Analyst insight: Opportunity to market 2023 wheat?

Thursday, 3 February 2022

Market commentary

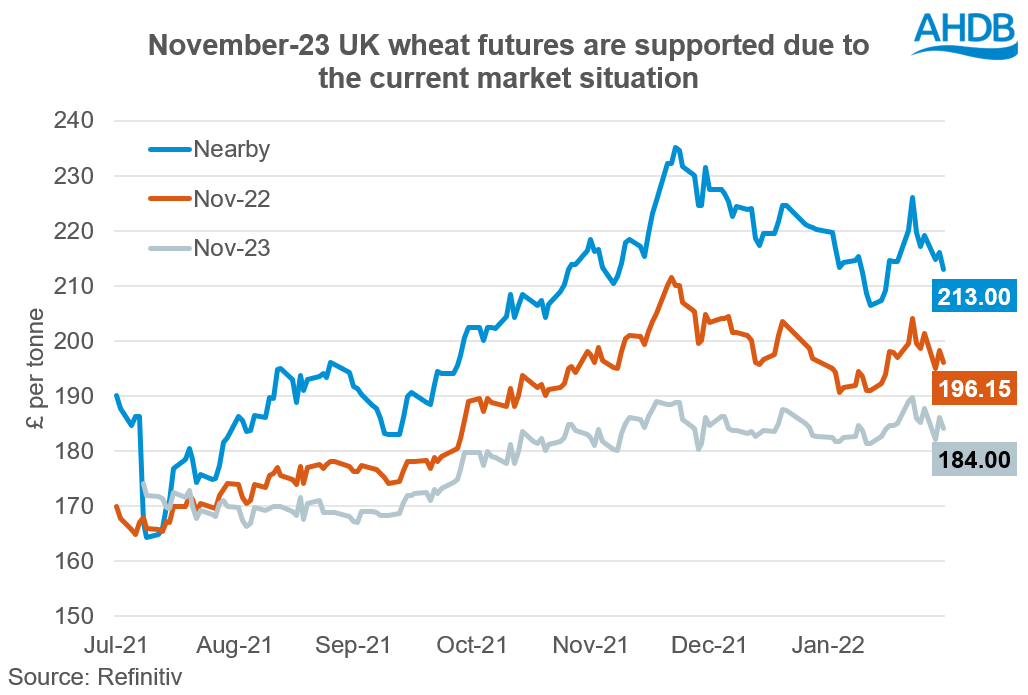

- UK wheat futures (May-22) closed yesterday at £215.00/t, down £3.05/t on Tuesday’s close. The Nov-22 contract closed at 196.15/t, down £2.10/t on Tuesday’s close.

- The domestic market followed the Chicago and Paris markets down. Cited to cause this pressure is technical selling, combined with US winter crops receiving beneficial rain. Megan discusses why the US crops are important to prices here.

- Yesterday, Russia banned the export of ammonium nitrate (AN) until 1 April 2022. The Russian government has done this in a bid to guarantee affordable supplies in their domestic trade, following the increase in global fertiliser prices.

Opportunity to market 2023 wheat?

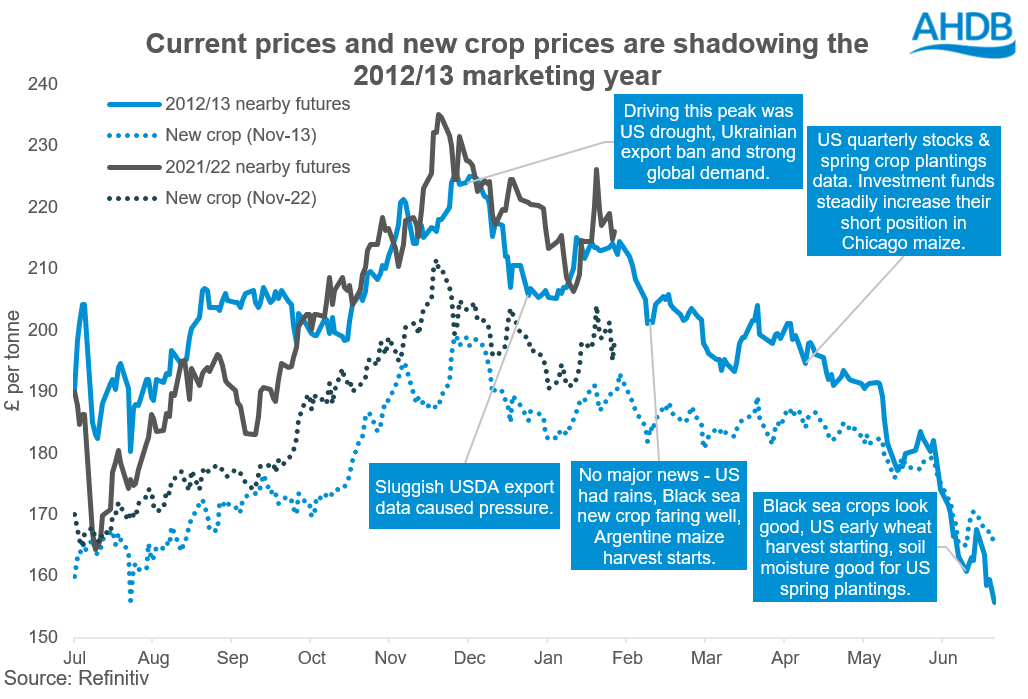

So far this marketing year (2021-22) nearby UK wheat futures values peaked at £235.10/t on 24 November 2021. This surpassed the previous high of £225.45/t that was set in the 2012/13 marketing year.

Looking a step ahead for selling

With the global wheat market floating at high levels, forward values for wheat are supported off the back of this. For example, the November-23 UK wheat futures price closed yesterday at £184.00/t. Although this is below May-22 futures of £215.00/t and the new crop futures (Nov-22) price of £196.15/t, it is still a strong price.

Traded volumes are low currently for this futures contract. However, if a grower can secure a trade, these prices could pose a significant opportunity for that grower to market a proportion of harvest-23 wheat.

AHDB has tools to help you understand and manage your costs, including FarmBench.

A warning from history

In previous analysis, I showed that both old crop (nearby) and new crop prices (Nov-22) are currently shadowing the 2012/13 marketing year.

This current marketing year both old and new crop futures resemble the 2012/13 marketing year. In 2012/13, a combination of bearish news and a lack of news pressured the market in the second half of the marketing year.

However, the recent anomaly in this marketing year (2021/22) that has stopped market pressure is the Russian-Ukrainian tensions. This has caused volatility for wheat prices. In January, we saw nearby UK wheat futures close as low as £206.35/t and as high as £226.05/t.

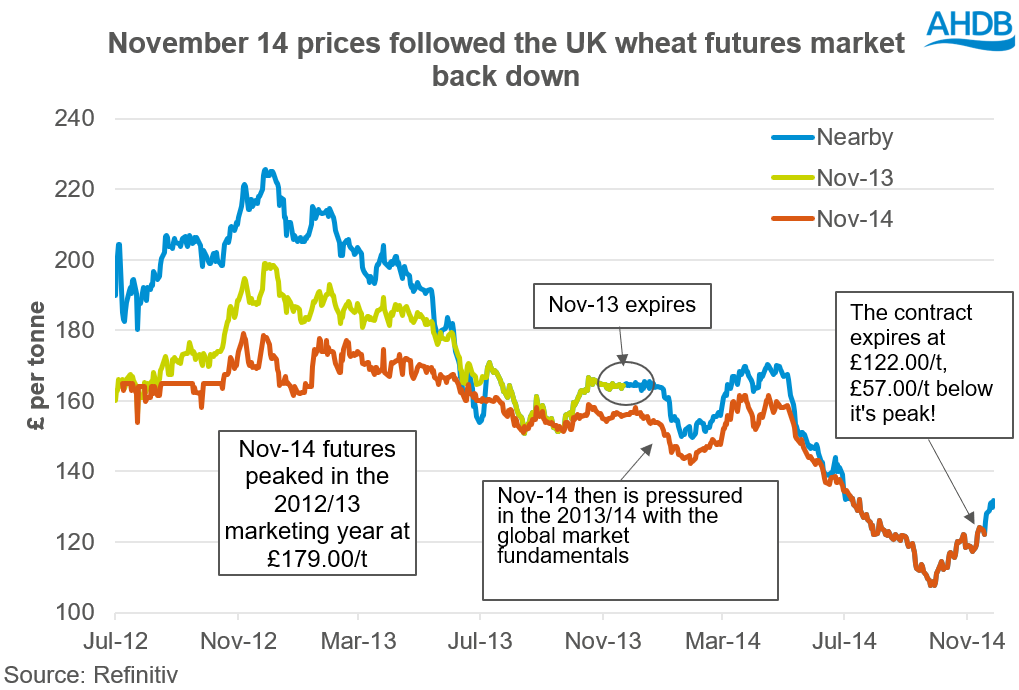

Nonetheless, in 2012/13 new crop prices (Nov-13) quickly came down as bearish news dominated the grain market. Further to this, November-14 (new-new crop prices at the time) also went from being high to later being subdued

Futures prices for November-14 were very supported during the 2012/13 marketing year and peaked at £179.00/t on 07 November 2012. However, as we progressed into the 2013/14 marketing year, prices became more pressured and eventually the contract expired at £122.00/t.

Seizing opportunities while prices are good

No one has a crystal ball to see the future of wheat prices. A lot can change between now and harvest 2023, as there is a lot of weather and data that can change the tide of a market. However, current high prices pose an opportunity to market a proportion of 2023 harvest.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.