Analyst Insight: Could US maize impact our new crop wheat futures?

Thursday, 5 March 2020

Market Commentary

- UK wheat futures (May-20) closed yesterday at £150.75/t, down £0.25/t on the day before. However, the November contract closed at £162.00/t, up £0.50/t.

- Chicago soyabean futures (May-20) closed yesterday at $333.32/t, up $1.37/t on the day before. Recent gains have been from an anticipated increase in demand for US supplies as Argentina plans to raise taxes on soya exports from 30% to 33%.

Could US maize impact our new crop wheat futures?

The adverse weather since the start of autumn has provided an array of challenges going in the 2020/21MY for the UK’s grain markets. In a matter of months, our domestic wheat market flipped from export to import parity and we now will be facing a wheat deficit.

With the recent re-run of the Early Bird Survey showing at best a 17% reduction in wheat area, a significantly reduced wheat crop is forecast for the 2020/21MY. Alex’s analysis a couple of weeks ago puts a mid-range scenario production figure at 10.74Mt, which will be the lowest wheat production season in the last twenty years by over 840Kt.

Although we will be facing a wheat deficit, there are interchangeable grains such as maize which could fill gaps created by a deficit. Globally the tone around maize is bearish and this is not just due to the coronavirus.

The latest USDA grains and oilseeds outlook advocates that the US is set to produce one of the largest maize crops on record. Furthermore, Buenos Aires Grain Exchange suggest that first yield figures from the Argentinian maize harvest are above the five-year average.

Interchangeable demand for wheat domestically

Although there isn’t another suitable homogenous commodity apart from wheat that will manufacture a loaf of bread, it’s worth noting that a lot of the UK’s demand for wheat actually goes into industrial consumption and animal feed.

For example, the latest UK Cereals Supply and Demand estimates that 50% of domestic wheat consumption for 2019/20 will actually go into animal feed. Within this sector consumption for wheat can become relatively elastic in nature, meaning increases in price could drive demand elsewhere for another suitable commodity, such as maize. From yesterday’s close, new crop UK wheat futures (Nov-20) are at a £43.52/t premium over Chicago maize futures (Dec-20).

US cropping intentions

With planting to commence in early April, growers within the US will be looking at the pricing relationship between soyabeans and maize. If there’s an imbalance in pricing, we may see one crop favoured over another.

With the US forecast to have one of the lowest planted winter wheat areas on record, crops such as soyabeans or maize could be viable alternatives.

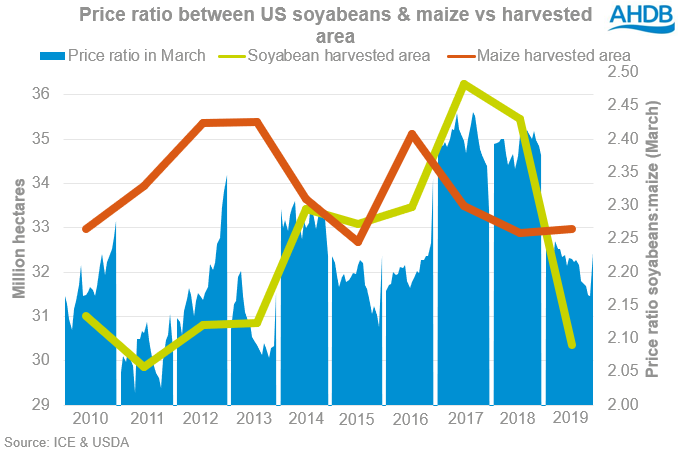

Conventionally soyabeans futures contracts are priced just over double the value of maize, due to input costs and yields. The graph below compares the price ratio in the month of March between soyabean (Nov) and maize (Dec) futures contract. March has been selected for comparison as this month of the year will determined planting decisions.

We can see that in years where the premium of soyabeans is elevated in March, the soyabean area harvested increases that year.

In Mar-11, soyabeans were priced on average 2.08 times over that of maize. During this year, the soyabean area harvested reduced by 3.7% and the maize area increased by 3.0%.

In contrast, in Mar-17 the opposite occurred. Soyabeans (Nov-17) were priced on average 2.4 times over maize (Dec-17). In 2017/18 the area harvested for soyabeans increased by 8.3%, and maize reduced by 4.6%.

Since the beginning of February to yesterday, soyabean futures (Nov-20) were on average 2.21 times the value of maize (Dec-20), which in comparison match Mar-19 averages.

The current soyabean to maize price ratio could support an increase in maize area. Should soyabeans move closer to 2.4 times the maize value, this may shift the area balance in favour of soyabeans.

However, it is important to remember that price ratios will not be the only factor that will be considered in a growers planting decisions.

Preliminary estimates for area planted 2020/21 are to increase to 38.04Mha for maize and 34.4Mha for soyabeans, increasing by 4.8% and 11.7%, respectively. This yearly increase is exacerbated by the challenging climatic conditions experienced during the 19/20 planting window.

An increase in US maize

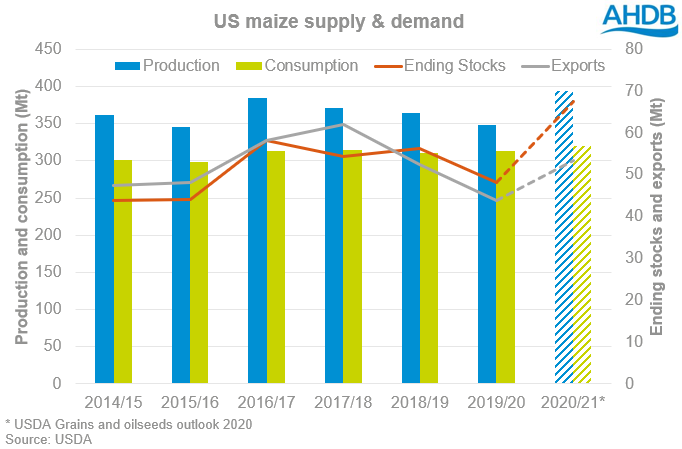

The USDA’s outlook for maize production in 2020/21 is forecast up 13% with a record production expected. Provisional estimates are at approximately 393Mt. The USDA further forecasts that there is an expected increase in exports and higher ending stocks.

For the 2020/21 marketing year, total exports from the US are forecast to be a record high at approximately 53Mt. This may result in increased global trade growth, although there will be competition from Argentina, Brazil and Ukraine, also large producers and exporters of maize.

Will US maize compete with UK wheat?

Since Aug-19 we have witnessed a diverging spread between new crop UK wheat futures (Nov-20) and Chicago maize futures (Dec-20). An over inflation of the domestic wheat market may see a move towards cheaper global alternatives being sourced.

Due to weather constraints last year, the USDA are forecasting an increased crop for both soyabeans and maize, with increased exports for the US. An increase in supply could set a bearish tone for maize markets going forward, potentially pricing below UK wheat futures.

Although we are forecast a significantly reduced wheat crop next year, strengthening prices may be capped by a bearish maize market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.