Yields contrast as UK harvest advances: Grain market daily

Friday, 16 August 2024

Market commentary

- Global grain prices declined yesterday as concerns from earlier in the day about the latest developments in the war in Ukraine eased. Refinitiv suggests that Russian missiles hitting the port of Odesa did not seem to be part of a wider offensive. Strong competition from Black Sea wheat and continuing positive prospects for US maize crops were also likely factors.

- Nov-24 UK feed wheat futures lost £6.60/t to settle at £182.05/t, while the Nov-25 contract closed at £192.00/t, down just £0.95/t. UK prices were likely further hindered by a rise in the strength of sterling against the euro.

- Meanwhile, Paris rapeseed futures for Nov-24 gained €6.50/t to settle at €463.50/t (approx. £397/t). The Nov-25 contract also rose €6.50/t and closed at €449.50/t (approx. £385/t). A dip in the strength of the euro against the US dollar helped prices, as Chicago soyabean and Winnipeg canola futures held relatively steady.

Yields contrast as UK harvest advances

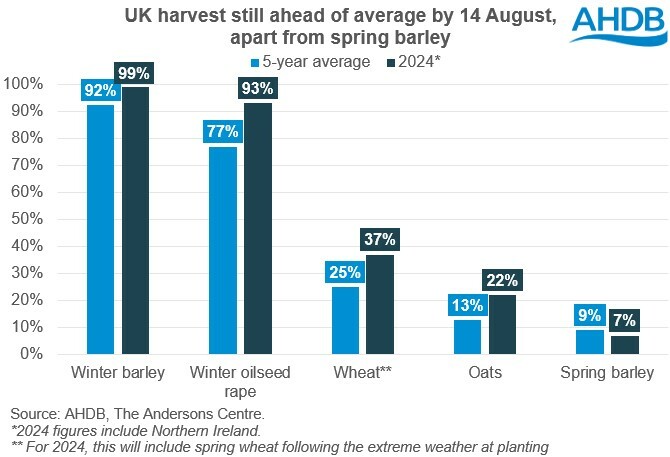

The second harvest progress report from AHDB shows that over the past fortnight, the UK harvest has continued to progress at pace amid warm, dry weather.

By 14 August, the UK winter barley harvest was now all but compete and only a small proportion left to be cut in Northern Ireland. Similarly, the UK winter oilseed rape (WOSR) harvest progress has advanced from 73% to 93% complete, while the wheat harvest reached 37% complete. Also, 22% of oats have been cut, and 7% of spring barley.

Variation in planting date and crop development could now mean a break in the harvest for some as some fields are not yet fit. For wheat, this is especially true where crops are thinner and secondary tillering has taken place.

However, winter cereal and oilseed rape yields are continuing to disappoint. Yields for winter barley across the UK are reported 11% below the five-year average, very close to the 12% drop reported a fortnight ago. WOSR yields are reported as 9% below the five-year average, and the first estimate for wheat is 7% below average.

Quality info emerging

From a quality perspective, the main concern for wheat is lower protein contents. These have improved in the past week but remain low, with UK Flour Millers Group 1 samples assessed so far averaging 11.5% to 12.0%.

While lower nitrogen contents and some bushel weights are reported for winter barley, merchants report that the crop is very usable for the domestic market. Early reports for spring oat yields, along with spring barley yields and quality look encouraging.

Market implications

Lower winter yields were generally expected after such challenging planting and early growing conditions. While expected, the growing confirmation of lower winter yields and lower grain production in 2024, will keep the UK more dependent on imports than usual this season. This could help keep UK prices supported compared to global levels, as they have been since last autumn. But the global market will still dictate overall prices.

Meanwhile, if confirmed as harvest advances, lower proteins here and in key European producers could keep premiums for full specification bread wheat elevated.

AHDB’s next harvest progress report is planned for 30 August, though this is subject to change based on the weather and harvest progression.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.