Analyst Insight: Budgeting your harvest 2023 crops, why is it important?

Wednesday, 19 July 2023

Market commentary

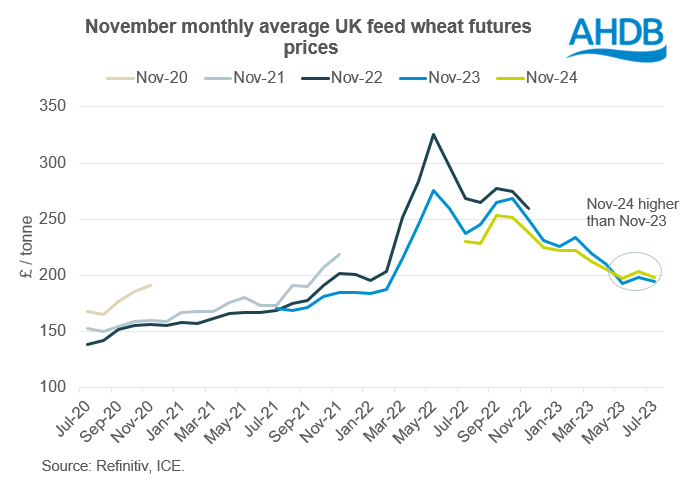

- UK feed wheat futures (Nov-23) closed yesterday at £198.85/t, up £2.85/t from Monday’s close. Nov-24 futures also gained £2.85/t over the same period, to close at £203.05/t.

- Domestic futures followed support in wider Chicago and Paris wheat markets, as well as Chicago maize markets yesterday. Support came from renewed tensions between Russia and Ukraine with the bombing of the Ukrainian port of Odesa. Though gains were capped by the expectation grain will continue to flow from Ukraine, despite the expiry of the Black Sea Initiative.

- Poland, Romania, Bulgaria, Hungary, Slovakia are reportedly asking the EU to extend a ban on Ukrainian grain imports beyond the 15 September deadline, according to Hungary’s Farm Minister (Refinitiv). Current restrictions only allow grain to flow through these countries should it be in transit to another destination.

- Paris rapeseed futures (Nov-23) closed yesterday at €482.00/t, up €6.25/t from Monday’s close. Wider support came from Chicago soyabeans futures and brent crude oil yesterday.

- The latest ONS UK inflation data has been released this morning, showing June inflation rates to be lower than expected. CPIH (including owner occupier housing costs) rose by 7.3% in the 12 months to June, down from 7.9% in May. CPI data rose 7.9% to June 2023, down from 8.7% in May. This follows a sharp fall in petrol prices.

- Labour costs grew within the Agriculture, Forestry and Fishing sector, as weekly earnings averaged £437 throughout the 12 months of 2022, according to the latest data from the Office of National Statistics. To read our latest analysis on this, please follow this link to the full article.

Budgeting your harvest 2023 crops, why is it important?

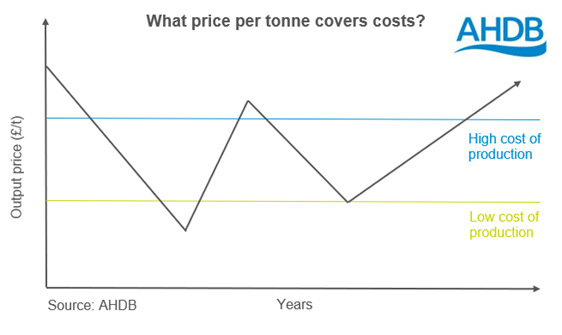

With harvest 2023 started for many, knowing your cost of production per tonne by crop type, is a great opportunity to manage risk and form/manage a marketing strategy for your 2023 crops. This is especially important considering the higher input costs and lower output prices seen over the past year - what is measured, can be managed more easily. Understanding your cost of production and break-even point can help you to identify what price to sell at to make a profit.

Right now, you might have started harvest or nearing harvest and will likely have a very good idea of what your crop conditions are currently like. Crop conditions can be assessed by looking at any weed impact, disease, as well as weather impact, both from dry periods and the rain now. Plant counts are also important too. For any harvested crops, you should be starting to get an early indication of yields and quality. While the weather over the next few weeks is impossible to predict, many growers can call upon experience and previous data to estimate yields and quality of this year’s crops.

Additionally, with most costs already spent, you have an accurate idea of what it has cost to produce your crops – both fixed and variable costs (for example fertiliser, crop protection products and fuel). Accuracy is very much key here, especially when splitting variable costs down by crop type.

Benefits of budgeting and where to start?

There are many benefits of budgeting and knowing your cost of production, including managing risk and informing decision making. This information can help inform your marketing plan and help you evaluate what price is actually a ‘good’ price for your business, as well as assessing your attitude to risk and business position.

Tools like Farmbench, can help you create a budget. Farmbench is an online benchmarking tool, designed to compare your business’ performance figures against similar businesses. You can evaluate your fixed costs and, in turn, improve your understanding of the strengths of your business. Farmbench has over 3,000 registered users for a range of comparable farms. If you would like to discuss, you can contact your regional Farmbench Manager or even join a benchmarking group.

What to do with this information?

For the 2023 crops, you should have a relatively accurate cost estimate and can produce a sensitivity analysis for different yield and quality scenarios. You can then calculate a cost per tonne for each scenario, with the aim to understand at what point you can make a profit for your crop in different outcomes.

This year is important as ever to understand the detail

Looking back, I talked about budgeting around this time in 2021, mentioning volatility in the context of extreme weather impacting grain supply in major exporters. Little could we have predicted an outbreak of war in Ukraine and the significant challenge presented to the industry in price volatility and high costs, with the additional context of changing agricultural policy. Now, global, and domestic grain prices have fallen significantly from highs seen back in May 2022, while costs have fallen too, for many they remain historically elevated, creating a difficult environment for margins. Budgeting and knowing your cost of production is vital to help decision making in times such as these.

What is the outlook for grain prices? Well, total global grain supply is still set to fulfil global demand, especially with rebounding global maize production. Ukrainian grain is still expected to flow this season, despite Russia withdrawing from the Black Sea Initiative – with grain expected to move via the Danube ports as well as road/rail. However, global wheat supply and demand remains finely balanced, with Northern Hemisphere harvest remaining a key watch point. Looking to the UK, weather will be a key watchpoint now for the harvest of winter crops.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.