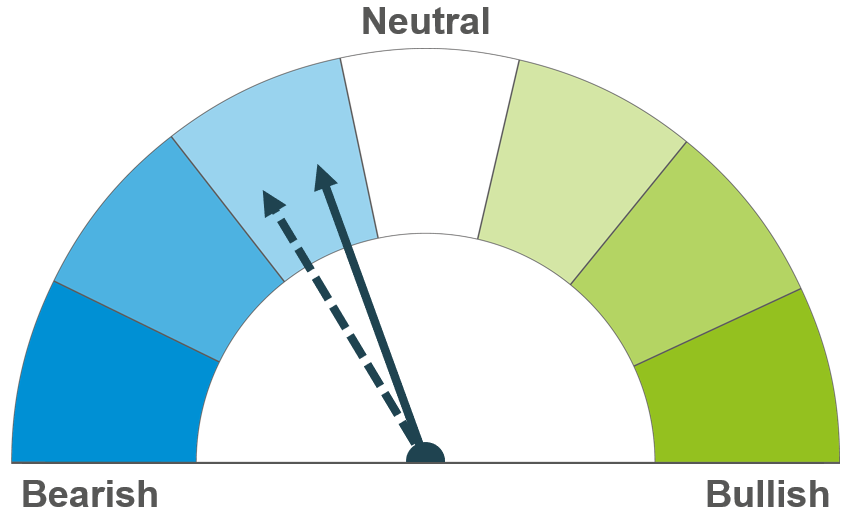

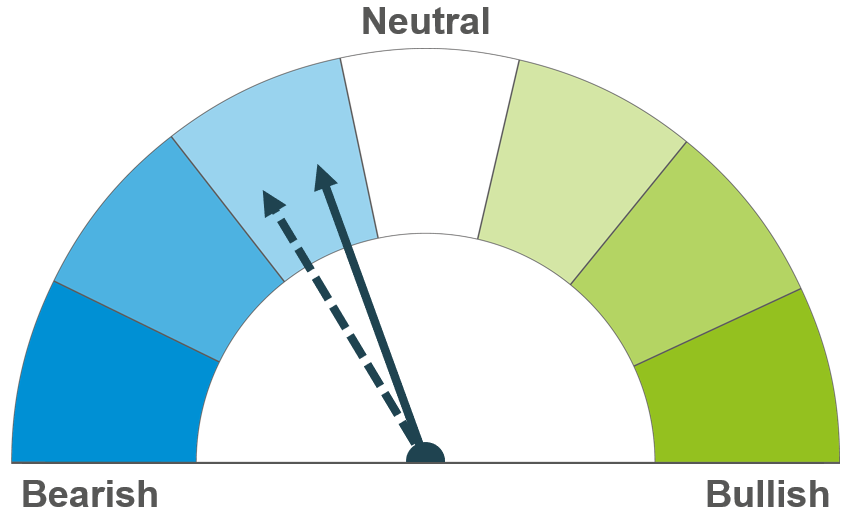

Weather across key producers remains the focus short term, as the market assesses new season supply. Overall EU new season rapeseed supply looks plentiful, with a large production forecast.

With US planting progressing quickly, and ample Brazilian supply on the market, global availability looks to be boosted heading into the new season and longer term, weather allowing.

Global oilseed markets

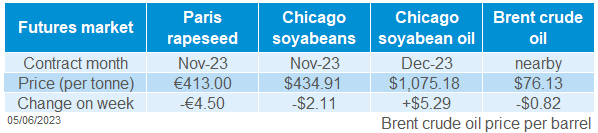

Global oilseed futures

Last week, Chicago soyabean futures (Nov-23) fell $2.11/t overall. This was on account of weakness early last week as US plantings progress, ample Brazilian soyabean supply, and with global demand concerns rumbling on. Despite this, Thursday and Friday saw gains for the contract, supported by ongoing concerns of dry weather across the US Midwest and gains in the wider oil complex. On Friday, the contract closed at $434.91/t.

US soyabean plantings are progressing well ahead of average. As of 28 May, 83% of soyabeans were planted according to the USDA. This is ahead of 64% at the same point last year, and the previous five-year average of 65%. The first US crop condition scores are due later today.

Dry conditions across the US Midwest remain an ongoing watchpoint. Over the next two weeks, most areas across the Midwest are due some needed rain. New season supply remains a key market mover, especially as this season’s US stocks remain tight. Reportedly, a boat arrived in the US last week carrying Brazilian soyabeans (Refinitiv).

Despite an overall slight reduction in nearby Brent crude oil prices last week, the oil complex saw some gains later in the week. These gains were on news the US would be raising its debt ceiling (borrowing limit), and in anticipation of the OPEC+ meeting over the weekend. It is now confirmed Saudi Arabia will reduce oil production by 1 M barrels a day in July, lending support to prices this morning. There was also support for Malaysian palm oil futures also at the end of last week from ongoing concerns about the possible impact of an El Niño weather pattern on palm oil production.

Rapeseed focus

UK delivered oilseed prices

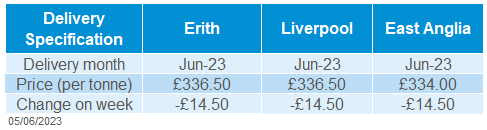

Paris rapeseed futures (Nov-23) fell €4.50/t overall last week, despite strong gains on Friday with wider oil and soyabean futures. On Friday, the contract closed at €413.00/t. Domestic delivered prices followed futures movements last week, though with prices taken around midday, futures gains on Friday are not shown fully in the week-on-week movement. On Friday, delivered rapeseed (into Erith, harvest delivery) was quoted at £335.50/t, down £14.00/t from the previous Friday.

The latest GB crop development was released on Friday. OSR crop conditions remain very mixed, with cabbage stem flea beetle (CSFB) the biggest issue reported. At the week ending Tuesday 30 May, 63% of winter oilseed rape was in good/excellent condition, compared to 70% at the same point last season. To read more, follow this link.

The latest Stratégie Grains oilseed report, released on Friday, revised up EU-27 rapeseed and sunseed production for next season (2023/24) boosting availability further. Harvest 2023 rapeseed production is now forecast at 20.4 Mt, up 400 Kt from last month mainly on account of the favourable spring in Germany, Poland, France, and Romania boosting yield potential. Sunseed production was also raised (+100Kt) to 11.3 Mt but soyabean production was trimmed (-200Kt) to 3.0 Mt. Rapeseed ending stocks for 2023/24 were also up this month, on higher production and reduced crushing forecast. In Benelux, rapeseed crush margins are now feeling competition from soyabean margins.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.