Will soya and sunflowers cap rapeseed price potential? Grain Market Daily

Wednesday, 19 August 2020

Market Commentary

- UK feed wheat futures (Nov-20) fell back yesterday, following a 3 day run of gains. The contract closed £1.05/t lower, at £164.45/t. The Nov-21 contract also closed lower, down £0.70/t at £149.90/t. At one point yesterday, the Nov-21 contract had traded at £152.50/t, but could not sustain the move higher.

- UK markets followed the trend in global markets yesterday, with nearby Paris and Chicago wheat prices also ending the day lower in both sterling terms and their native currencies.

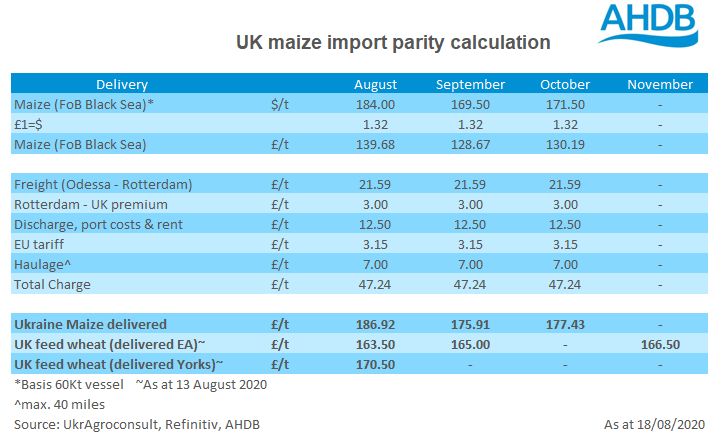

- A rise in Ukrainian FoB maize values, freight rates and the implementation of a tariff on imported maize imposed by the EU last Wednesday has pushed the latest import parity calculation for maize delivered to a compounder in October to £177.43/t. This compares to delivered feed wheat, East Anglia (as at 13 Aug), at £166.50/t. This could give domestic feed wheat prices some breathing space, and support premiums.

Will soya and sunflowers cap rapeseed price potential?

We know this year that rapeseed crops are looking tight, not only in the UK but across the EU and Ukraine. As such, the EU market is likely to be dominated by imported rapeseed/canola from Australia and Canada, as well as imports of other oilseeds. One oilseed which we need to be aware of, and which could play an increasing role in the determination of EU and subsequently domestic oilseed prices, is sunflowerseed.

So far this season, EU rapeseed imports have been sluggish, reaching just 216Kt. This time last season the EU had imported some 408Kt of rapeseed. One reason for this sluggish start to imports is substitution. Soyabean imports in the first six weeks (to 10 Aug) of the marketing year are up 9% at 1.74Mt, meanwhile imports of sunflowerseeds are up 104%, albeit at just 33Kt.

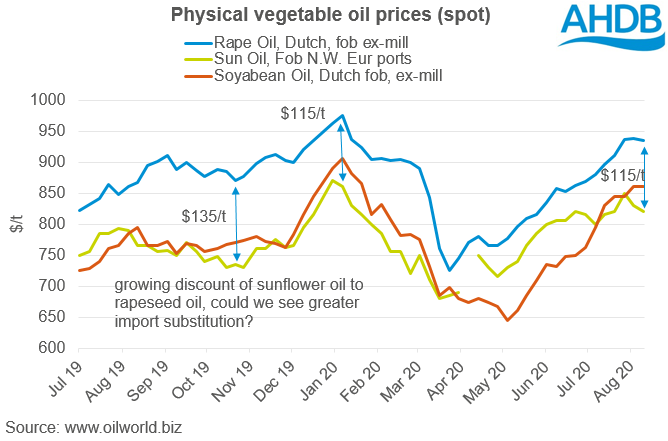

Looking at the comparative values of oils and seeds, it is likely we will see this kind of substitution taking some pressure out of the rapeseed market, capping price potential. According to the latest Oilworld data (www.oilworld.biz), prices of sun oil (FoB North West European ports) and soya oil (Dutch FoB, ex-mill) are trading at a significant discount to rapeseed oil.

The discount of sun oil to rapeseed oil is currently standing at $115/t, similar to levels seen in early 2020. With strong discounts at the beginning of the year we saw an increase in sunflowerseed oil imports into the EU, up 355Kt year-on-year in the second half of 2019/20.

What next for sunflowerseeds?

We have recently covered soyabeans and the possible impact these may have on the market, as well as looking at palm oil in Market Report. The direction for sunflowerseeds is something else we need to pay attention to.

The primary origins for EU sunflowerseed, sunflower oil and sunflower meal imports are Russia and Ukraine. Ukraine is expected to harvest a record crop in 2020/21, 17.5Mt according to the USDA. Meanwhile Russia is heading for its second largest crop on record at 14.0Mt, although estimates of Russian production have declined of late, following the impact of extreme heat.

World stocks-to-use of sunflower oil is also growing, and set to move to the highest point in the past three years.

How important is it going to be?

Sunflowerseeds still represent a comparatively small part of the oilseed complex relative to soya and palm. However, the crop is growing and subject to end use, the oil is looking increasingly attractive. With sunflowerseed harvests in the Black Sea typically taking place in Sept-Oct, we will monitor values over the next couple of months for their impact on rapeseed. Should Russian and Ukrainian harvests meet expectations, the increase in supply may apply a pressuring effect on European rapeseed values.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.