Could the falling price of soyameal pressure rapeseed prices? Grain market daily

Wednesday, 31 January 2024

Market commentary

- UK feed wheat futures (May-24) closed at £177.50/t yesterday, gaining £0.35/t from Monday’s close. While new crop futures (Nov-24) gained £0.50/t over the same period to close at £195.00/t yesterday.

- The domestic market followed some marginal gains in Chicago wheat yesterday, following a technical bounce for Chicago maize and soyabeans. However, competitive Black Sea grain and a lack of global demand continues to cap gains, especially on the continent. Russian prices continue to fall, and Ukrainian wheat continues to be offered through the recently established wartime shipping channel (LSEG).

- Paris rapeseed futures (May-24) closed at €424.25/t yesterday, down €1.75/t from Monday’s close. The new crop futures contract (Nov-24) closed at €422.50/t yesterday, down €0.75/t over the same period.

- Some weakness in the global vegetable oils complex weighed on rapeseed futures. Malaysian palm oil futures fell yesterday due to a stronger ringgit, while Chinese soyabean oil were also under pressure following weakened demand.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Could the falling price of soyameal pressure rapeseed prices?

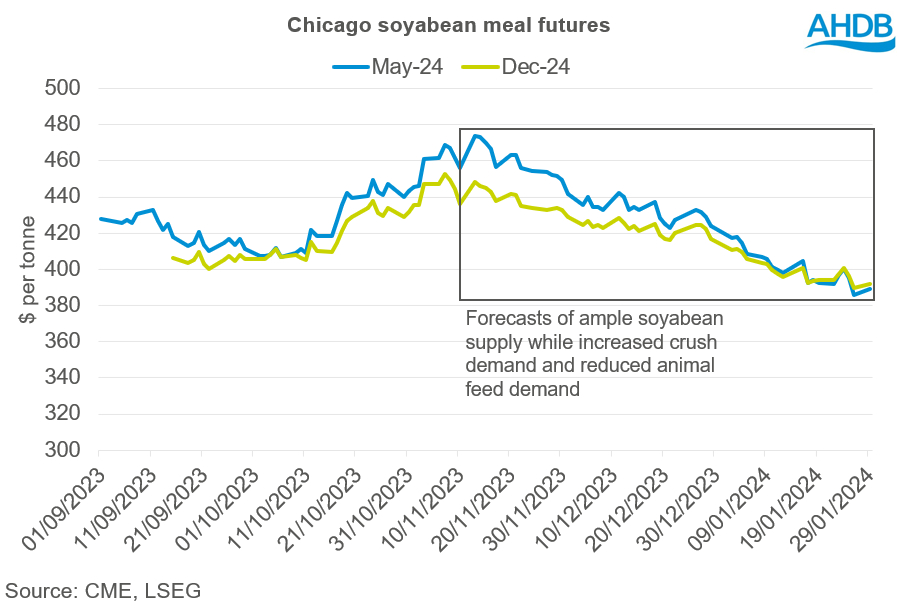

Global soyameal stocks are expected to increase in the coming months, with large soyabean supplies due in South America especially, and consequently Chicago soyameal futures have been seeing some downward pressure. Since 10 November 2023, the May-24 contract has fallen 14.7% while the Dec-24 contract has fallen 10.2%.

This pressure has also been seen in the physical market as the spot price for soyameal (Hi Pro) ex-store on 10 November 2023 was quoted at £494.00/t. However currently, the latest spot price for soyameal (Hi Pro) ex-store was quoted at £393.00/t, a 20.4% fall from November.

What has been causing the pressure?

- Going into 2024, the record South American soyabean crop will be harvested, offering a fresh supply of competitively priced soyabeans and soyameal supplies. Collectively, Brazil and Argentina are expected to produce 52% of global soyabean supply at 207 Mt. Compared to last season, where Brazilian and Argentinian supply accounted for 49% of world soyabean production.

- Strong US crush to meet biodiesel demand has been boosting meal supplies too. Soyabean oil used as a feedstock for biodiesel in the US, using available data January to October, is up 24% from the same period last year.

- Soyameal demand has been weakening in the EU and China, with lower pig herds pressuring demand for the animal feed. The pig herd size for the EU in the last quarter of 2023 was 5.4% down from the year before, while China’s pig herd has contracted 4.1% from the end of 2022 to 2023.

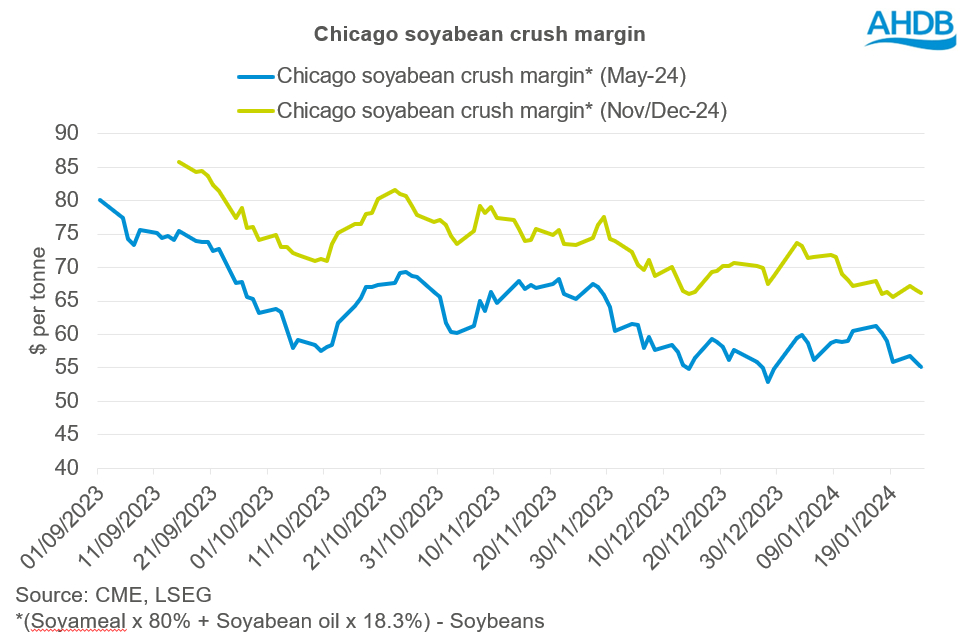

What does this mean for US soyabean crush margins?

In the case for soyabean crushing, 80% of the product is meal, and therefore a weakening of soyabean meal prices impacts crush. Since the beginning of the 2023/24 soyabean marketing year, both old crop and new crop soyabean crush margins have been in decline, as the old crop (May-24) crush margin fell 31% to below $60/t, while new crop (Nov/Dec-24) fell 23% to below $70/t.

What does this mean for rapeseed?

Should US soyabean crush margins continue to decline, this could also pressure US soyabeans if we see this impact crush demand. Though ultimately, with such strong US crush currently driven by biodiesel demand, could we see soyabean oil prices react?

Since the start of the soyabean marketing year, Chicago soyabean futures (May-24) have fallen 13.3% while the Nov-24 contract has fallen 8.7%. Over the same period, Paris rapeseed futures (May-24) has fallen 13.3% while the Nov-24 contract has fallen 12.6%. Downward pressure on US soyabeans can see filtered through into the wider oilseed complex including rapeseed, and going ahead, the large South American supplies could still weigh on oilseed markets longer term. Soyabean production for 2023/24 is forecast to account for 60% of global oilseed production. Though with reduced supply expected for rapeseed on the continent for harvest 2024, this could provide some support for rapeseed prices in relation to other oilseeds.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.