Winter barley results disappoint in France and Germany: Grain market daily

Friday, 19 July 2024

Market commentary

- UK feed wheat futures made small gains yesterday. A slight drop in sterling against the euro and US dollar offset small dips in Chicago and Paris wheat futures. The UK feed wheat futures Nov-24contract gained £0.35/t to settle at £191.25/t.

- Global grain supplies continue to look adequate. The International Grains Council yesterday increased its estimate of global wheat production by 7.9 Mt to 801.0 Mt due to larger crops for the US, Canada, Kazakhstan and Pakistan. This added a notable amount to end of season stock forecasts, though they remain 0.8 Mt lower than 2023/24. While global maize production was also increased, concerns persist about Black Sea maize production due to recent hot weather.

- Potential support from buying by key countries such as Egypt and Algeria, was limited as Black Sea grain reportedly won most of the business.

- Paris rapeseed futures for Nov-24 rose €13.00/t to settle at €494.25/t on worries about heat stress on oilseed crops in Canada and the Black Sea. Rises in Winnipeg canola futures and higher soy oil prices also contributed.

Winter barley results disappoint in France and Germany

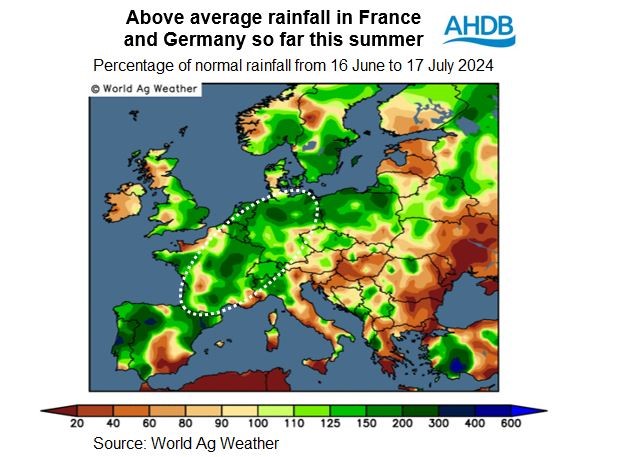

Winter barley yields and quality so far are said to be disappointing in top European producers France and Germany. This follows persistent wet weather this summer, which is also now causing harvest delays.

Two German associations representing farmers, DBV and DRV, this week reported lower yields and specific weights for winter barley. As a result, and combined with lower planted areas, the German Farmers Association DBV expects production to fall 3% year-on-year. DRV, the German association of farm cooperatives, is more pessimistic, estimating output to fall 6% year-on-year; a month ago it had predicted a 2% fall.

While winter barley harvesting is into the latter stages, the results also enhance concerns for wheat crops. In France just 14% of wheat (exc. Durum) had been harvested by 15 July (FranceAgriMer). While up from 4% a week earlier, this is well behind the average of 43% for the time of year (2019-2023), despite crops finishing flowering in line with average.

Wheat production (exc. Durum) is currently expected to fall 15% year-on-year in France (Ag Ministry). While still early in terms of harvest progress, there’s speculation that the crop could be lower than this. In Germany, DRV expects total wheat production to fall 6% year-on-year.

Spring barley harvesting, which is key for European malting supplies, has also started in France and is 15% complete. France and the EU has a larger spring barley area for harvest 2024, giving more room for manoeuvre when it comes to quality. But these results will still be in the spotlight with limited quality stocks to fall back on.

France and Germany are having a couple of dry days but the forecast again looks unsettled over the weekend and into next week.

Could this impact premiums?

Last year, heavy rain through July and into August reduced both yields and quality in these countries. This contributed to higher premiums for bread wheat and malting barley during the 2023/24 season, both in Europe and the UK. If quality in France and Germany struggles again, this could again offer support to milling, and more uncertainly malting, premiums in the 2024/25 season.

Our quality will also be important for UK premiums and the market will be closely watching harvest results. AHDB will start reporting on GB harvest progress in early August, with highlights in Grain market daily – click here to subscribe.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.