A closer look at Japanese trade flows

Friday, 2 October 2020

Recently, the UK has secured an Economic Partnership Agreement (EPA) with Japan, ensuring the continuation of access for British products after the transition period has ended. Currently, the UK has favourable access to the Japanese market through the EU-Japan EPA. As the final text between the UK and Japan is still to be released, we are unable to comment on exactly how tariffs will be liberalised or what specific levels of quota the UK will have access to after 31 December. In this article we take a closer look at some of the major agricultural products Japan imports, as well as their key suppliers.

Beef

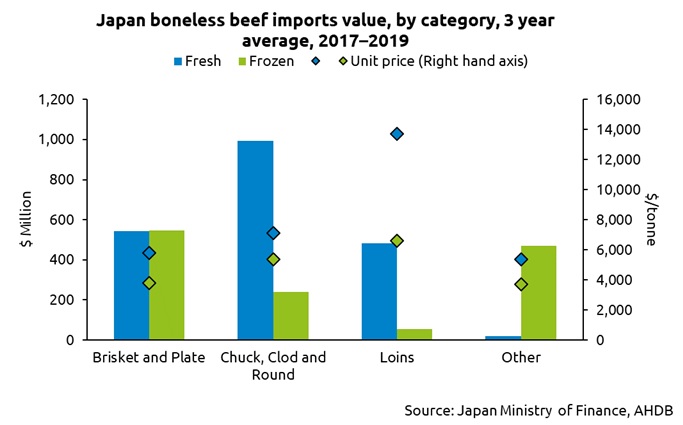

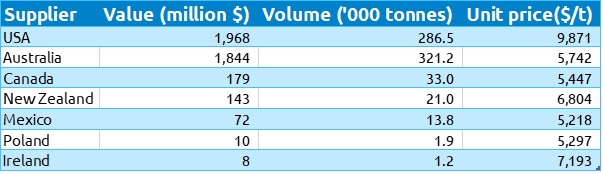

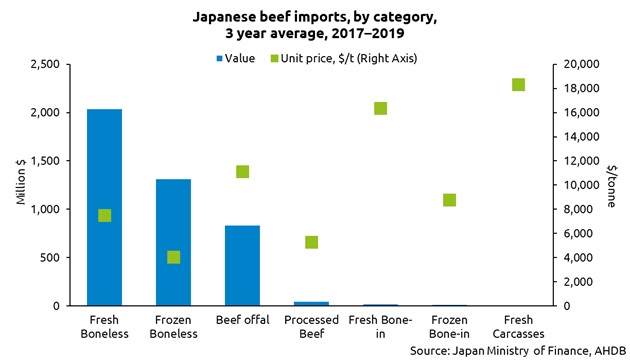

Imports of beef to Japan are predominately characterised by relatively high value fresh/frozen boneless beef cuts. Fresh chilled beef is generally more prominent in the marketplace and commands a premium in price. The US and Australia, which both enjoy favourable access negotiated through Free Trade Agreements (FTAs), dominate the market, commanding almost 90% of the market share. Boneless beef imports are split across a number of categories, with varying unit prices and fresh/frozen splits, see below.

Key suppliers of beef to Japan:

Source: Japan Ministry of Finance, AHDB

While fresh/frozen beef is the most popular import in volume terms, certain offal products are also highly valued in the Japanese market. Fresh boneless beef, which is generally considered as high value, ships to Japan at a unit price of $7,500/t. In comparison, beef offal products average around $11,000/t, with a total annual market value of around $830 million. The UK was granted access to the Japanese market in 2019, since which beef exports commenced and have continued to grow, totalling $5.7million (£4.6 million) in the first half of 2020, from a base of $4.1 million (£3.2 million) for the whole of 2019.

Japan’s exports of beef, while small in comparison to their own import market, have grown significantly over the past few years. In 2019, beef exports totalled $274 million, up from $91 million in 2015. Almost solely exported as fresh/frozen boneless beef, exports are extremely high value, with a three-year-average unit price of $61,800/tonne. Japanese beef is predominately from Wagyu cattle which produces a highly marbled product often sold under various regional names, such as Kobe or Matsusaka beef.

Pork

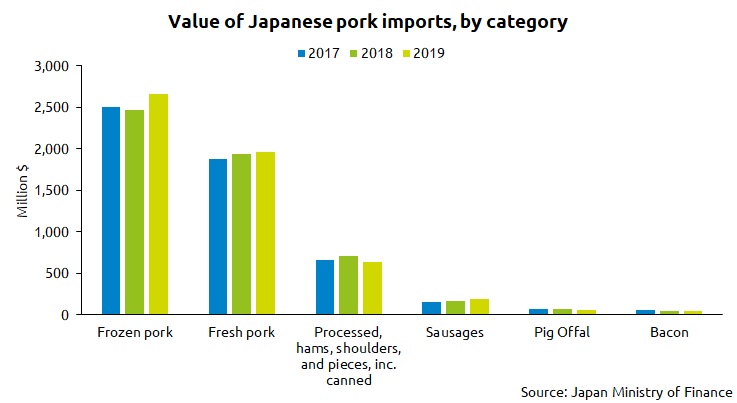

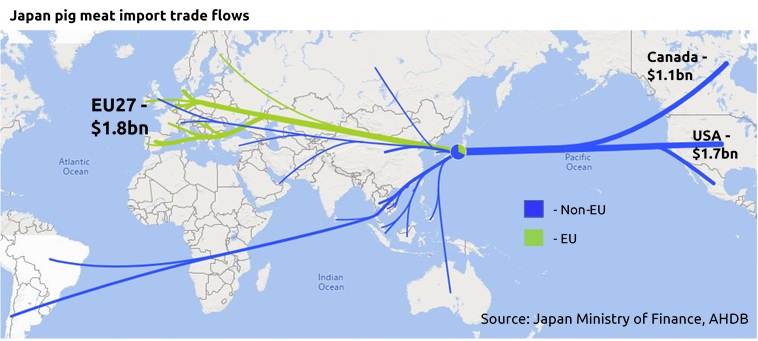

Pork is one of Japan’s major imported agricultural categories, with a market size averaging $5.4bn over the last three years and growing in value terms. The majority of Japanese imports come in the form of fresh and frozen pork which, unusually, are imported at a relatively similar unit price of around $4,800/tonne. Major suppliers to the market are the United States and Canada. Spain and Denmark are also key suppliers from a European perspective, collectively supplying around 20% of imported pork in value terms.

The EU27 as a bloc, make up a significant amount of Japanese imports, totalling around $1.8 billion between 2017 and 2019, with a small amount of growth between 2018 and 2019. The EU signed a trade deal with Japan in early 2019, which helped improve market access for EU producers and reduce burdens from the complicated import gate price system that Japan uses. However, this growth has fallen away in the early part of this year – down 10% in the first half of 2020 compared to the first half of 2019. It is likely coronavirus disruption has played a part in this fall, as well as demand from China remaining strong due to continuing protein shortage on the back of the African Swine Fever epidemic.

The UK itself has been increasing exports to Japan, although these are still comparatively small in the grand scheme of things. UK shipments in 2019 totalled around $3.93million, according to the Japanese Ministry of Finance, up from just $280,000 in 2017.

Lamb

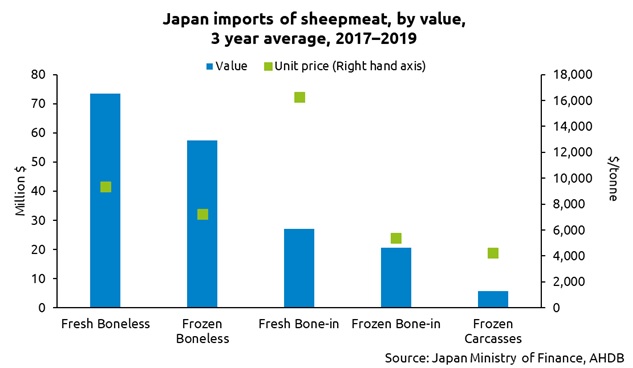

Japan is a tiny consumer of sheepmeat, importing around $185 million each year. Like a lot of international importing countries, the sheepmeat market in Japan is dominated by New Zealand and Australia and products are generally fresh/frozen boneless cuts. Average prices for sheepmeat are around $8,200/tonne which also varies throughout the product groups (see below).

Japanese consumer preference

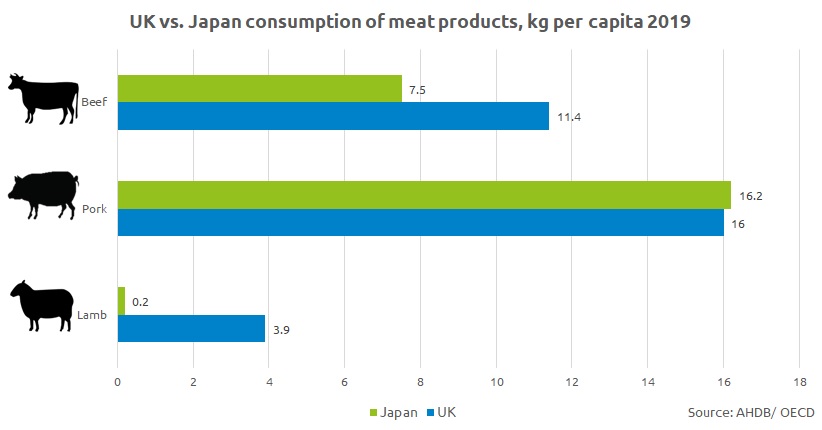

Japan’s high population density and low self-sufficiency in food production has led to a change in consumer diet. Traditionally, the Japanese diet would consist of high volumes of fish and seafood, however, due to demand outweighing supply, these products now boast high price premiums. Therefore, many consumers have increased their consumption of cheaper proteins such as beef, pork and lamb.

Although Japan is an affluent country, slow economic growth has left many consumers reluctant to spend. With beef and pork prices rising, Japan has seen a slow uptake in lamb consumption, as lamb meat is considered a healthier and cheaper alternative. In contrast, consumers are also willing to pay an extremely high price for a small quantity of premium product, providing it is only purchased occasionally as a treat.

Consumer age has a direct impact on the variety of meat consumed, for instance older generations often look for a high fat content in beef products, driving significant demand for Wagyu beef. In contrast, younger generations can be considered more health conscious, creating a trend toward the consumption of lean meat. In addition, more than 35% of Japan’s population live alone, which has generated high demand for smaller cuts of meat and single-portion meal options.

Finally, Japanese consumers show great preference towards food products which highlight good animal welfare, traceability and heritage. This will provide the UK agricultural industry with the potential to export premium and heritage products to Japan.