- Home

- Pork market outlook

Pork market outlook

August 2025

Key points

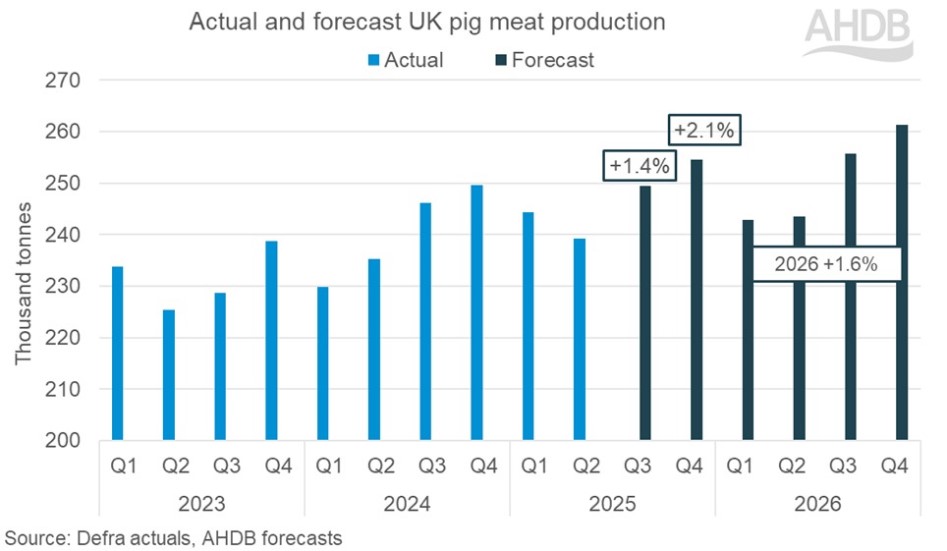

- UK pig meat production has been revised marginally lower since May and is now expected to reach 988,000 t in 2025, with year-on-year growth supported by clean pig numbers and higher carcase weights

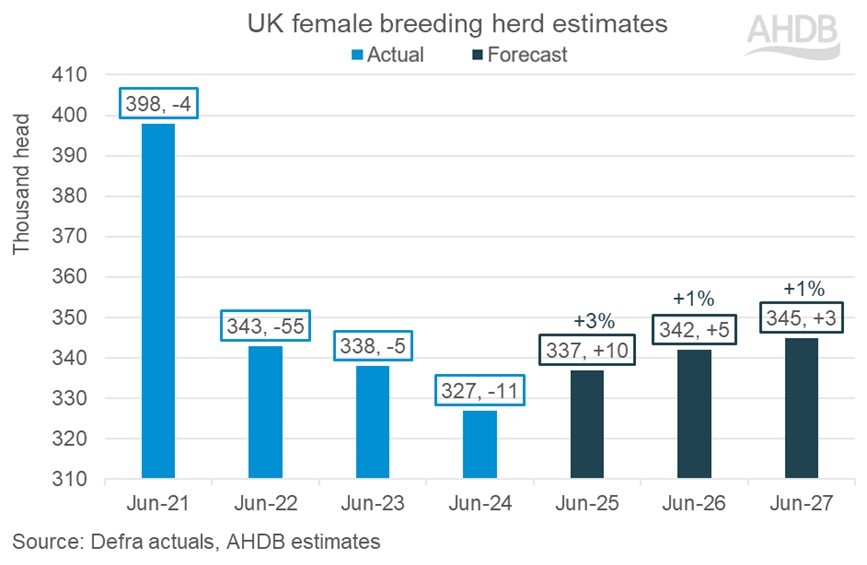

- The UK female breeding herd is forecast to grow by nearly 3% year-on-year in June 2025, following the trend recorded in the English pig population in December 2024

- In the longer term, breeding pig numbers are only expected to return to 2022 levels by 2027 as uncertainties around government policy may limit future investment

- Exports continue to grow, driven by China. Meanwhile, imports ease as the gap between EU and UK pig prices closes

- UK pig prices look to be relatively stable, currently at a similar value to 2024. However, some bullish factors exist in the market

- Higher beef prices in retail are resulting in many consumers switching into pig meat, while out-of-home market growth slows compared to previous years

Overview

Overall supply and demand appear to have been relatively well balanced through 2025 so far. Pig meat production stormed ahead through the first half of the year, totalling 483,000 tonnes (t), with strong annual growth recorded in Q1 (+6.3%) and Q2 (+1.6%). Meanwhile, high beef prices and warm weather have lifted domestic pig meat purchase volumes year-on-year (YoY).

Balance, however, is not a word that can be used to describe the global market; perhaps turbulent, unpredictable and ever changing are more suitable. Disease outbreak in Europe, President Trump’s return to office and subsequent trade tariffs, escalating hostilities in the Middle East region and unclear governmental direction are just a few headlines.

The UK pig industry is demonstrating its resilience once again, making the most of every opportunity presented, such as additional shipments to China.

Supply

We are forecasting that full year UK pig meat production for 2025 will total 988,000 t, an increase of 2.8% compared to 2024. This is a slight adjustment down from our May update due to growth in Q2 not preforming as strongly due to lighter weights, likely resulting from prolonged warm weather. We anticipate YoY growth to continue through H2, but at a slightly slower rate than we have seen during H1. This is in part due to annualising against very high production during Q3 and Q4 last year.

Overall pig meat production growth will be driven by clean pig kill, which we forecast to total 10.57 million head, up 2.3% annually. Carcase weights are expected to average around 90.5 kg, half a kilogram higher than 2024.

Looking ahead to 2026, we again forecast YoY growth for UK pig meat production, albeit it a smaller gain than we have seen in 2024 and 2025. This continued growth is driven by a 1.2% increase in clean pig kill, following an uplift in the female breeding herd, alongside a continued growth in carcase weights as producers maximise their contracts.

The forecasted growth in clean pig kill is based off the assumptions from our previous update in May, using English female breeding herd data. As a result, the UK female breeding herd is forecast to grow by around 3% YoY in 2025 to 337,000 head.

Through 2026 and 2027 we anticipate only a small change in annual population numbers, around 1% annually, with the female breeding herd size in 2027 similar to that seen in 2022.

Although farm margins have remained positive, prices for key inputs within the cost of production are increasing and/or volatile, such as labour and bedding materials. This, paired with geopolitical market uncertainties and caution over domestic government policy such as larger tax burdens, and the potential of new welfare and environmental regulations, leads us to believe that further on-farm investment may ease in the short to medium term.

Trade

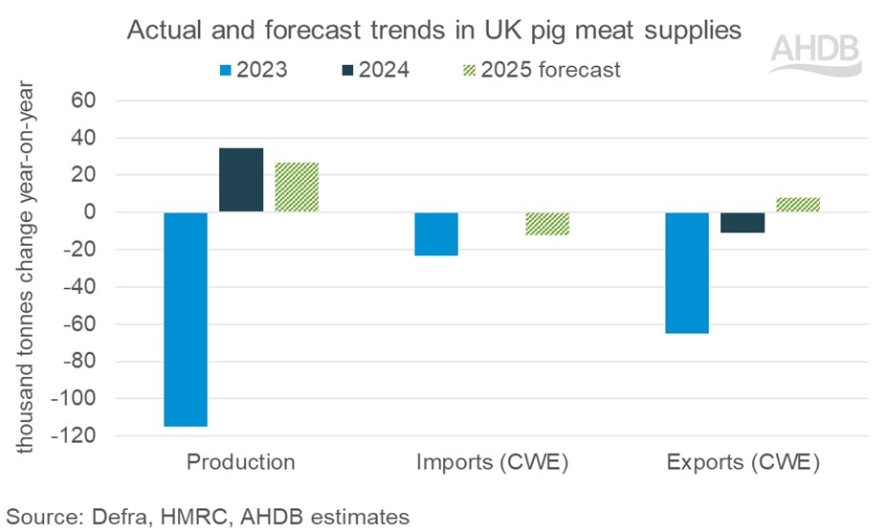

Although there remains a lot of uncertainty in the global marketplace, we believe the UK has positioned itself well and anticipate the trends seen so far this year to continue. This would result in exports growing by 5% annually and imports declining by 2%.

Exports

In the first five months of 2025 (the most recent data available), UK pig meat (including offal) trade has been robust, with exports up by 5% YoY at 129,500t. This is despite the challenges faced by escalating geopolitical tensions across the globe (such as trade wars and physical conflict).

The UK appears to have put itself in a good position, highlighting its important role within the global pig meat market. Stable pricing, higher production and maintaining positive relations and market access with key trade partners have been essential parts of the UK’s success so far.

China is a prime example, with the re-listing of two UK processing plants in December improving market access and the trade war between the USA and China making the UK more attractive for sourcing product. China’s import volumes have been the driving force behind the UK’s export growth, with shipped volumes in the five months ending May 2025 at their highest in four years. Volumes of both fresh and frozen pork and offal have increased significantly. This trade is vital in supporting the value of the whole carcase.

The latest news from government that 12 businesses across England and Northern Ireland have secured access to Mexico for pork and offal provides further opportunity for British product overseas.

Imports

On the contrary, UK pig meat (including offal) imports were down by 3% YoY for the period of January to May. The outbreak of foot-and-mouth disease (FMD) in Europe during Q1 significantly impacted import volumes. Despite a small recovery in May, after FMD-free status was granted to Germany, the narrowing of the price differential between EU and UK pigs has kept import volumes muted.

The EU27 accounts for over 99% of UK pig meat imports. Market commentary coming from Europe notes a tight balance between supply and demand, with the European Commission’s latest forecast expecting supply decline in the latter half of 2025, driven by a smaller breeding herd. This may limit the availability of product for export.

Nearly 80% of GB pig meat purchases come from within the retail sector (Worldpanel by Numerator UK), with most major retailers continuing to hold firm on their British product commitments. Our latest country of origin audit (July) shows, on average, 87% of supermarket fresh pork facings is of British origin. The foodservice sector is more likely to rely on imported product but is a smaller section of purchases. The out-of-home market is not expected to perform as strongly in 2025 as previous years, and so import demand may be more subdued.

Prices

GB deadweight pig prices have been relatively stable so far in 2025. Although in Q1 there was some downward pressure, prices recovered during Q2, generally trending upwards. At the end of July (w/e 02 Aug), the EU spec SPP stood at 207.8p, up 2.4p compared to the beginning of the year.

High beef prices are proving beneficial to pig meat consumption both domestically and globally and is a trend we expect to continue for the rest of the year. This is likely to keep prices balanced through the remainder of the year, with the potential for uplifts ahead of Christmas, as seasonal demand for pork products picks up.

Most of the major domestic retailers continue to champion British pig meat, with the percentage of British facings remaining stable year-on-year, providing further support to domestic pig pricing.

Despite a strong supply forecast for UK pig meat production, European production is anticipated to weaken in the second half of the year, creating a tighter market. This may result in strengthening EU pig prices in the latter part of the year, which, if demand is sustained, may be reflected in UK pricing.

Overall, the feeling for UK pig prices remains stable at a similar value to 2024, with some bullish factors that may provide an upwards movement. However, any significant change in export dynamics has the potential to negatively impact pricing.

Consumption trends

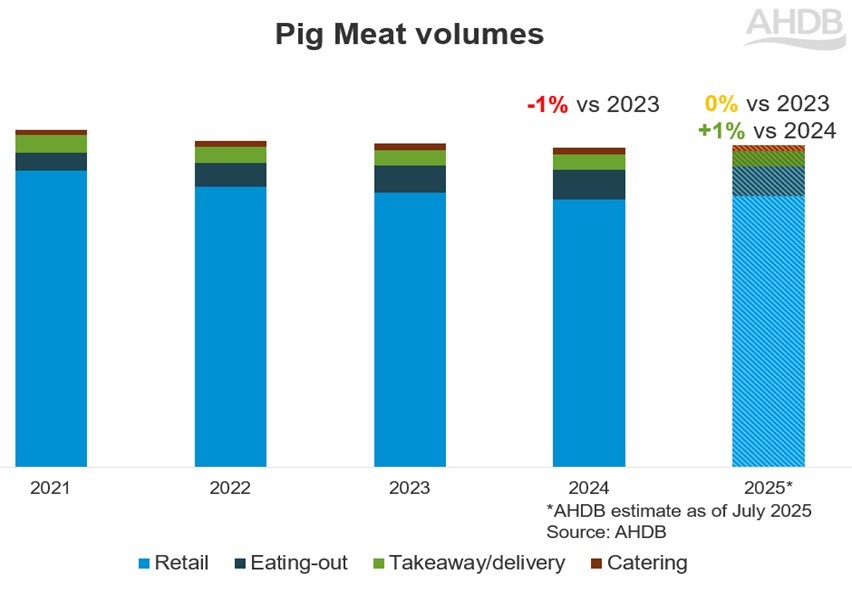

In 2024, total pig meat volumes fell by 1.2% year-on-year, with growth in foodservice offset by a decline in retail sales (AHDB/Worldpanel by Numerator UK, 52 w/e 29 December 2024).

For 2025 we expect a level of economic uncertainty. We expect business confidence will remain low, and this will likely feed down to shoppers. So far in 2025, pig meat volumes within retail have risen by 1.3% (Worldpanel by Numerator UK, 24 w/e 15 June 2025) and out-of-home volumes have declined by 1.5% (AHDB estimates based on Worldpanel by Numerator UK OOH, 24 w/e 15 June 2025). As a result, we forecast total pig meat volumes for 2025 will increase by 1.1%.

For more details on recent trends on pig meat and cut specifics, see our retail and foodservice dashboards.

After multiple years of overcoming challenges and reconsidering how to spend their (shoppers') money, we expect any changes in shopping behaviour to be gradual.

In retail, the increase in pig meat volumes during 2025 has been driven by the higher prices of beef, resulting in many consumers switching into this more affordable protein. Within pig meat, we expect the trend towards cheaper and convenient cuts such as mince and sausages to continue as these offer good value for money and are quick and easy to cook. In addition, the summer months traditionally see growth in sausages and burgers when BBQs and social events take place.

We also predict that added-value cuts like marinades and sous vide will continue to grow for those consumers looking for a cost-effective treat to eat within the home. At this time, shoppers are carefully considering their spend, so growth in pig meat volumes will be limited due to consumers switching into chicken as a cheaper alternative, selecting cuts such as chicken legs, wings and thighs.

As consumers are becoming more health conscious in 2025, pig meat has become more appealing, but growth will be restricted as consumers perceive poultry to be a better source of protein at 61% versus 41% (AHDB YouGov Tracker, May 2025). It remains key to communicate the health benefits and versatility of pig meat.

Dining out and on-the-go pig meat volumes are expected to remain stable this year. Pig meat is well suited to on-the-go dining, with tasty affordable treats such as sandwiches, sausage rolls, pork rolls and savoury pastry products being popular choices for breakfast, lunch or snacks (Worldpanel by Numerator UK OOH). In contrast, takeaways are likely to fall slightly as consumers are transitioning back to the office, resulting in less takeaway lunches.

How might pig meat consumption be improved?

- Address health concerns by communicating the health benefits of pig meat, such as being rich in vitamins B12 and B6, good sources of iron and zinc and a high source of protein

- Highlight the versatility of pig meat dishes, which can offer nutritious and filling meals for families at a reasonable cost. Inspire batch cooking and new recipe ideas as an alternative to chicken

- For more premium cuts of pork, capture meal occasions lost from more expensive proteins by encouraging tasty, treat dinners such as fakeaways or dine-in meal occasions, e.g. pork tenderloin, ultimate pulled pork, roasted pork belly

- Engage with retailers to communicate the benefits of pig meat in-store, online, on packs and within foodservice

- Engage with consumers regularly to maintain and build trust and to share the work that farmers are doing in the UK around animal welfare, environmental stewardship and their high levels of expertise to provide quality food products

For more information, see our consumer reputational landscape hub. AHDB has a range of marketing activities planned for the year, including the new Love Pork campaign. Please visit our marketing pages for more information. For more insight around consumer demand, visit our retail and consumer page.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.