Could it be cost beneficial to sell at harvest? Grain market daily

Tuesday, 20 June 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £203.50/t, gaining £0.85/t from Friday’s close. Nov-24 futures closed at £207.80/t, gaining £0.65/t over the same period.

- Our domestic market followed the Paris market up yesterday, which was supported by concerns over dry weather in the US Midwest.

- Yesterday, the EU crop monitoring service reduced nearly all its average yield forecasts for this year’s grain and oilseed crops, due to adverse weather conditions. The average yield projection for soft wheat is now 5.92 t/ha, down from 6.01 t/ha in last month’s report. However, this remains above the 5.79 t/ha yielded last year.

- Paris rapeseed futures (Nov-23) closed yesterday at €474.75/t, down €2.25/t from Friday’s close, retreating from the highest price since the middle of April 2023. However, losses were limited as there is some concern over drought stress on the US soyabean crop.

Could it be cost beneficial to sell at harvest?

With inflation still historically high, interest rates are still on the rise. The market is pricing in further interest rate hikes in 2023, with some predicting that the Bank of England base rate could rise to 5.4% by the end of 2023, before slowly falling over the next five-years.

As grain stores are being cleared all set for this coming harvest, could there actually be a cost benefit from selling your grain around harvest and putting the cash in the bank?

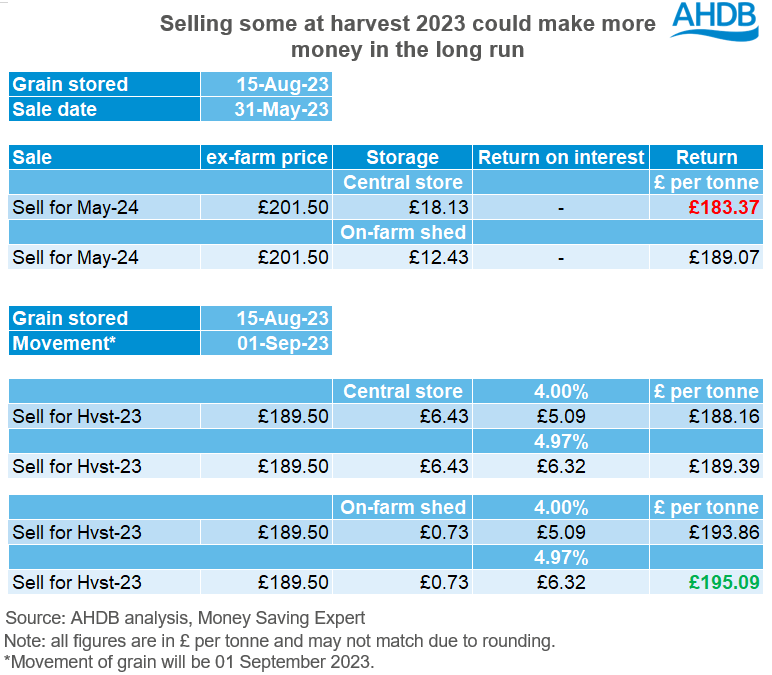

Currently, some of the best, easy access savers are offering 4% interest. However, there are top-fixed term savings accounts that are offering a rate of 4.97% fixed over nine months (20 June, Money Saving Expert).

Below is a list of assumptions used in this analysis:

- Wheat has been stored from 15 August 2023, although we can’t forecast the timeframe of this coming harvest, taking into account the current conditions, assumptions from last year’s harvest have been used.

- Payment for selling now, is based off movement on 1 September 2023 and that the grower receives money in the bank from the start of October – not instantly, to reflect a delay in payment. Storage until May 2024 is an assumed sale on 31 May 2024.

- For this analysis an indicative ex-farm spot price and May 2024 price for Avonrange have been used. These have been calculated using the latest AHDB delivered survey prices (as at 15 June), into the respective location. A £7.00/t haulage rate has been deducted from the delivered price to reflect an ex-farm price, therefore close proximity to both store or feed mill, is assumed in this analysis. Please note this is an indicative value to aid this analysis, not a quoted ex-farm price.

- Storage fees are indicative values with an in/out fee of £3.20/t and £2.50/t, respectively. Also, there is a weekly storage cost of £0.30/t a week. Please note that the on-farm storage costs are the same to reflect depreciation and costs, however, the in/out fee has been deducted.

Could there be a cost benefit to selling for this harvest?

Based on the prices last week, its more economical to sell grain this coming harvest and putting the money in the bank. With the final scenario in the table (selling out the shed, 4.97% interest) yielding the most income at £195.09 /t for feed wheat.

Please note though that this a nine-month fixed interest – so cash will not be accessible until June 2024 in this scenario. However, the easy-access accounts are currently offering a slightly lower interest of 4% and the overall income is higher than selling for May 2024. If interest rates are expected to increase, you may not want to lock into a rate at the moment as you could forgo the ability to ditch and switch to a better deal.

This analysis isn’t a one size fits all approach. However, it does highlight the need to know exactly what your storage costs are going to be for the 2023/24 marketing year, as you may find it’s more economical locking an interest rate and putting your cash in the bank over storing your grain.

Over recent months there has been a bearish outlook for global grain markets. However, the uncertainty around weather events or what happens in the Black Sea could keep forward markets elevated, in the short to mid-term. This is just one option right now when exploring marketing some of your 2023 crop.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.