2022 pig cost of production in selected countries: feed prices

Tuesday, 13 February 2024

The overview of the Pig Cost of Production in participating countries sheds light on the increases to overall pig costs of production (COP) in 2022. For all InterPig* countries, feed accounts for the largest cost, usually averaging around 60% of the total pig cost of production. In 2022, this soared, contributing to 70% of total costs.

UK feed market developments

At the beginning of 2022, Russia invaded Ukraine, contributing to a spike in grain and oilseed markets globally. Input feed costs in relation to pig prices reached historical highs when inflation peaked in October 2022. Despite greater domestic production of wheat for harvest 2022, feed wheat prices were well supported due to general global tightness in supply. Concentrate feed prices remained elevated until summer 2023, when prices finally began to ease.

On top of rising grain and oilseed prices, there was greater demand for pig feed from 2021 into 2022, when animals were held back from slaughter due to labour shortages. However, following this, the national pig herd dipped to its lowest in a decade in 2023, and UK pigmeat production was down 11% year-on-year in Q1 of 2023. Consequently, UK demand for pig feed has decreased, although we have started to see some uplift recently.

Where next for feed prices?

A wet domestic grain harvest in 2023 led to some low-quality milling crops building into feed supplies. UK end-of-season grain stocks are forecast up this season from last, on slow farmer selling, exports and animal feed demand. However, markets are anticipating a smaller UK wheat crop for harvest 2024 after a wet autumn/winter.

Globally, cereal prices have been under pressure in recent weeks and months from competitive Black Sea supplies and slow global demand. Looking ahead, forecast large maize supplies from South America and the US in 2024 could put pressure on the feed grain complex. Brazilian weather remains a watchpoint, however, as well as EU cereal availability from harvest 2024. Healthier pig prices and cheaper feed may encourage sector growth going forward.

Looking to oilseeds, during 2022, soyabean prices were elevated due to tight global supply. By summer 2023, soyabean prices had fallen in response to a record Brazilian soyabean crop, making up for the shortfall in Argentinian and US supplies. Prices continue to ease into 2024 with another record South American soyabean crop due. However, as with maize, focus points remain in Brazilian supply, as well as strong US domestic biodiesel demand.

From a strong US soyabean crush, this has been boosting US soyabean meal supplies and seeing falling prices.

For rapeseed, following a wet autumn, European and domestic production is set to fall for harvest 2024, which may support rapeseed in relation to other oilseeds.

Read more about the implications of the falling price of soyameal

Table 1. Compound-feed prices per tonne (sterling), 2022

|

|

AUS |

BEL |

BRA (MT) |

BRA (SC) |

DEN |

FIN |

FRA |

GER |

GB (IN) |

|---|---|---|---|---|---|---|---|---|---|

|

Sow |

365.50 |

365.50 |

264.77 |

321.94 |

316.57 |

352.60 |

329.33 |

334.45 |

399.17 |

|

Rearer |

455.80 |

485.90 |

437.69 |

486.56 |

404.96 |

449.78 |

430.62 |

452.70 |

517.45 |

|

Finisher |

344.00 |

337.98 |

253.52 |

335.44 |

286.48 |

308.74 |

296.18 |

326.71 |

412.54 |

|

Average farm feed price |

321.67 |

355.84 |

279.51 |

349.40 |

300.23 |

294.20 |

309.29 |

343.27 |

430.92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

GB (OUT) |

HUN |

IRE |

ITA |

NL |

SPA |

SWE |

USA |

EU Average |

|

Sow |

394.13 |

285.22 |

352.60 |

354.84 |

345.63 |

337.58 |

397.58 |

278.05 |

342.90 |

|

Rearer |

473.43 |

368.30 |

449.95 |

450.73 |

448.66 |

510.04 |

540.60 |

590.58 |

453.84 |

|

Finisher |

412.54 |

259.72 |

333.68 |

347.70 |

331.82 |

347.62 |

375.39 |

261.01 |

322.91 |

|

Average farm feed price |

420.81 |

270.43 |

357.84 |

353.77 |

344.97 |

357.41 |

386.84 |

289.20 |

332.98 |

Table 2. Compound-feed prices per tonne (euro), 2022

|

|

AUS |

BEL |

BRA (MT) |

BRA (SC) |

DEN |

FIN |

FRA |

GER |

GB (IN) |

|---|---|---|---|---|---|---|---|---|---|

|

Sow |

425.00 |

425.00 |

307.87 |

374.35 |

368.10 |

410.00 |

382.94 |

388.90 |

464.15 |

|

Rearer |

530.00 |

565.00 |

508.95 |

565.77 |

470.88 |

523.00 |

500.72 |

526.40 |

601.68 |

|

Finisher |

400.00 |

393.00 |

294.79 |

390.04 |

333.12 |

359.00 |

344.39 |

379.90 |

479.70 |

|

Average farm feed price |

374.03 |

413.77 |

325.01 |

406.28 |

349.11 |

342.09 |

359.64 |

399.16 |

501.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

GB (OUT) |

HUN |

IRE |

ITA |

NL |

SPA |

SWE |

USA |

EU Average |

|

Sow |

458.29 |

331.65 |

410.00 |

412.60 |

401.90 |

392.54 |

462.30 |

323.31 |

398.72 |

|

Rearer |

550.50 |

428.26 |

523.20 |

524.10 |

521.70 |

593.07 |

628.60 |

686.72 |

527.72 |

|

Finisher |

479.70 |

302.00 |

388.00 |

404.30 |

385.84 |

404.21 |

436.50 |

303.50 |

375.48 |

|

Average farm feed price |

489.32 |

314.45 |

416.09 |

411.36 |

401.13 |

415.59 |

449.81 |

336.28 |

387.19 |

The impact on pig producers’ feed costs in 2022

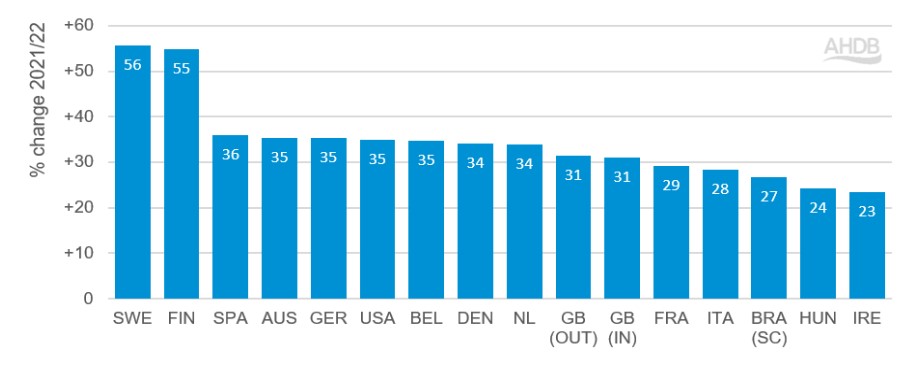

Average farm feed prices for all InterPIG countries saw a considerable increase from 2021 to 2022. Costs of GB (indoor) pig feed rose by 31% to £431/tonne.

A larger price increase of 35% was seen in the EU countries, but it reached a lower average of £333/tonne.

Figure 1. Changes in feed costs per tonne of average feed costs, 2022

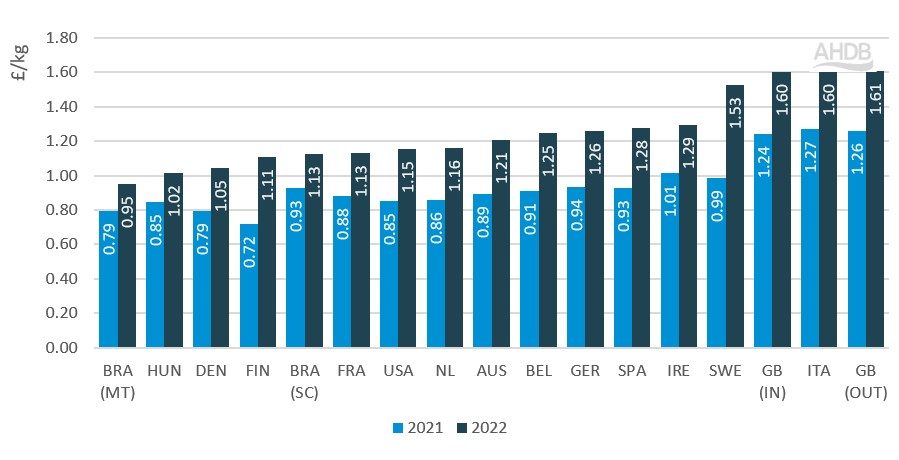

Figure 2. Feed costs per kg of carcase produced

Great Britain and Italy experienced the highest cost of feed per kilogram of carcase produced, though year-on-year percentage cost increases were below average in comparison to other InterPig countries. Across EU countries, the average feed cost was 125p per kg/carcase in 2022, having increased from 94p in 2021.

Average indoor and outdoor GB feed consumption in 2022 was 340 kg per slaughter pig, below the EU InterPig average of 358 kg. The figures infer that UK producers are competitive in terms of feed-use efficiency, but the producers are faced with the challenge of higher prices.

The InterPig data suggests that feed prices in Great Britain have been consistently higher than in other InterPIG countries, as can be seen in previous reports.

We will be conducting further investigations to understand the reasons and causes. It might be that variances are generated by differing methodologies on the collection of feed price information, so caution is advised on the interpretation of these specific results.

Read about the international pork cost of production methodology

*InterPIG is an international group of economists who gather physical and financial data to a standard methodology so that the cost of pig production can be compared across a selected group of countries. AHDB was a founding member of the group and continues to be an active member.