What’s driving grain prices this week? Grain market daily

Wednesday, 17 July 2024

Market commentary

- UK feed wheat futures (Nov-24) gained £0.75/t yesterday, to close at £191.30/t. The May-25 contract gained £0.90/t over the same period, ending the session at £201.90/t.

- Domestic wheat futures followed European grain price direction upwards yesterday, see more information on this below.

- Nov-24 Paris rapeseed futures closed at €472.75/t yesterday, up €1.75/t from Monday’s close. The May-25 contract rose €1.25/t over the same period, closing at €475.75/t.

- European rapeseed prices tracked US soyabeans up largely on the back of bargain buying after news of strong US crop production prospects. On Monday, the USDA rated 68% of the US soyabean crop in good or excellent condition. This was unchanged on the week, and above 55% at the same point last season.

What's driving grain prices this week?

Over the last week prices have generally trended down, largely due to harvest pressure in the northern hemisphere, as well as an increased global wheat supply estimate made by the USDA on Friday. However, hot and dry weather in the Black Sea region, as well as a flurry of international tenders have limited losses, and even led to some support for prices yesterday.

Northern Hemisphere harvest progress

On Monday, the USDA reported that US winter wheat harvest was 71% complete as at week ending 14 July. This is well ahead of the five-year average of 62% for this point in the season, and up from 53% a year earlier.

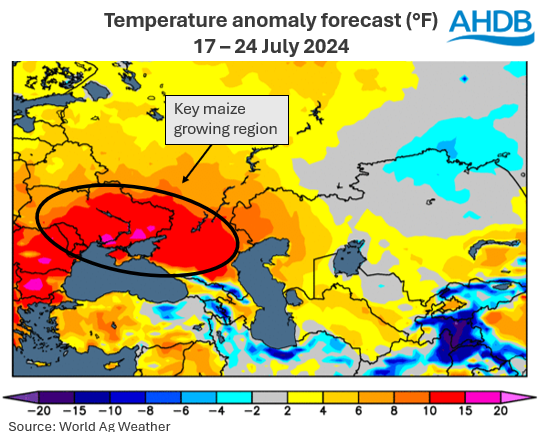

Harvest also continues across Russia, with improved weather over the last few weeks improving the wheat outlook. Russian agricultural consultancy firm IKAR increased its forecast for the country’s wheat crop to 83.2 Mt on Monday, up from its previous estimate of 82 Mt. However, weather in parts of southwestern Russia and eastern Ukraine over the coming days looks more unfavourable for maize crops.

In areas of western Europe however, harvest is progressing more slowly due to wet conditions. FranceAgriMer reported on Friday that just 4% of the soft wheat area had been harvested by last Monday, compared to 26% at the same time a year ago, and the five year-average of 19% for this point in the season. The continued rains and limited sunshine have seen poor winter barley yields in the country so far too.

Black Sea weather

Parts of southwestern Russia and eastern Ukraine are raising concerns over the current high temperatures in the key maize growing regions.

A weather forecaster in Ukraine said yesterday that the harvest of late crops (largely sunflower and maize crops) in the country could be reduced by 20-30% in some areas due to this extreme heatwave. They added that 30-50% of the overall area under late crops could be affected by drought.

It is important to note that maize is now in its most vulnerable development stage, and as such crop condition will be impacted by weather over the coming weeks – something to monitor.

International tenders

As a result of the lower prices as of late, Algeria, Egypt and Jordan all called wheat import tenders at the beginning of this week. The lowest FOB offer presented was $226/t for 60 Kt of Russian wheat.

Egypt’s state grains buyer said on Tuesday that it had purchased 770 Kt in total, comprising of 50 Kt of Bulgarian and 720 Kt of Russian origin wheat. Meanwhile Jordan’s state buyer purchased around 60 Kt of hard milling wheat from optional origins yesterday.

More updates on global tenders will be a watchpoint over the next few days.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.