Analyst Insight: Could we see a switch in animal feed?

Thursday, 12 March 2020

Market Commentary

- January HMRC trade data came out yesterday showing barley exports season-to-date sit at 60% of the estimated surplus available for export or free-stock. Pace of export has picked up slightly from December but are well below the Aug-Nov pace.

- Reports from our export price survey suggest that exports of both wheat and barley are minimal at best at the moment.

- Since Friday sterling has dropped 1.6% to close yesterday at £1=€1.1372, the lowest since October last year. Weak sterling can help with pricing competitively into export markets but if there is a lack of demand the question remains as to how low our price needs to go to gain custom.

Could we see a switch in animal feed?

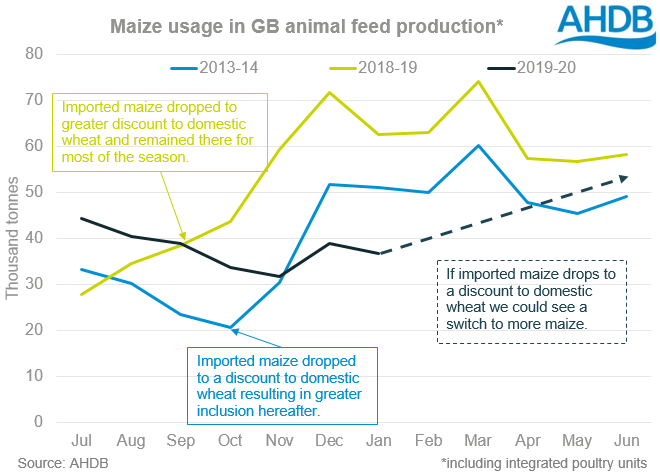

Last week the latest GB animal feed production and usage stats (including integrated poultry units) were released. This showed the total usage season-to-date (Jul-Jan) has dropped 1.5% compared to the same period in 2018/19. Helen touched upon this in Fridays Grain Market Daily but there is now a question of what could happen over the latter half of the season.

Although usage was only marginally down there has been some big shifts as to which key cereals have been used in rations. The total wheat and barley usage is up, but just 0.69% for wheat compared to an increase of 15.5% for barley. Maize on the other hand is significantly down (Jul-Jan) with a drop of 21.8%.

The need for feed could be heightened for the latter part of the season if spring livestock turn out is delayed or grass growth is hampered. So the question arises as to what cereals may be used in animal feed rations?

The continual wet weather throughout autumn and winter, delaying winter cereal planting, offered support to both new and old-crop domestic wheat. Despite UK futures dropping back down more recently, we still sit close to import parity for feed commodities.

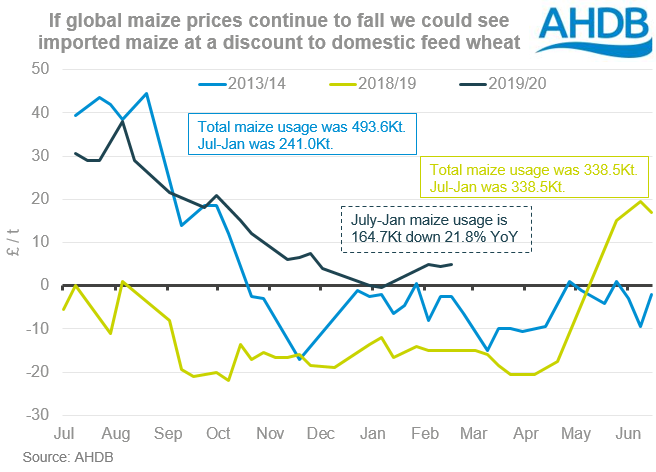

When domestic cereal prices sit low relative to imported maize it is likely that the inclusion of these products will be higher and vice versa. This was a key driver behind increased maize usage last season.

Animal feed usage was up last season partly on the back of a dry summer, increasing the need for supplementary feeding. But the inclusion of maize shot up year-on-year due to the significant discount in price from domestic feed wheat. From July 2018 to January 2019 maize usage was up 90.6% compared to the previous season. Wheat and barley usage were up just 4.4% and 8.2% respectively.

Similarly to this season, the 2013/14 season started off with delivered feed wheat (East Anglia) pricing cheaper than that of imported any origin maize. However, when the imported maize price moved to a discount position the inclusion of maize in animal feed spiked.

Currently, delivered feed wheat into East Anglia sits only marginally lower than any origin imported maize. Last week, imported maize was at a premium of just £5.00/t, at £159.00/t which dropped a further £2.00/t in Monday’s imported price survey. As Anthony talked about last week, the global picture for maize is generally bearish and therefore maize prices are likely to be further pressured.

Although this can drag our domestic prices lower, the prospects of a tight 2020 wheat harvest may ease the drag somewhat. If this were to happen we could see a switch from wheat to maize as we have done in previous seasons such as 2018/19.

The decision to switch to maize however, may be dampened by barley. With prospects of a significant barley crop for 2020 harvest, prices could remain competitive, continuing a larger inclusion of barley instead. This season so far we have seen that the barley inclusion is greater than last season by 15.5%. If barley prices continue at a competitive rate, it may be a simpler switch for compounders that want to move away from wheat.

However, there will be other factors considered, asides price as the specific ration requirement will dictate how easy a switch can be made. For certain animals, such as pigs, a diet can only be altered at certain stages of their lifecycle and gradually at that. However, price is a key indicator as to whether a switch is even considered.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.